Europe’s latest bank stress test is working, and it hasn’t even started yet

European banks are getting their spring-cleaning done early. In recent months balance sheets have been thoroughly, if somewhat hastily, scrubbed ahead of an inspection by a stern new regulator.

European banks are getting their spring-cleaning done early. In recent months balance sheets have been thoroughly, if somewhat hastily, scrubbed ahead of an inspection by a stern new regulator.

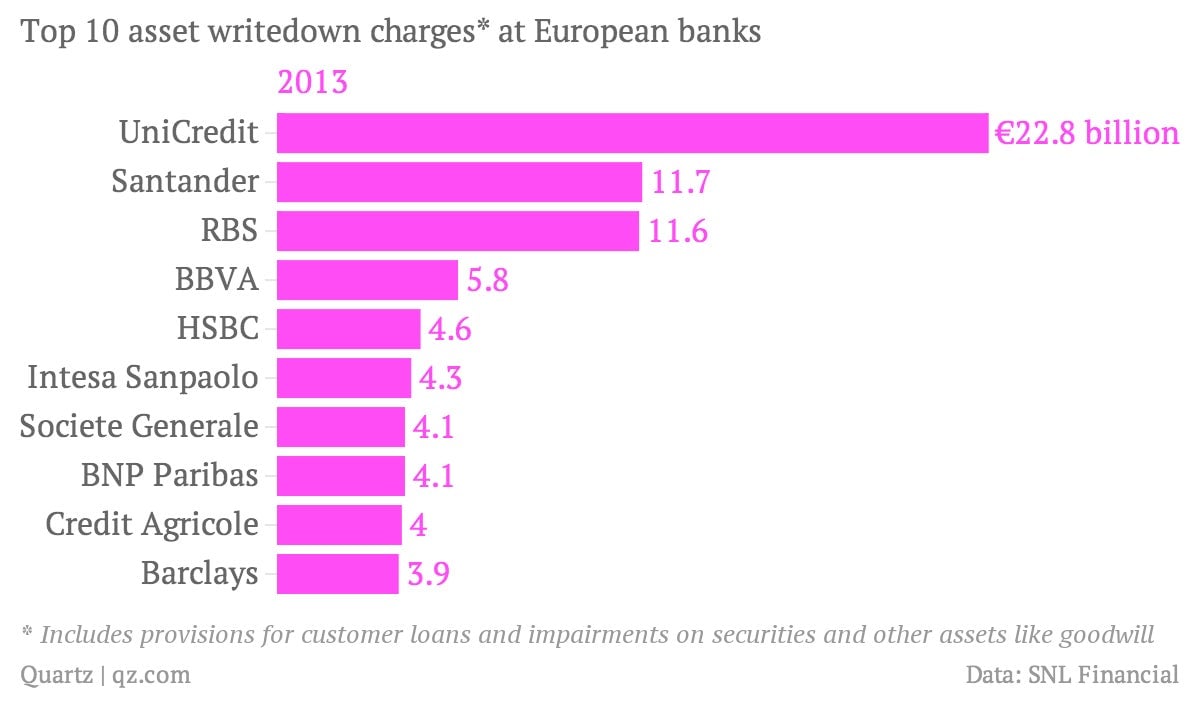

At least, that’s one interpretation for the welter of write-downs, provisions, and asset sales at the region’s largest banks over the past year. According to data compiled for Quartz by SNL Financial, the 10 most aggressive banks in this regard took nearly €80 billion in charges against the value of their assets last year.

The writedowns are conspicuously timed ahead of the European Central Bank’s “comprehensive assessment” of the balance sheets of the euro zone’s 130-odd largest banks. The ECB is running the rule over these banks before taking over as their main supervisor in November.

The ECB recently started the second phase of the assessment, after the first identified some €3.7 trillion ($5.1 trillion) in risk-weighted assets that needed a closer look. Officials are now examining whether these assets are properly valued, and whether sufficient provisions have been set aside given the riskiness of the loans, securities, and other holdings. Later, a stress test—which includes banks from across the EU, not just the euro zone—will judge how well assets can withstand an economic shock, and order lenders without big enough equity cushions to raise more capital. The results of these exams will be published in October.

For real this time

Since previous stress tests proved far too mild, European officials have gone out of their way to emphasize that they are willing—eager, even—to mete out lots of failing grades. And although all eyes will be on the euro-zone-based banks that are moving under the ECB’s supervisory umbrella, there is plenty of rot elsewhere in Europe’s banking system, so those lenders won’t escape scrutiny.

This latest battery of tests could be the real deal, judging by how aggressively banks have been preemptively boosting provisions and impairing assets. On the same day that the ECB published the rules for its asset-quality review (pdf), Italy’s UniCredit shocked the markets with a €15 billion quarterly loss thanks to €18 billion worth of extra provisions and asset impairments. A day later another Italian lender, Monte dei Paschi di Siena, doubled the bad-loan provisions it set aside in the fourth quarter. Confirming the suspicions of many, Italian and Spanish banks account for nine of the 10 largest individual quarterly writedowns over the past year, with UniCredit’s fourth-quarter blowout the biggest by far.

Although UniCredit is the leader (so to speak) in the charges it took against its assets last year, plenty of other banks have put big dents in their earnings in order to get their financial houses in order. And given the stress testers’ determination to get tough regardless of these actions, bank balance sheets are in for some rough justice. In the long-running saga of Europe’s financial crisis, it seems that we may finally be closer to the end than the beginning.