An obscure derivative is costing investors billions as China’s currency falls

The People’s Bank of China has been letting the yuan weaken, in an attempt to slow down the flow of hot money into China. But it may be about to give some investors a nasty case of heartburn.

The People’s Bank of China has been letting the yuan weaken, in an attempt to slow down the flow of hot money into China. But it may be about to give some investors a nasty case of heartburn.

The culprit is a specialized financial product, originally used to hedge foreign exchange risk, called a “trade redemption forward”—it pays investors if the yuan remains strong. But if the currency weakens—as it has since Beijing increased the yuan’s trading band—the derivative can result in escalating losses. The products are tied to the offshore-traded yuan, or CNH, which today fell 0.34% to 6.1922 to the US dollar—that’s just below the critical “red line” of 6.20, at which some analysts predict an meltdown for some trade redemption forward products.

In a February 24 report that’s now proving very prescient, Morgan Stanley analysts explained the trade’s prevalence and importance, and how it has been widely adopted beyond its original purpose:

While originally designed to hedge exposure to a stronger currency, these products have increasingly been used as a source of monthly income, as they benefit so long as the RMB does not materially depreciate – which it has not tended to do, even through the most recent financial turmoil.

That lack of depreciation, of course, is no longer true, with the yuan falling for much of the past month. “For most of these structures, banks no longer make payments at CNH/USD 6.15,” Dariusz Kowalczyk, an analyst with Credit Agricole, wrote in a recent report, as the Financial Times reported. Beyond 6.20 yuan to the US dollar, he said, “clients are exposed to unlimited, leveraged losses.”

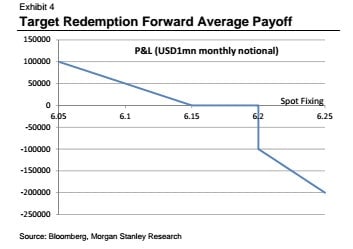

Here’s what losses will look for trade redemption forward investors if the yuan (again, offshore value) falls further and below 6.20, according to Morgan Stanley.

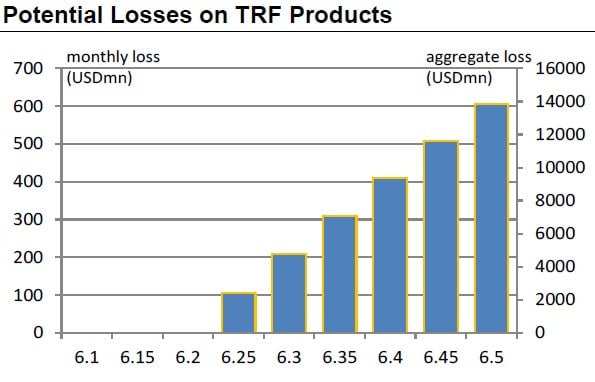

There have been $350 billion of these instruments sold since the beginning of 2013, Morgan Stanley said, and some $150 billion might still be outstanding. The monthly aggregate losses that the holders of these trades face increases as the yuan drops in value to the US dollar. Here’s the bank’s estimate of how those pile up:

Geoff Kendrick, head of Asian currencies and rates at Morgan Stanley, told the Wall Street Journal this week that losses from these products this year may have already reached $2.3 billion. But figuring out who holds the bulk of these positions is difficult, because companies rarely disclose their hedging strategies.

Taiwanese corporations, particularly importers and exporters, have taken a large share of the dollar-renmibi hedging market, according to Global Capital (login required) and now account for 10 to 20% of all these trades. But they won’t be the first—in 2008, Citic Pacific, the mining company, lost about $2 billion (paywall) after its trade redemption forward positions suffered losses—and they almost certainly won’t suffer alone.