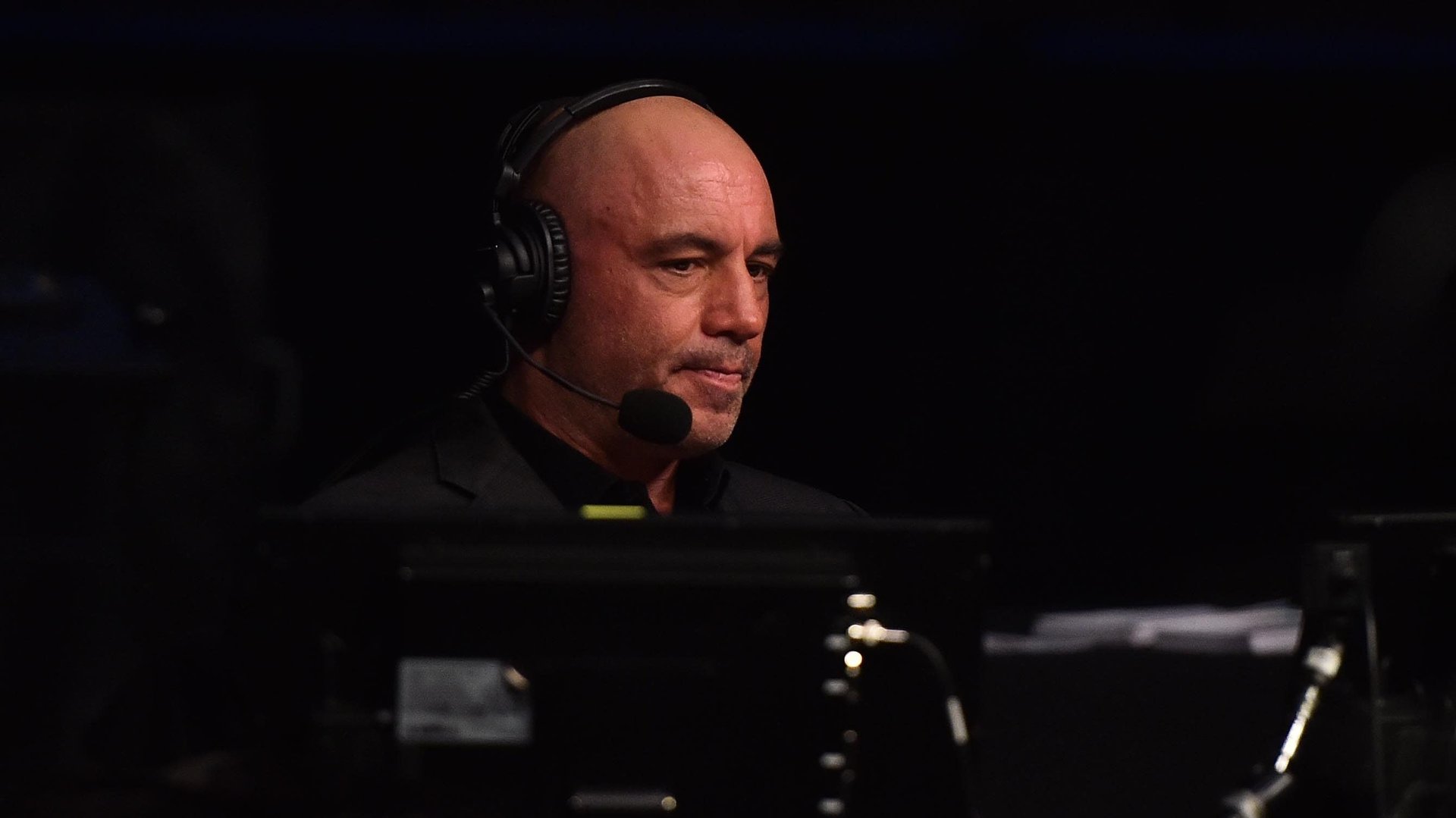

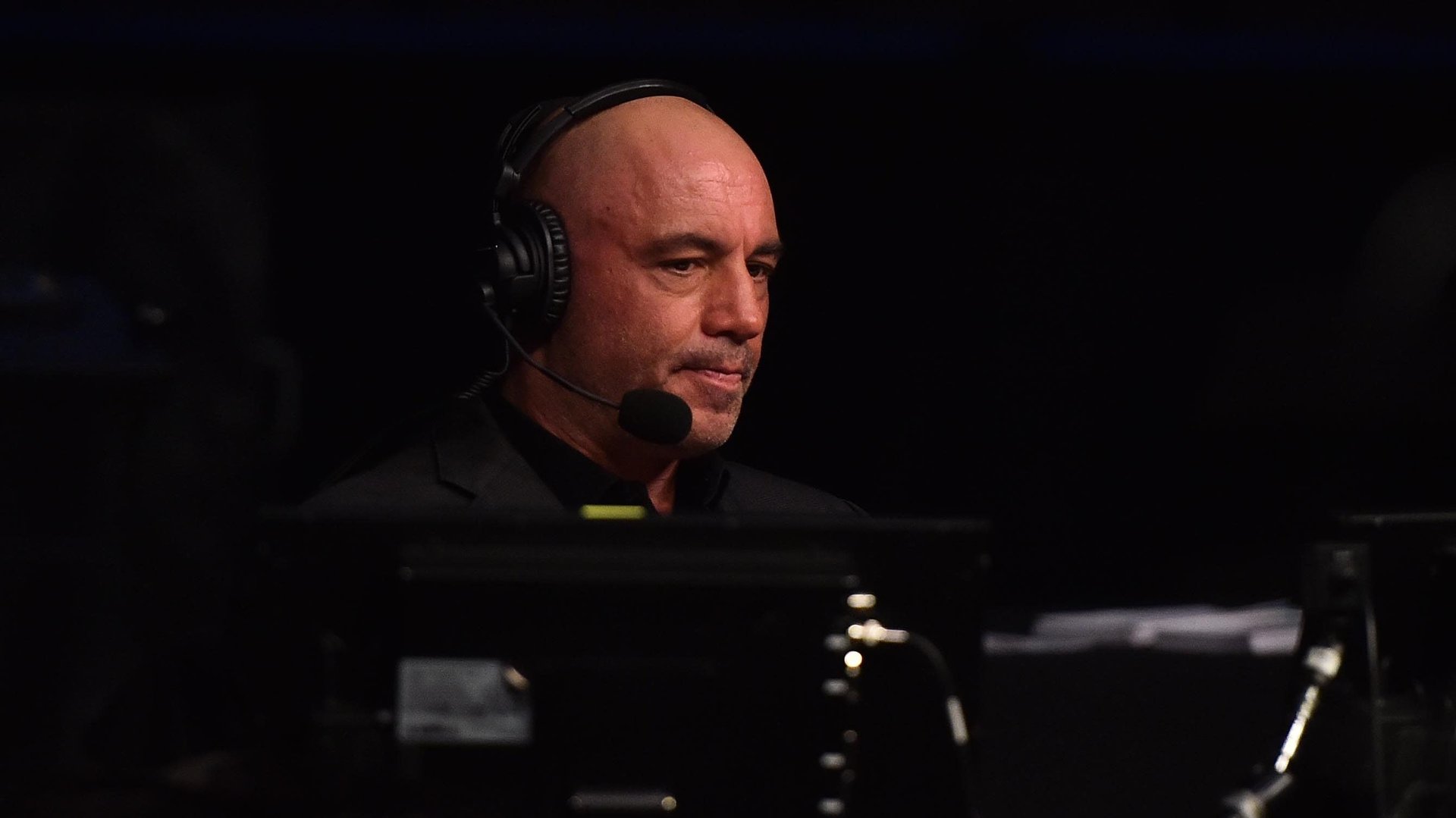

Spotify’s value jumped after buying the “Joe Rogan Experience”

Spotify is having quite the 2020. Today, the streaming giant’s market value is at about $46 billion—as recently as early April, Spotify was worth half that.

Spotify is having quite the 2020. Today, the streaming giant’s market value is at about $46 billion—as recently as early April, Spotify was worth half that.

What changed? Not a lot, actually. The Swedish company continues to see steady revenue and user increases, but reported losing €355 million ($420 million) in the first half of 2020. (It didn’t make a profit in 2018 or 2019 either.) Spotify is also making less money per premium user, a key metric of how much it can get people to pay for the service. Still, Spotify’s stock has grown twice as fast as the S&P 500 since Covid-19 spurred a market dip in March.

The most likely explanation for the sharp increase is investors’ hope that Spotify can become the Netflix of podcasts, explains Pivotal Research Group analyst Jeff Wlodarczak. The stock truly took off when the company announced its $100 million acquisition of exclusive rights to popular interview podcast the Joe Rogan Experience on May 19. Since the beginning of last year, Spotify has also acquired podcasting companies The Ringer and Gimlet Media, and inked an exclusive deal for Michelle Obama’s podcast.

Wlodarczak sees these moves as a way to gain leverage against the four music labels that control more than 90% of Spotify’s music content.

Right now, Spotify primarily serves as a platform for music, but its music offering is not much different from what users can access on competitors like Apple Music, YouTube music, and Deezer. If exclusive podcasts can attract and keep users on its platform, Spotify may be able to negotiate keeping a larger share of what it earns from subscribers (Spotify currently gives music labels more than 50% of revenues). With more users dedicated to Spotify because of its popular podcasts, music labels would be afraid of losing their place on the platform.

Spotify’s podcasting gamble may not work. The company is facing deep-pocketed competitors in Apple and Google (owner of YouTube Music), which seem willing to subsidize their streaming services in order to keep people using their other products, says Wlodarczak. Also, if Spotify’s podcasting strategy seems successful, those companies should be able to copy it.

But for the moment, investors seem to believe that Spotify’s “Netflix of podcasting” dreams just may come true.