ESPN is—and will remain—the most valuable network in the US

If American television junkies are hesitant to cut the cord and go cable-free, it’s likely because of sports—one of the few bits of programming that can’t usually be watched more conveniently on other platforms. That makes high-profile sporting events especially valuable to both cable companies and advertisers. And that’s why ESPN is the most valuable television channel in the United States, and will likely remain so.

If American television junkies are hesitant to cut the cord and go cable-free, it’s likely because of sports—one of the few bits of programming that can’t usually be watched more conveniently on other platforms. That makes high-profile sporting events especially valuable to both cable companies and advertisers. And that’s why ESPN is the most valuable television channel in the United States, and will likely remain so.

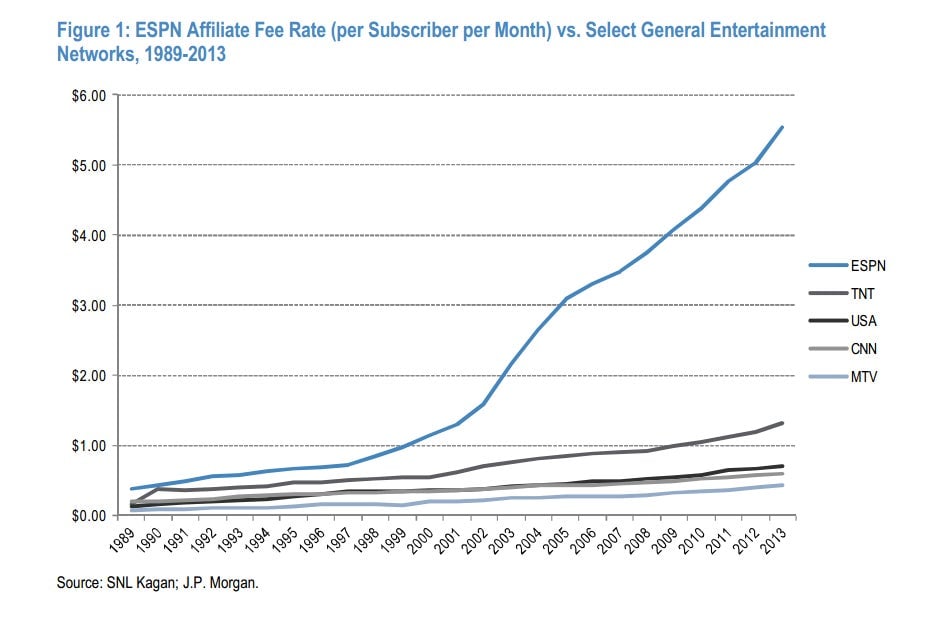

Check out the surge in affiliate fees—the cash cable companies fork over to channels such as ESPN in exchange for carrying content—that the Disney-owned sports network has logged since 1989. (J.P. Morgan media analysts put out a fascinating note on the topic today.)

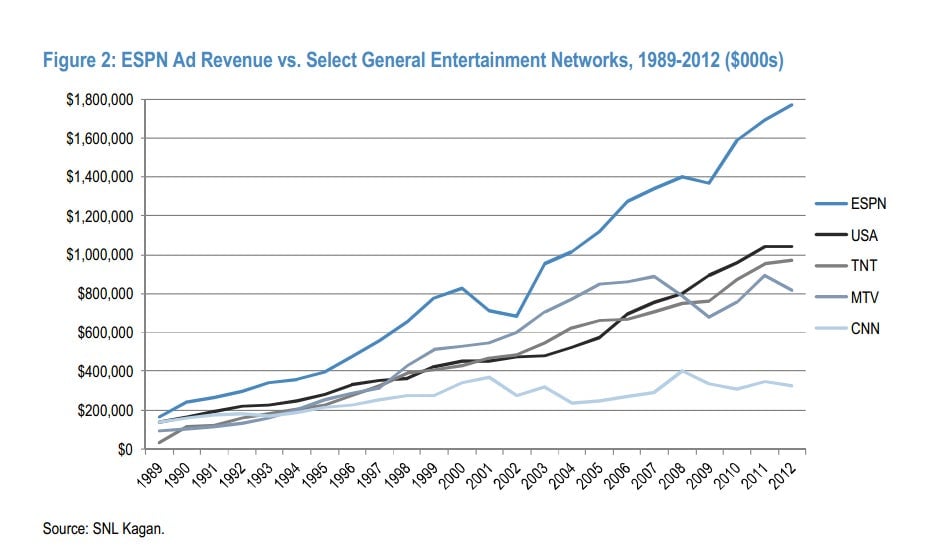

Likewise, ESPN advertising revenues have also run far ahead of other cable channels.

JP Morgan analysts look at these numbers and come to a succinct conclusion: “We see little threat to disrupting ESPN’s advertising and affiliate revenue streams or leverage in the market.”

If there is a threat, it may come from ESPN’s current business partners. Large US sports leagues have shown increasing interest in their own video streaming services.

But even large scale disruptions to the US television business—such as the possible alliance of Apple with Comcast to create a new live streaming service—won’t be enough to dislodge ESPN. That’s because to gain traction with US consumers, such services will also have to have access to the live-sporting events that ESPN offers. ESPN will simply start collecting affiliate fees from those new streaming services.

ESPN, which by some estimates accounts for about 40% of operating income of its megalith parent Disney, will continue to be a cash cow for some time. In other words, score.