That hotly awaited rebound in US business spending is still awaited

Winter is not quite over for capex.

Winter is not quite over for capex.

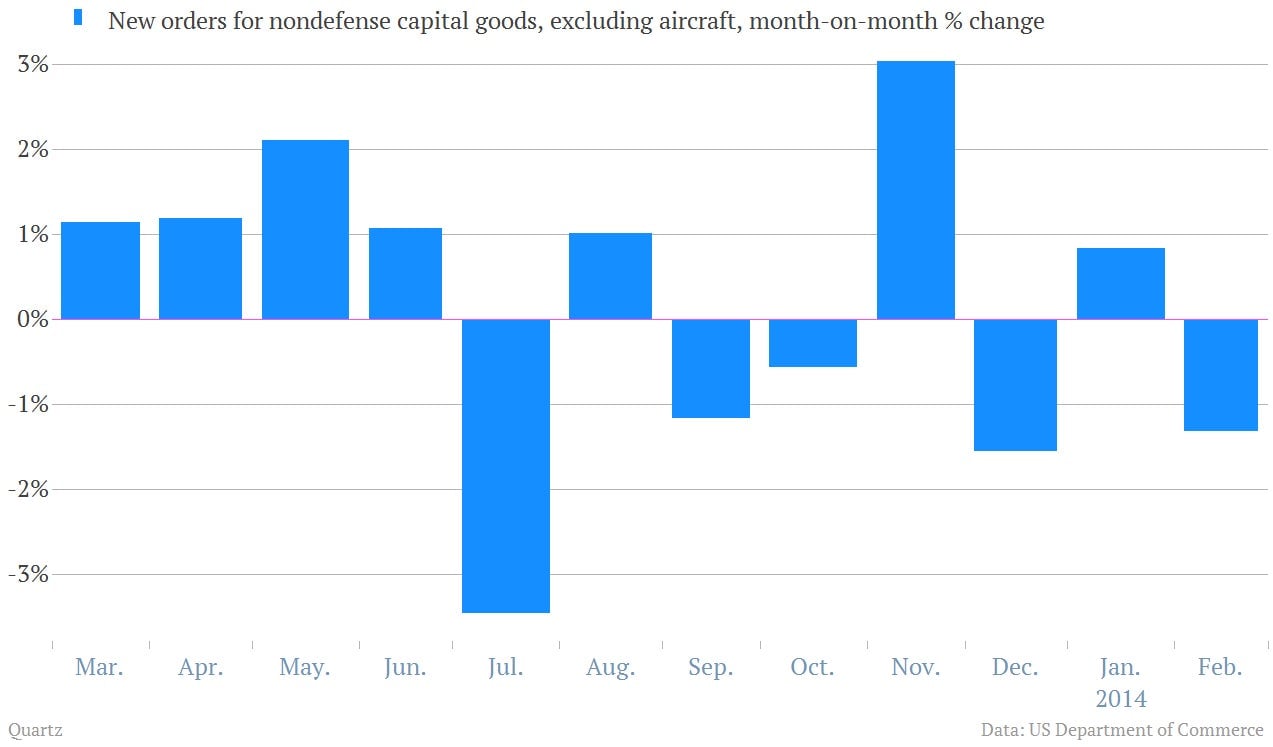

One of the most closely watched gauges of US business spending is in this morning’s report on US durable goods—items meant to last at least three years. It’s the line called “non-defense capital goods orders, excluding aircraft,” and it’s considered a decent barometer of demand for the big pieces of equipment that businesses purchase. As a result it’s watched for new information on capital expenditures—or capex—the long-term investments business have to make on equipment in order to maintain their productive capacity.

The latest numbers showed that capital expenditures slipped 1.3% in February compared to the prior month. (Like all the recent data, you should take this with a bit of a grain of salt, as weather distortions are making recent numbers very tough to read.)

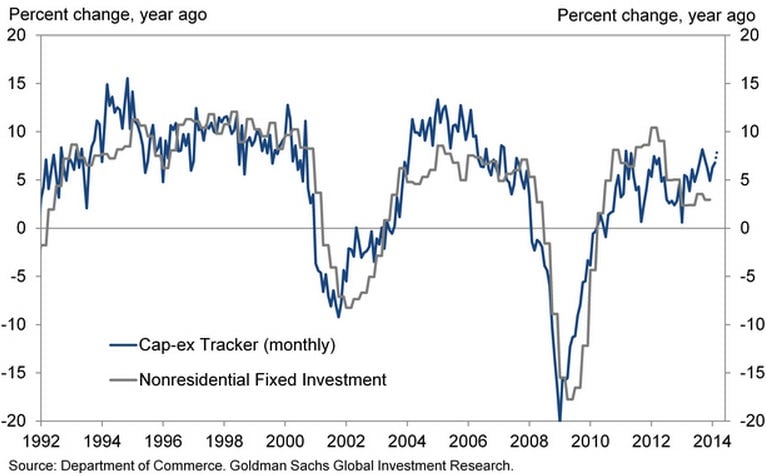

Analysts on Wall Street, including those at Goldman Sachs, are on record expecting a revival in capital expenditures. In a recent note, Goldman Sachs economists said their proprietary estimates of new business spending pointed to “meaningfully better capex growth over the next year.”