Obamacare is already working, at least on one front

Forget all the feel-good stuff about looking after the wellbeing of fellow citizens. When it comes to the impact of Obamacare—the deadline to sign up for the new US healthcare program is today—budget geeks have one key question: Will it rein in the decades-long spiral in healthcare inflation?

Forget all the feel-good stuff about looking after the wellbeing of fellow citizens. When it comes to the impact of Obamacare—the deadline to sign up for the new US healthcare program is today—budget geeks have one key question: Will it rein in the decades-long spiral in healthcare inflation?

As America’s population gets older, unrestrained healthcare cost inflation is seen as a driver of long-term US debt issues in the coming decades. So getting a handle on those costs is a priority.

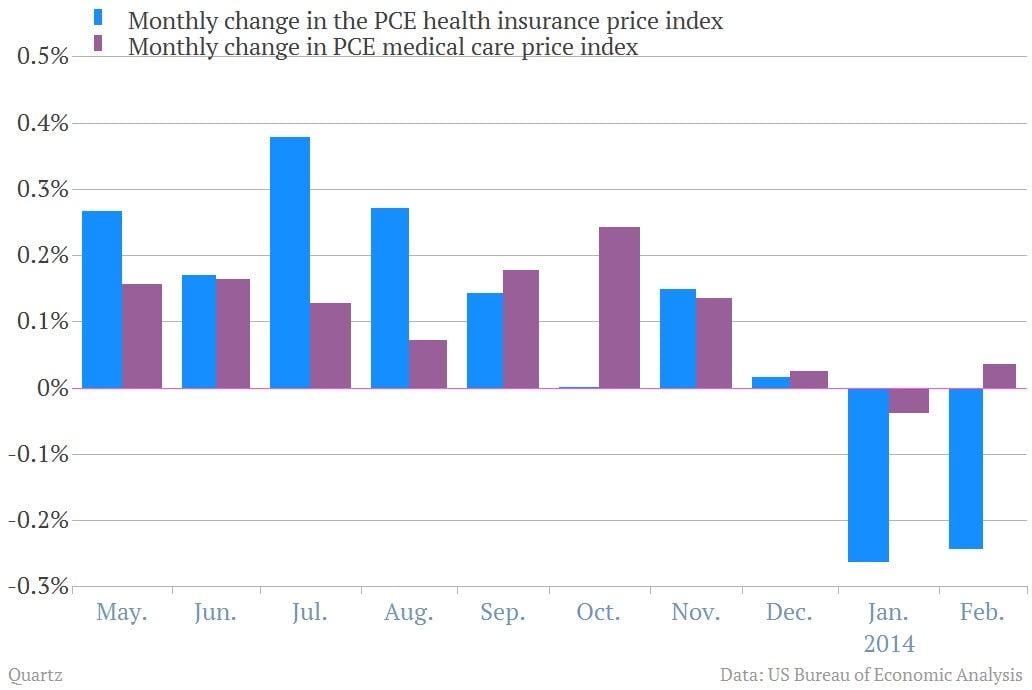

Early indications look promising. Here’s a look at inflation data from a report out Friday morning.

It’s worth noting that the inflation data above is from the personal consumption expenditures (PCE) report. While not as well-known as the consumer price index (CPI), the PCE inflation report is an alternative gauge of price increases. And when it comes to healthcare inflation, PCE is the number to watch. That’s because CPI data includes only healthcare spending by consumers themselves. It leaves out employer spending on healthcare, as well as government spending on healthcare. (Which is significant: about half of all healthcare spending comes from federal, state and local governments in the US.)

President Barack Obama’s marquee healthcare overhaul—the Affordable Care Act—is designed in part to halt the rise of healthcare inflation by trimming Medicare payment increases. It also shouldn’t be overlooked that an across-the-board 2% cut to Medicare payments also went into effect in April 2013, as part of the so-called sequester. And it’s these changes to policy that are driving the slowdown in US healthcare costs, according to a note from Goldman Sachs economists published earlier this year.

We believe that much of the recent trend is also clearly due to exogenous policy influences: First, sequestration cut the price that Medicare pays for most services by 2%, along with the more publicized cuts to defense and non-defense federal spending. Second, the Affordable Care Act reduced payment rates for most segments of Medicare starting in late 2010.

“Health spending growth—particularly the share financed by the federal government—still looks likely to be somewhat slower than expected a few years ago,” they concluded.

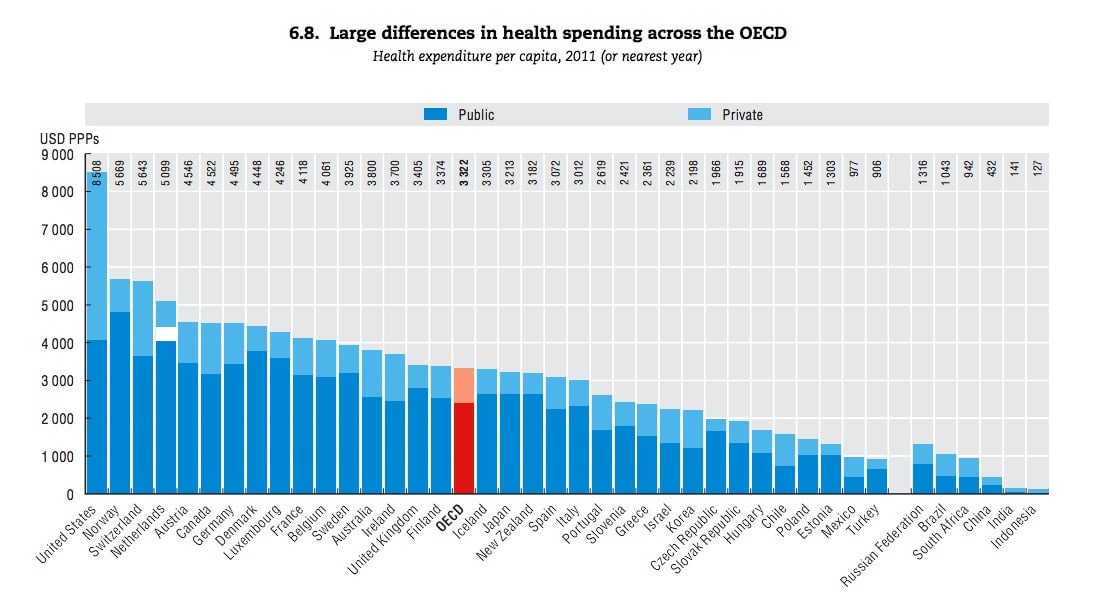

This is a very good sign. After all, America remains a giant outlier in healthcare spending. (And not in a good way.) In other words, a change is well past due.