PIIGS stock markets did insanely well during the first quarter

We’ve already spotlighted some of the biggest financial losers of the first quarter. (We’re looking at you, bitcoin.)

We’ve already spotlighted some of the biggest financial losers of the first quarter. (We’re looking at you, bitcoin.)

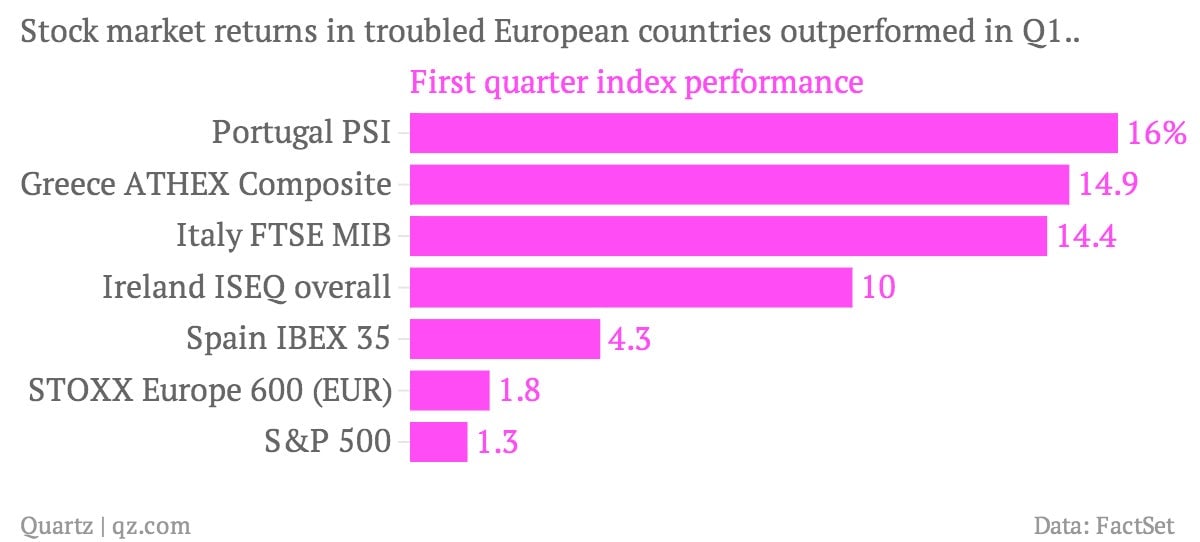

But there were also winners. For instance, stock markets in Europe’s beleaguered PIIGS (Portugal, Italy, Ireland, Greece, and Spain) did tremendously well during the first three months of the year.

The question, of course, is why. And the answer, of course, is that no one really knows exactly. (Aside: The certainty that accompanies most explanations of the behavior of financial markets is an act of theater. Markets are by their very nature the agglomeration of millions of individuals making individual decisions. You can have a pretty good guess about why markets move, but no one really knows.)

It is obvious, however, that these markets are not lifting off because of an economic miracle in these countries. Italy’s unemployment hit a record high of 13% in February. Spanish and Greek unemployment are catastrophic, at nearly 26% and 28% respectively.

No—it seems that much of the rally in European stock markets is due to the oversized influence of the continent’s bloated banking sector. For instance, in Italy’s market-capitalization weighted FTSE MIB, banks had by far the largest weighting of the index, nearly 27%, at the end of February. So when Italian banks make giant moves—such as the more than 60% rises logged by Banca Popolare di Milano and the Banca Monte dei Paschi di Siena during the first quarter—the stock market as a whole moves higher.

So the rise of the European markets signifies growing confidence in the banking system—which isn’t a bad thing—but doesn’t necessarily bode well for the broader economy. It’s best understood as just another bit of evidence that the European Central Bank has been successful in putting out the conflagration that was the European financial crisis. The economic and unemployment crisis, though? That’s still blazing away.