The one chart that shows why Mario Draghi is wrong about the IMF

Global finance is getting snippy: The head of Europe’s Central Bank, Mario Draghi, is tired of backseat driving from the International Monetary Fund.

Global finance is getting snippy: The head of Europe’s Central Bank, Mario Draghi, is tired of backseat driving from the International Monetary Fund.

“I think the IMF has been of recent extremely generous in its suggestions on what we should do or not do,” he told reporters after a meeting of the ECB’s rate-setting council today. “And, we’re really thankful for that. But the viewpoints of the Governing Council are in a sense different. Frankly, I would like the IMF to be as generous as they have been towards us also with other monetary policy jurisdictions, like for example issuing statements just the day before an [US Federal Reserve] meeting would take place.”

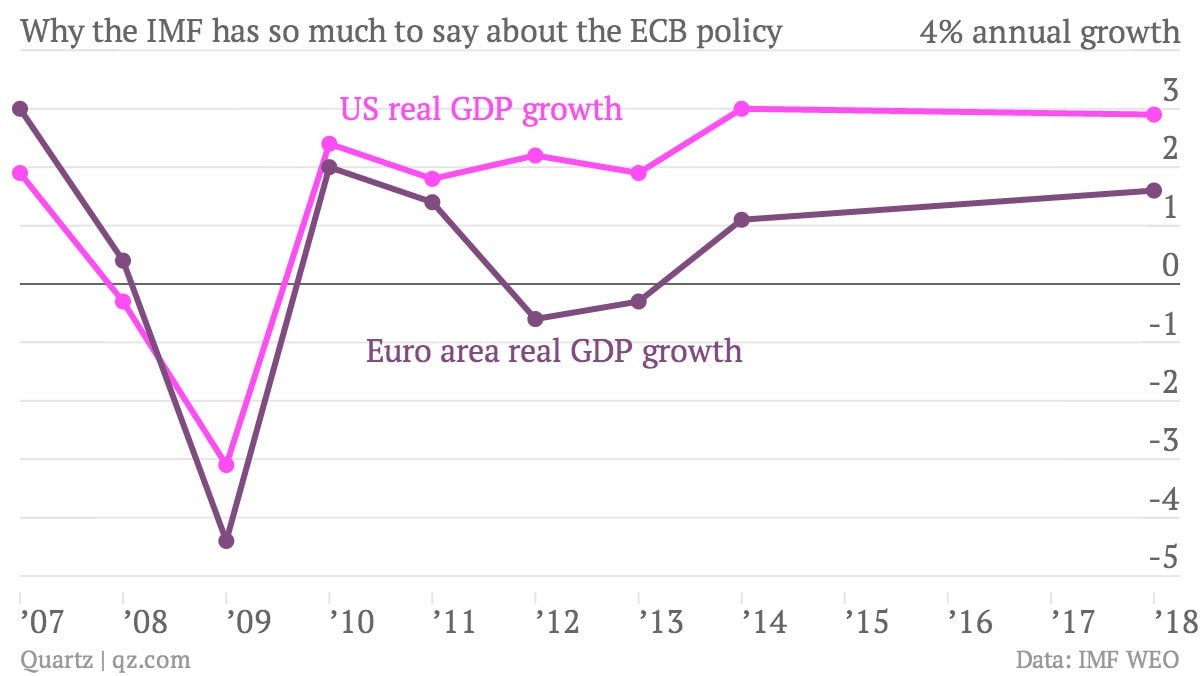

Indeed, in a speech yesterday IMF managing director Christine Lagarde said the ECB should act more aggressively to support the euro zone’s recovery. The IMF’s latest World Economic Outlook, published today, details how the ECB is missing the mark—the IMF’s economists say that what was once a snappy recovery in emerging markets and a slower recovery in the advanced economies has become a tale of three paths, with the euro area diverging from the US recovery. You can see why they might be concerned in the chart below:

Whether Draghi likes the IMF’s suggestions or not, the proof is in the pudding, and in Europe that pudding tastes pretty bad. Draghi’s war of the words has limited the euro area’s financial crisis, but the bank still hasn’t done much to spur sustainable growth. The IMF thinks it’s time for the bank to do more to lower rates and stimulate growth. Across the pond, the US Federal Reserve Bank’s more novel approach to monetary policy may have raised worries among the inflation crowd, but it’s managed to spur growth without the adverse consequences those critics have predicted.

And besides, it’s not as though the IMF has gone easy on US policymakers. The organization has spent the last four years criticizing America’s fiscal policies as ad hoc, too focused on austerity in the short-term, and not prudent enough in the long-term.