The new monster tech IPO is a video app giving voice to China’s “silent majority”

When Chinese short video app Kuaishou marked its ninth anniversary in June, its promotional video for the platform didn’t feature well-known celebrities or youthful influencers. Instead, Kuaishou invited Huang Chunsheng, a 50-year-old user living in a small northern city, to be its face.

When Chinese short video app Kuaishou marked its ninth anniversary in June, its promotional video for the platform didn’t feature well-known celebrities or youthful influencers. Instead, Kuaishou invited Huang Chunsheng, a 50-year-old user living in a small northern city, to be its face.

“Don’t pass by ordinary people with indifference,” said Huang Chunsheng, wearing a suit and standing against a backdrop of videos uploaded by Kuaishou users. “There are people dancing in the mountains, and those singing in vegetable plots…Technology has offered the opportunity for the silent majority to break up their silence, and help ordinary people become unordinary. This is the power of seeing them,” he said.

The video offers a perfect snapshot of Kuaishou’s successful strategy of billing itself as a platform for grassroots users from beyond China’s most cosmopolitan cities, such as Beijing and Shanghai. Usually seen wearing tee shirts rather than suits, Huang is an archetypal Kuaishou user himself—the former school teacher who takes care of an elderly father has amassed 5 million followers with his intense and exaggerated delivery of short motivational speeches.

The platform’s approach seems especially well-timed amid a rising wealth gap, exacerbated by the coronavirus, that is driving anger toward the rich and powerful. While China registered a record number of billionaires last year thanks to booming stock markets, nearly half of the country’s 1.3 billion population lives on a monthly income of less than 1,000 yuan ($140), Chinese premier Li Keqiang noted last year. Young workers, including those in the lucrative tech sector, are protesting against excessive work hours that they believe has enriched executives while leading to exhaustion, or even death, for people like them.

The irony is Kuaishou’s “ordinary folks” ethos is about to make its founders very rich when the platform goes public in Hong Kong on Friday (Feb. 5). Its IPO has been oversubscribed 1,200 times, making it the most oversubscribed listing in the city ever, according to the South China Morning Post. As a result, the company priced its shares at the top range of HK$115 ($15), allowing it to raise $5.4 billion, the biggest tech IPO since Uber in 2019.

From a GIF maker to Douyin’s biggest rival

Kuaishou, whose name means “fast hand,” was launched as a GIF maker in 2011 by ex-Google employee Su Hua and his friend Cheng Yixiao, who are currently the firm’s CEO and chief product officer, respectively.

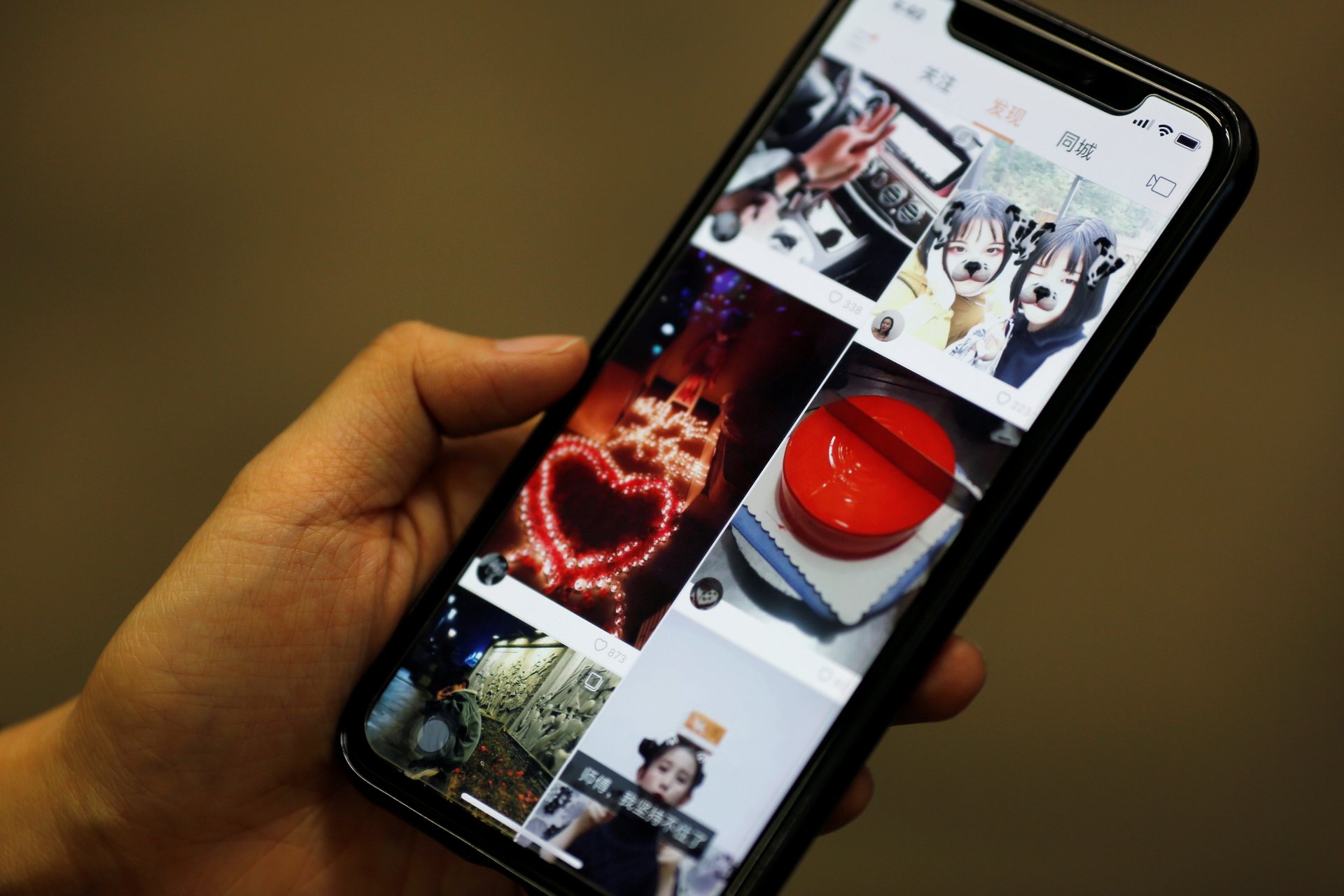

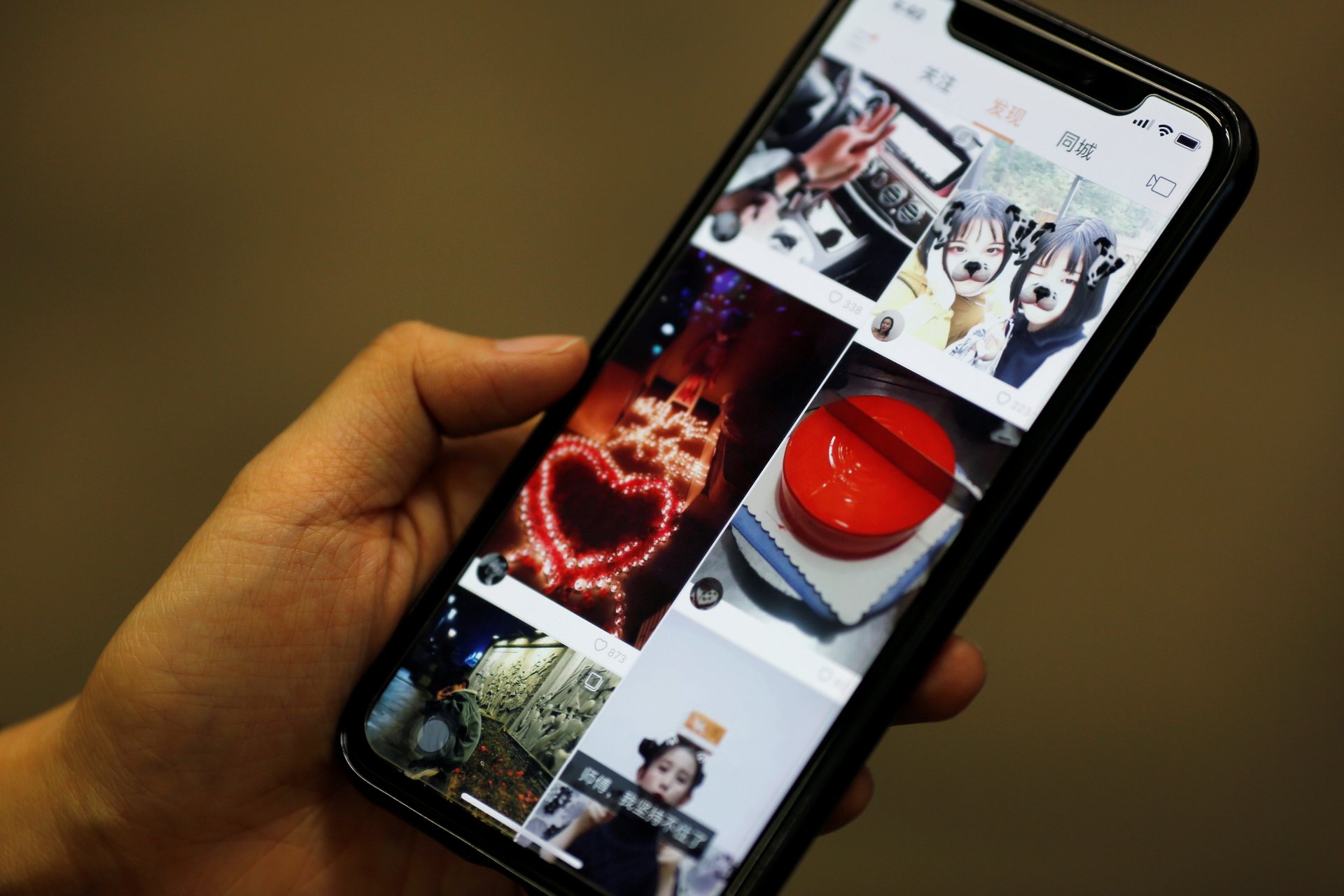

A rival to TikTok—or Douyin as the app’s Chinese version is known—Kuaishou’s videos often feature users from rural areas, who film themselves feeding chickens or pulling off pranks on friends. Some urban commentators dismiss the content as crude and bizarre, or label the app a reflection (link in Chinese) of “the dark side of a glamorous era,” a reference to China’s economic rise. In contrast, Douyin is known for its hip, mainly urban users who show off complex dance moves or sing.

Nevertheless, Kuaishou reached over 300 million daily active users as of September, making it the second-biggest short video platform after Douyin, which has double that number.

“Unlike Douyin’s focus on creators with the biggest followings, Kuaishou has distributed around 70% of its traffic to creators with a mid-sized following,” wrote Kong Rong, an analyst with China’s Everbright Securities in a note (link in Chinese). “This has encouraged Kuaishou creators to use the app more…offering users more freedom to see a world with diversity.”

Amy Wong, a Hong Kong-based professional who opted to subscribe to the IPO, echoed Kong’s opinion. The 26-year-old said Kuaishou seems to have grasped her taste better than Douyin, which she described as “noisy” because it mainly pushes dance and music videos to her.

“I started using Kuaishou last year amid the pandemic, and soon the app’s algorithms understood my interests in youngsters from small towns but working in big cities, whose dreams and struggles touched me because I am in a similar situation,” she told Quartz.

In its prospectus, Kuaishou highlighted its focus on ordinary users, as well as diversity as one of its core values.

“We are most proud of the fact that our platform can act as a service that helps ordinary people of all backgrounds realize their innate potential and live a life of greater dignity,” it said.

Around 23 million users managed to make money through the app for the nine months ended in September last year, compared with 6 million for the whole of 2017. The company’s revenues, meanwhile, increased from 8.3 billion yuan ($1.3 billion) in 2017 to 41 billion yuan during the first nine months last year.

Most of its revenues come from virtual gifts, which users buy to reward creators they like, while the rest of the earnings come from online marketing services, and commissions from e-commerce sales on its platform. But despite the increase in revenues, the company reported a net loss of 7.2 billion yuan in the first three quarters last year due to rising selling and marketing expenses amid cut-throat competition with Douyin, owned by China’s ByteDance.

It won’t be an easy task for Kuaishou to narrow its losses.

While Douyin brought in nearly 108 billion yuan in ad revenue for ByteDance last year, according to Reuters, Kuaishou made only around 13.4 billion yuan from marketing services, including advertising, during the first nine months last year. And ByteDance, which reportedly made $37 billion in revenue last year, can continue to fund Douyin’s expansion, say observers.

Both Kuaishou and Douyin, facing fierce competition, are learning from each other’s advantages.

“Kuaishou is being ‘Douyinized,” while it is vice-versa for Douyin. While the two products look increasingly similar, when the growth of video platforms reaches its limit, the competition for users will come down to users’ preference for content,” wrote Kong from Everbright Securities.

There’s another thing both platforms have in common: uncertainty about how China’s increasing regulatory pressure on tech firms will affect their future expansion.

Previously, the flamboyant Jack Ma’s fintech giant Ant Group saw its $37 billion IPO thwarted by Beijing, which is increasingly worried about both the company’s dominance and potential financial risks, and Ma’s rising influence. In 2018, Kuaishou and Toutiao, a news aggregator under ByteDance, were told by regulators to temporarily suspend users from adding new content, while removing those deemed as violent or obscene. On Jan. 29, China’s top cyberspace regulator said it will enhance scrutiny of content that “disrupts the order of online communications” on online platforms such as short video apps, asking the platforms to always prioritize “the correct political direction.”

“Given that the internet business is highly regulated in China, intensified government regulation of the short video, live streaming and e-commerce industries in China could also restrict our ability to maintain or increase our user base or the user traffic,” said Kuaishou in its prospectus.