In the auto industry, Jan. 8, 2021 was an earthquake. Tesla’s valuation eclipsed that of the rest of the world’s automakers combined, reaching a record $844 billion. Although the electric carmaker was responsible for selling less than 1% of the world’s vehicles, in the eyes of investors, at least, it was worth more than an entire industry that has been around since the 1880s. The future of vehicles, the market is saying, will look nothing like its past.

But at present, little about Tesla’s valuation makes sense. A JPMorgan analysis of Tesla’s fundamentals suggests the company should be worth around $130 billion, just 15% of its peak market cap earlier this year. Tesla has only recorded one profitable year (2020) thanks in large part to selling zero-emission credits to other automakers. And while it delivered an impressive 500,000 cars to customers last year, that’s just 5% of what Toyota delivered. In fact, Ford sells nearly as many pickup trucks in Texas as Tesla sells Model 3s on the planet, and the Model 3 is the world’s most popular electric vehicle (EV).

But Tesla’s success isn’t really about the numbers. It’s about the story that chief executive Elon Musk has been selling about the future since writing a prescient blog post titled “Secret Tesla Motors Master Plan” in 2006. In it, Musk lays out an improbable vision:

- Build sports car

- Use that money to build an affordable car

- Use that money to build an even more affordable car

- While doing above, also provide zero-emission electric power generation options

Against the odds, Musk has delivered, albeit late and over budget. Today, the company is the world’s largest builder of affordable electric vehicles (the Model 3 starts at $38,190, just under the average price of a new car in the US) and sells thousands of batteries and solar panels on the side. Musk is now working on “Part Deux” of Tesla’s plan: He’s integrating solar and energy storage, conquering the car market beyond sedans, and building software to turn every Tesla into a self-driving robotaxi.

Critics are skeptical. Musk has overpromised before. Tesla is now years behind on “full-self driving” software, and failed to deliver the “one million robotaxis” promised by the end of 2020. Rivals such as Waymo, owned by Google’s parent company, have even dismissed the company out of hand: “For us,” Waymo’s CEO John Krafcik said this January, “Tesla is not a competitor at all.”

Tesla’s build quality is shaky as well: The look, feel, and finish of a Tesla still doesn’t compare to an Audi, Jaguar, or Porsche. Customers complain of ill-fitting components and long waits for repairs. And intense competition is barreling down the highway: Nearly 100 battery-electric EV models will hit the market by 2024.

All that has kept Wall Street analysts relatively bearish amid Tesla’s dizzying ascent. Their forecasts chased the stock’s price upward as Tesla entered the S&P 500 index in Dec. 2020, becoming the sixth most valuable company in the benchmark, and Tesla’s share price rose another 50% in early 2021. Analysts’ consensus price is now six times higher than it was in 2020, but remains 40% lower than Tesla’s actual share price, according to the equity research firm Sentieo.

Automakers aren’t asleep at the wheel. They’re finally embracing an electric future by announcing plans to turn themselves into technology companies that build electric cars. In the last three months, Ford, GM and Volkswagen have seen their share prices rise by 40% or more, outpacing even Tesla in 2021. But their dilemma is clear, says David Keith, an engineer and professor at the MIT Sloan School of Management: “Do you want to be a company that bends metal in a very low-margin business, or a tech business with recurring revenue and a giant blue sky valuation?” Investors are demanding the latter.

What electric car race?

For years, old-school automakers believed their superior balance sheets and manufacturing prowess would allow them to catch up to Tesla once the market for electric vehicles matured. The EV market remains small: Only 1.8% of new sales in the US are electric. Even in an optimistic scenario, just a quarter of the new cars in the US will run on electricity by 2030, estimates the energy research firm Cairn Energy Research Associates.

But waiting appears to have been a grave miscalculation. Policymakers around the world have signaled they plan to accelerate the transition to electric vehicles as soon as possible. Norway will phase out new fossil fuel vehicles by 2025. California, much of Europe, and even China are close behind. Waiting until then to retool factories will be too late.

Automakers need more than a decade to design a new engine, says MIT’s Keith, and the job before the auto industry is much bigger than building a new V8. It must master electric propulsion, self-driving software, and move away from lucrative business models centered on dealerships, regular maintenance, and internal combustion engines. “The challenge any incumbent faces in the technology transition is when do you give up on a profitable product [and back] new difficult things,” says Keith. “That’s the classic story of why incumbents frequently struggle to survive these technology transitions.”

EVs are now the fastest-growing segment of a shrinking global vehicle market. Global passenger vehicle sales peaked in 2017, according to BloombergNEF, declining nearly 14% since then. In the same period, EV sales more than doubled to 2.6 million units. The industry is now leveraging everything it has to get ahead of that curve collectively committing $225 billion to electrification through 2023, a massive sum. Companies like GM say the effort will consume more than half of its capital spending. “We’re getting to the end of the song quicker than expected, and there are only so many chairs left,” says Sam Jaffe, managing director of Cairn Energy Research Associates. “There’s going to be big losers among the incumbent automakers.”

Beating Tesla means these automakers must now master a new set of skills: software development, systems engineering, rapid prototyping, digital services, and machine learning. This devalues automakers’ expertise in building fossil fuel-powered cars, argues David Kirsch, a historian at the University of Maryland’s Smith School of Business who studies the emergence of new industries. “I’m very sympathetic to the argument that the incumbents make: They’re really good at what they do,” says Kirsch. “But the things they do may not be that valuable to the market of the future.”

Tesla’s competitive advantages

Tesla has already changed the automobile industry, and is poised to change it further. Here’s what it has going for it.

Innovative, efficient manufacturing

“Where the greatest potential lies is building the machine that makes the machine,” Musk told Tesla’s shareholders at its 2016 annual meeting. “In other words, building the factory…like a product.” Musk estimates Tesla can improve the efficiency of its factories ten-fold, far more than incremental gains from redesigning the vehicle itself. By automating production, simplifying assembly, and shrinking the size of the factory, Tesla plans to radically cut its manufacturing costs, cementing its advantage over legacy automakers.

Though Tesla’s early manufacturing efforts were beset by delays and cost overruns, its new factories are rising at an unprecedented pace; Tesla’s Shanghai factory in China went up in a remarkable 168 working days. Today, Tesla is gearing up to build its seventh factory after establishing plants in California, New York, Nevada, Texas, Germany, and China. With each new factory, the company says it is bringing down the cost of building its cars (and batteries). “What Tesla does [better] is the machine that builds the machine,” argues Nathan Niese, a partner at the Boston Consulting Group focused on electrification and climate change. “They started with a clean sheet of paper and asked what could be.”

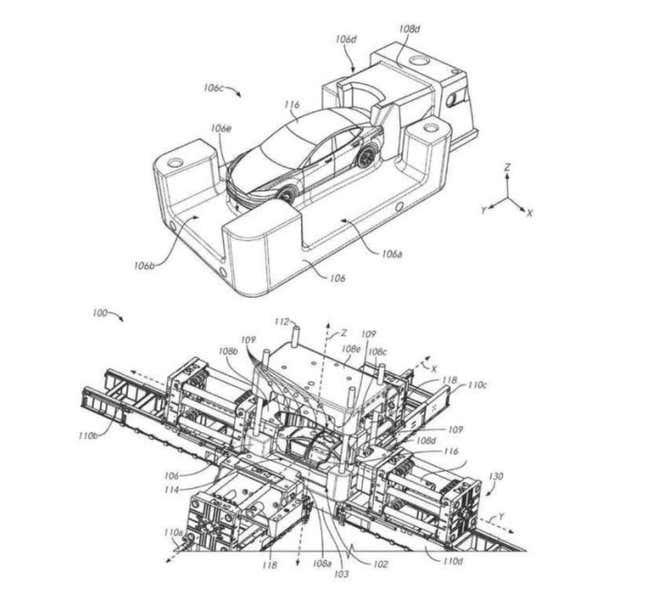

The 2020 Model Y points to a new standard to beat in auto manufacturing. Previous models followed traditional industry practice: welding together stamped steel and aluminum parts into a chassis, an expensive and laborious process. For the Model Y, Tesla commissioned the world’s largest die-cast machine to inject molten metal into a mold under high pressure. The press, clamping down with 6,000 tons of force, replaces 70 pieces of welded metal with a single slab of cast aluminum. JPMorgan cited huge potential savings: 40% lower rear underbody costs, 30% smaller body shop, and 20% lower labor expenses. An even larger press is now planned for Tesla’s Cybertruck. Eventually, a 2019 Tesla patent suggests, the entire automobile underbody could be cast as a single piece of metal, portending “a radical change to traditional automobile production process,” JPMorgan wrote in a February investor note.

Tesla has by no means perfected its manufacturing. In 2019, Musk’s misguided quest to build a fully automated “alien dreadnaught” factory nearly bankrupted the company (a new assembly line had to be airlifted from Germany to meet production deadlines). And even today, Tesla’s cars sometimes roll off the lot with manufacturing oversights. Tesla owners regularly snap photos of ill-fitting seats, body panel gaps, and mismatched doors that would not pass muster at traditional automakers.

But Tesla has mastered the process of quickly improving its factories. Traditionally, new vehicle models take six years to roll out, and major components a decade to redesign, says Kirsch at the University of Maryland. Tesla has shown it can turn around overhauls in months. For Model 3s built in China, it recently started using a cobalt-free battery system—a substantial cost savings—in what was perhaps record time for such a dramatic change to an EV’s systems.

This pace of improvement will give Tesla a shot at automotive margins that could eclipse every global automaker. Last year, Toyota posted 18% gross margins, and GM 17%—both respectable for the industry. Tesla, which reported 24.1% margins (pdf) last year, is now on track to achieving 30%, unprecedented for a company mass-producing vehicles, argues Jaffe. That not only breaks the trend for the industry, but could put Tesla into a different industry altogether, one closer to Apple which enjoys gross margins on its hardware above 30% thanks to operational efficiencies, premium products, and a lucrative software and services business “It’s scale mainly,” Jaffe says. “Applying lessons learned from the factory in Fremont to Berlin to Austin, and then incrementally realizing the improvements.”

Access to capital

Ask industry watchers how much cash will be needed to master electric cars, and the answer is invariably some variation on “limitless.” Tesla will need all the cash it can get to reach its goals. Musk announced in 2020 that Tesla plans to produce more than 3 terawatt-hours of batteries annually by 2030 (more than 50 times today’s global capacity), split roughly between vehicles and stationary applications such as buildings and the electrical grid. Tesla aims to do this while selling into a shrinking global automotive market that likely peaked in 2017.

That makes Tesla’s stratospheric valuation a potent advantage (while it lasts). Traditional, legacy automakers have loaded up with debt and are already leveraged to the hilt; the industry has $1.1 trillion in outstanding debt. But Tesla is tapping the stock market for cash. Tesla’s valuation allows it to raise billions of dollars, issuing highly-priced stock with little dilution. Last year, Tesla announced more than $12 billion in fundraising. The cost to Tesla? Equity worth less than 1% of the firm’s December valuation. The new funds weren’t earmarked for a specific project. The company just plans to pour as much capital as it can into new vehicle factories, battery manufacturing, and expansion. Investors appear willing to write the blank check. “We’re trying to spend money at the fastest rate that we can possibly spend it and not waste it,” Musk said on a third-quarter earnings call.

Of course, investors may start to question Tesla’s high-flying share price. “Tesla’s stock price is an enormous resource that has allowed them to accelerate development in lots of different areas,” says Kirsch. “But it’s a mile wide and inch deep.” Tesla’s profits in 2020, its first profitable year, relied heavily on the sale of zero-emission tax credits, more than $3,000 for every vehicle, rather than operational margins on vehicles, says Eric Ibara, executive analyst at Kelley Blue Book. While Tesla plans to raise its operating margins by ramping up volumes from 500,000 vehicles to more than 750,000 in 2021, that hasn’t happened yet. As the company sells cheaper vehicles, leaving behind the luxury margins of Model S sedan and Model X SUV, even more pressure will fall to its bottom line.

And Tesla remains one of the world’s most shorted companies, with $39 billion in short interest, three times more than Apple, even after Wall Street investors suffered huge losses in recent years. Between 2017 and 2021, investors shorting Tesla lost $52 billion. GameStop short sellers, by contrast, lost an estimated $8.4 billion, according to data from US exchanges analyzed by S3.

All this may represent something new in modern corporate America, says Kirsch: Musk’s ability to shape investor sentiment beyond any reasonable reading of the company’s current capabilities. Tesla’s greatest financial asset may be Musk’s ability to rally the market, and his 47.3 million Twitter followers, behind his narrative. “The new route [to a trillion-dollar company] is the ability to marshal novice investors in support of weakly supported but attractive-sounding claims about future corporate activity,” suggests Kirsch. “And in some ways, it’s a self-fulfilling prophecy.”

Systems engineering

The average car already has more than 100 million lines of code running under the hood, four times more than the average commercial aircraft. That number will explode 10,000-fold as self-driving, networked vehicles hit the road. “If [car companies] want to play, you have to find a way to do software,” says Niese. “The vehicle of the future is a software-enabled one.”

Incumbent automakers have always lived in a hardware world. For the last 50 years, carmakers have seen themselves primarily as “system integrators,” the final assembly for other companies’ physical parts. Thousands of pieces of metal, plastic, and glass from suppliers are assembled in a final vehicle bearing the automaker’s logo. Over time, they’ve added software, but it’s never updated over the life of a car. Thanks to Tesla, that’s changing; hardware and software are merging into a single, integrated system. “The beating heart [of a vehicle] is no longer the V8 engine,” says MIT’s Keith. “It’s the chip that drives us around.”

Tesla shook the auto world by updating its operating system wirelessly on a rolling basis, sometimes several times each week. This new code isn’t just cosmetic: It allows cars to drive autonomously across intersections, adapt suspensions, and extend battery life. To facilitate this, Tesla brought as much of its hardware and software production and development in-house as possible, going so far as to buy lithium mining rights in Nevada. Systems engineering, rather than designing isolated components, is the secret weapon. In this sense, Tesla has taken a page right out of Apple’s playbook, designing software on top of custom hardware.

That has proven hard for the auto industry to master. VW had to delay the launch of the ID.3, its first dedicated electric vehicle, after years of development when software systems failed to function properly. New owners reported hundreds of software bugs, according to The Wall Street Journal, forcing 50,000 owners to visit service stations since VW couldn’t update the software wirelessly. And the (failed) partnership between Hyundai and Apple speaks to automakers’ resistance to handing over too much control to tech companies. In February 2021, the Korean automaker backed out of an Apple-branded autonomous car venture, reportedly over worries it would end up as just another low-margin supplier to the Cupertino, California company.

Automakers are now seeking vertical integration by snapping up assets from raw materials to retailers to software developers. Unlike today’s cars, many of these systems are not commodities like air-conditioning systems, brakes, or transmissions. And to get the most out of them, you need to design everything together as a system, not just combine off-the-shelf components. GM, for example, is now hiring 3,000 engineers and software developers for its cars.

That’s forcing incumbents into competition with new entrants they haven’t faced in more than half a century, says Anna Stefanopoulou, a professor of mechanical engineering at the University of Michigan. “We knew how to [build vehicles] so well, it could be safely outsourced,” she says about automakers’ traditional strategy. “Now we are at the cusp of a new technology, and it has to be completely integrated and rethought from the beginning. If you don’t do that, you leave so much on the table.”

The Tesla fan club 🚀

Every car company has fans. Not many have people like Will Fealey. The president of the Tesla Owners Club UK, along with his fellow club members, spends his spare weekends at car shows offering “10,000 test drives” to prospective Tesla owners. “Staff from companies like Pagani, Aston Martin, BMW, and Porsche had to pick up their jaws from the floor once they realized we were volunteers from the official UK owners club and not employed by Tesla,” he tweeted after the event.

Tesla’s most durable competitive advantage has come from the devotees who bought Tesla’s cars and rallied behind its stock long before it rocketed to its current status. Millions of customers have plunked down deposits or taken to social media at key moments to support the struggling carmaker. One such moment, the launch of the Model 3 in 2016, stands as the most successful launch of any product in history. During its first week, Tesla took 325,000 Model 3 orders, collecting $325 million in refundable deposits, for a car that didn’t yet exist. By contrast, the Chevy Bolt has yet to crack 100,000 sales since it first became available in 2016 (the Model 3 is now above 507,000). For Tesla, this launch was a turning point cementing its place as a global competitor with access to huge, untapped demand.

Would this have happened without Elon Musk? Unlikely. While other companies sell cars based on performance, lifestyle, status, or raw horsepower, Musk somehow has made Tesla synonymous with buying a more exciting future. Musk’s ability to enlist customers in its ostensible mission to “accelerate the world’s transition to sustainable energy,” is unique.

And for those who just want a sexy vehicle powered by electrons, well, that’s for sale too.