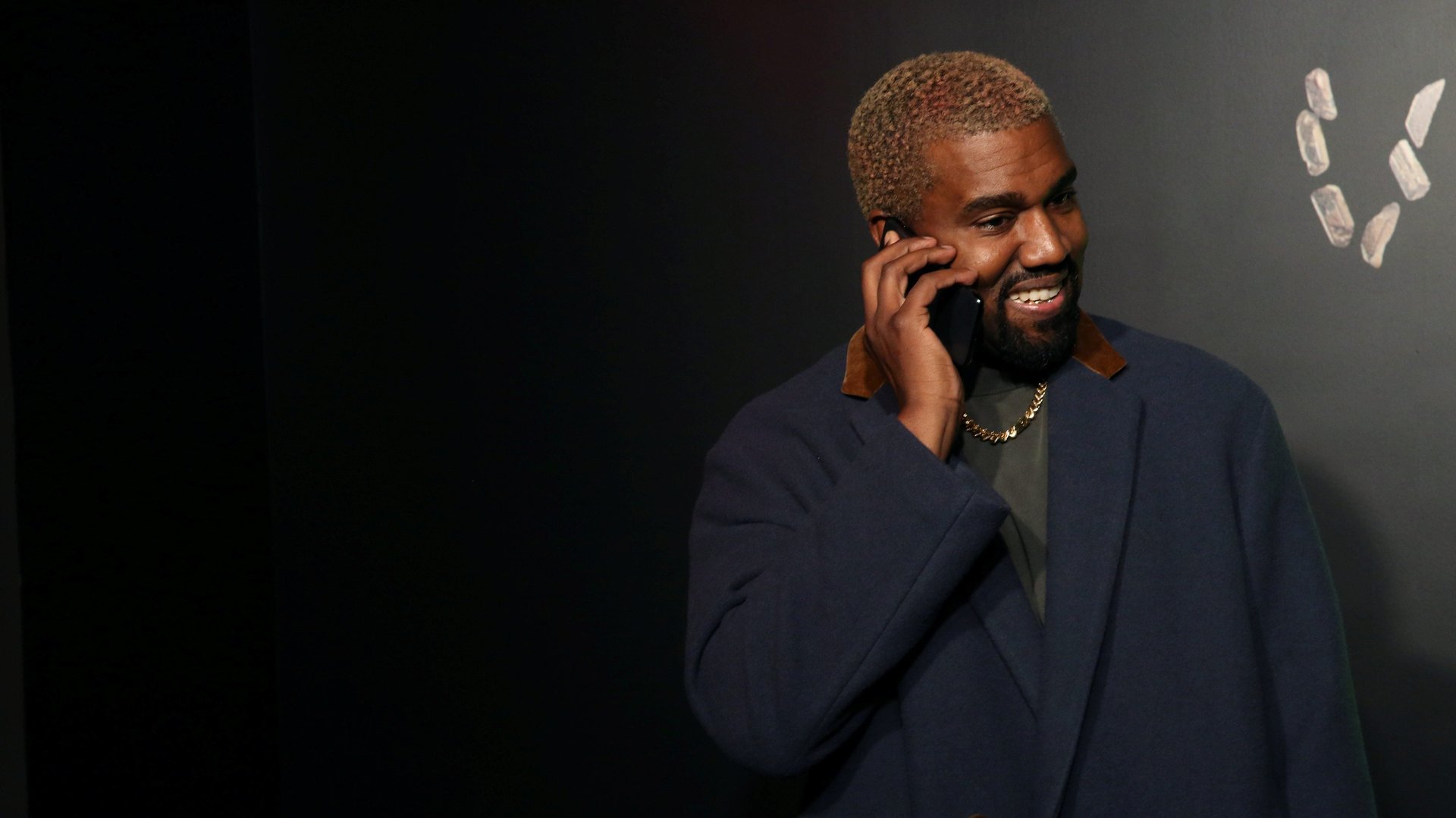

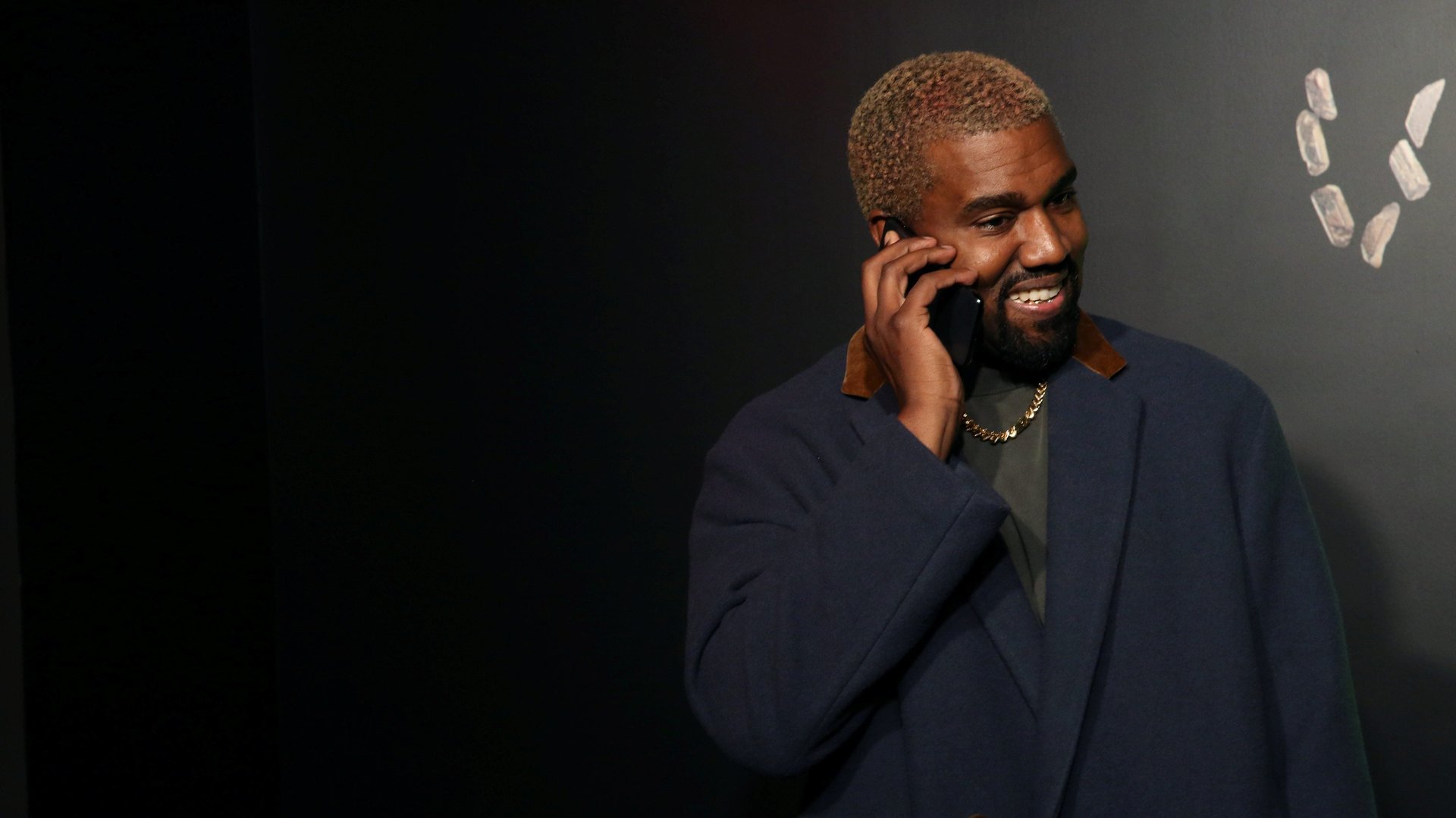

Kanye West’s fortune could sink or soar with his Gap partnership

Kanye West rose to fame as a rapper, but it’s his sneaker and clothing brand, Yeezy, that makes up the bulk of his wealth today. Investment bank UBS has valued the brand between $3.2 billion and $4.7 billion, according to a report from Bloomberg, which viewed a private UBS document with the figures. West’s cash and other assets additionally totaled nearly $2 billion, Bloomberg said, citing an unaudited balance sheet from West’s lawyer.

Kanye West rose to fame as a rapper, but it’s his sneaker and clothing brand, Yeezy, that makes up the bulk of his wealth today. Investment bank UBS has valued the brand between $3.2 billion and $4.7 billion, according to a report from Bloomberg, which viewed a private UBS document with the figures. West’s cash and other assets additionally totaled nearly $2 billion, Bloomberg said, citing an unaudited balance sheet from West’s lawyer.

Companies are often valued at a multiple of their current sales based on factors including expected future growth. Yeezy’s value rests primarily on sales of West’s sneaker line with Adidas, which UBS said reached $1.7 billion last year, netting West $191 million in royalties, and continue to grow quickly. But as much as $970 million of the valuation is tied to West’s recently announced clothing deal with Gap, which will see him design items such as hoodies and jeans for the mass retailer. It’s a significant amount given the clothes haven’t even debuted yet, and though the partnership holds a good deal of potential, it’s far from a guaranteed success.

West’s success to date has been largely in sneakers, a category he won’t touch at Gap due to his Adidas contract. Yeezy clothes, meanwhile, haven’t fared nearly as well. Yet Gap anticipates its Yeezy sales will hit $150 million in 2022 and reach $1 billion in sales within eight years, potentially as early as 2023, Bloomberg reported. West will earn royalties and equity based on how the line performs.

The estimate is sizable given the entire Gap brand did $3.4 billion in sales (pdf) last year, down from $4.6 billion the year before due to the pandemic. Adidas, by contrast, recorded $19.8 billion (pdf) in 2020 sales. It’s a much bigger company and took years to build up its Yeezy sneaker sales.

Key to that growth was a carefully crafted distribution strategy that has seen the company releasing a slow drip of new styles in small quantities, patiently building up the volume over time. The model keeps demand rising just ahead of supply, so sales are able to grow without demand flagging.

The Gap collaboration with Yeezy, on the other hand, will be made available to “millions of customers,” the company said when it first announced the tie-up. It’s uncertain how demand will fare over time.

Gap’s sales woes

The Gap brand, while still powerful, isn’t in its best shape. Between 2000 and 2016, it ceded about half its market share to low-cost rivals, Morgan Stanley estimated. While companies such as H&M and Zara have attracted customers by offering inexpensive imitations of designer items, Gap has strained to carve out a relevant design identity of its own in recent years. Even today, as shoppers shell out for vintage Gap hoodies online, Gap is struggling.

The association with West and any freshness he can bring to Gap’s clothes could provide a boost, assuming he doesn’t tarnish his own image. Gap is certainly optimistic. “We are on track to launch in the first half of this year, and I’m impressed with how the team is unleashing their creativity and innovation in both the development of the product and the experience for the customer,” Sonia Syngal, CEO of Gap Inc., said during an earnings call earlier this month.

How the line performs will be critical to Gap, and to Yeezy’s brand value.