How marriage is keeping gold’s prospects bright in China

Last year was a big one for gold in China. As Chinese middle class families, particularly aunties, bought up gold bars and jewelry for their use as accessories as well as investments, China became both the number one producer and consumer of the precious metal—surpassing even India where yearly bullion demand had long been the world’s highest.

Last year was a big one for gold in China. As Chinese middle class families, particularly aunties, bought up gold bars and jewelry for their use as accessories as well as investments, China became both the number one producer and consumer of the precious metal—surpassing even India where yearly bullion demand had long been the world’s highest.

This year, with prices up of gold up, a government campaign against conspicuous spending by officials, and financial reforms designed to increase the availability of other investment opportunities, a new report (pdf) from the World Gold Council predicts that demand for the metal won’t be as strong as last year.

But there’s one segment of the market that has and should continue to underpin China’s appetite for gold—newlyweds and the people who want to wish them well.

Last year, Chinese families bought 669 tonnes of gold jewelry, about 40% of which was related to weddings, according to a new report by the World Gold Council. Parents on either side of a betrothed couple give the couple jewelry–often a three-piece set of a necklace, pendant and bracelet, what jewelry stores call jiehun san jin, literally “marriage, three gold”—to represent the passing of blessing from the elder generation to the younger. This is even more the case in rural or third and fourth-tier cities where traditions are stronger. “Yellow means rich and abundant… non-destructible. It’s a blessing that is passed on,” Albert Cheng, the World Gold Council’s Asia head tells Quartz.

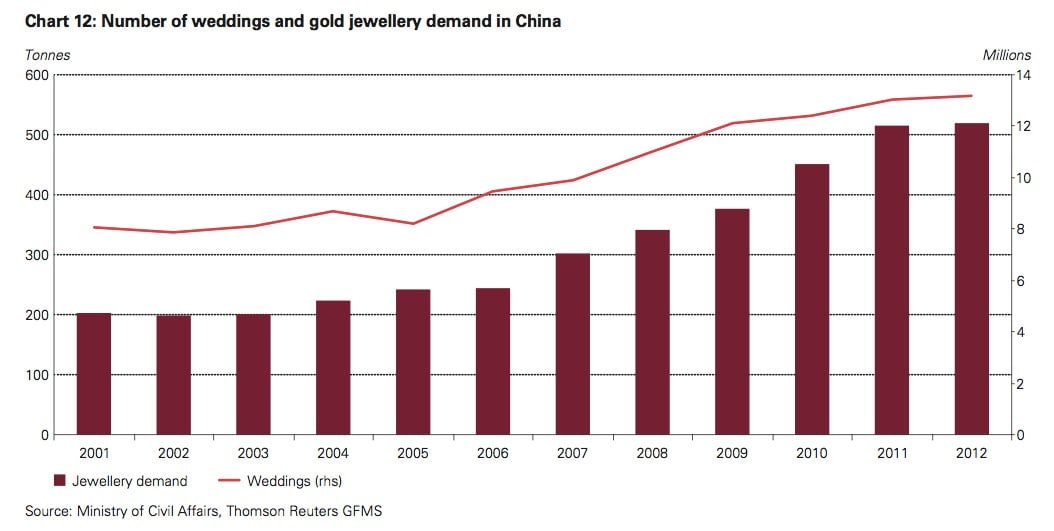

According to government data, the total number of marriages in China has grown 60% over the last decade to reach about 13.2 million as of the end of 2012—one reason why jewelry now accounts for over half of all private consumption of gold in China. As China’s middle class has grown, so has the amount families are spending on weddings.

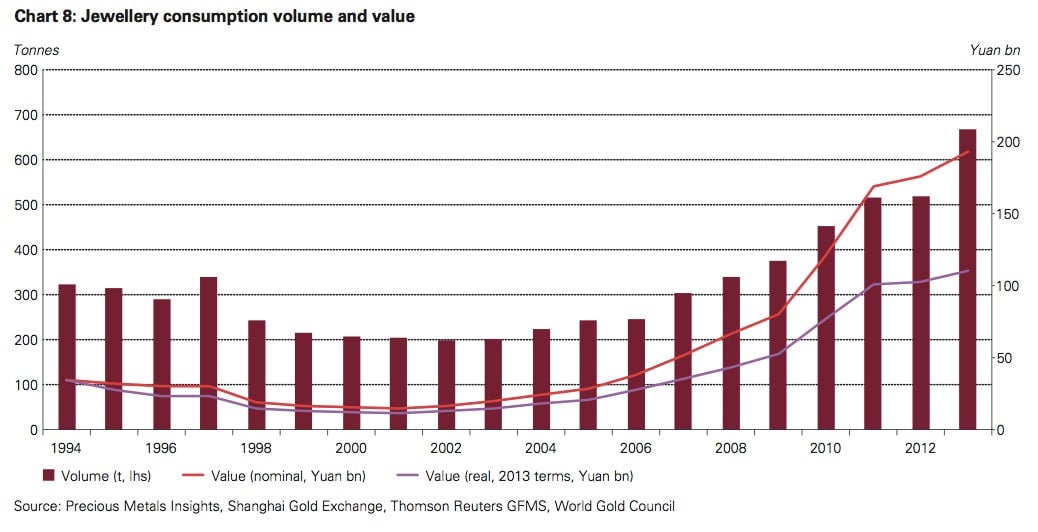

Gold, once reserved only for the wealthiest families is quickly becoming a major part of China’s mainstream consumer culture. Average middle-class Chinese can afford to shell out $100 or $200 for small accessories. Gold pendants and other gold accessories are also increasingly being given for Valentine’s Day, as well as Mother’s Day and to celebrate the birth of a new child. The amount that Chinese families are spending on gold jewelry has almost risen almost six-fold since 2004, according to the World Gold Council report.

Cheng expects jewelry demand to increase another 17% to 780 tonnes by 2017. Total private sector demand should reach 1,350 tonnes by then, which could account for as much as 30% to 35% of global demand, according to Cheng.

While weddings are propping up gold prices for now, in the long run that’s could change because China’s population of the young and marriageable is shrinking. The United Nations forecasts that the number of those between the ages of 15-59 will shrink to 908 million (pdf, p. 20-21) in 2025, from 938 million in 2015. But that effect on consumption won’t be felt until the 2020s, the World Gold Council says, at which point increased consumer spending overall might make up the make up for the difference.