Credit Suisse’s profits plunged thanks to its misfiring investment bank

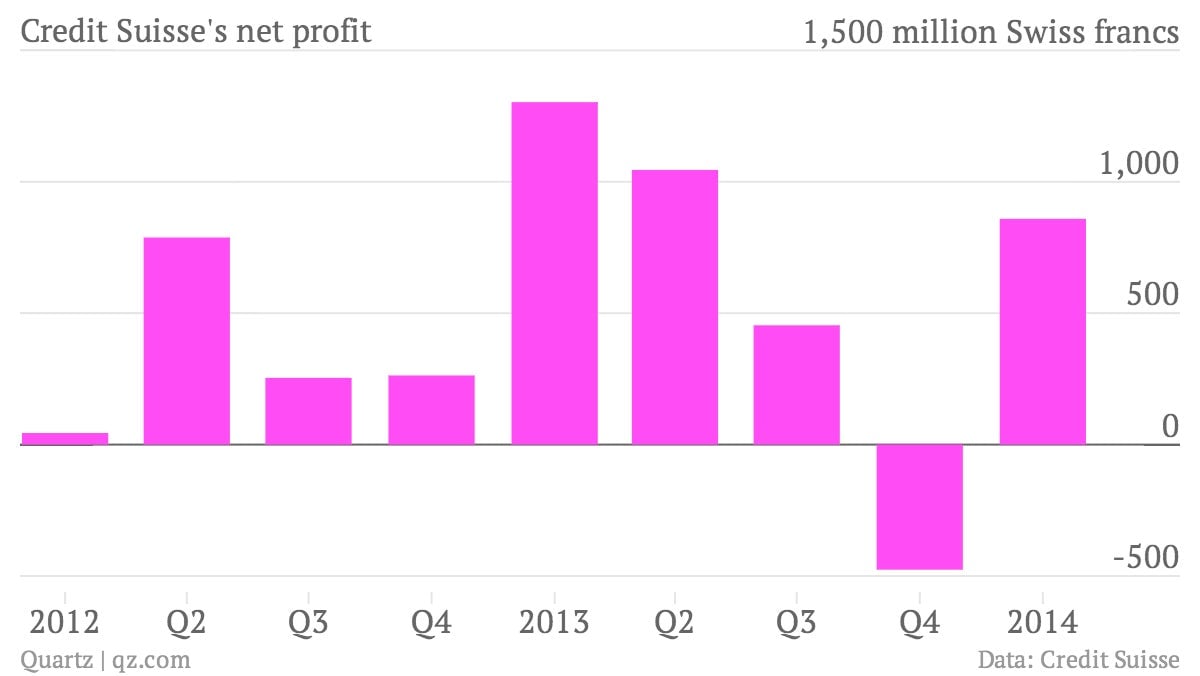

The numbers: Disappointing. Credit Suisse’s first-quarter profit fell by 34% versus the prior year, missing analyst expectations by some distance. The bank will try to steer the markets towards more flattering measures of its performance—the bank breaks out ”core,” “strategic,” and “non-strategic” results in various combinations—but this won’t obscure a weak set of results. The bank’s shares opened 2% lower in Zurich trading.

The numbers: Disappointing. Credit Suisse’s first-quarter profit fell by 34% versus the prior year, missing analyst expectations by some distance. The bank will try to steer the markets towards more flattering measures of its performance—the bank breaks out ”core,” “strategic,” and “non-strategic” results in various combinations—but this won’t obscure a weak set of results. The bank’s shares opened 2% lower in Zurich trading.

The takeaway: As at its larger peers, fixed-income trading put a big dent in Credit Suisse’s latest quarterly profit. Bond trading, which accounts for nearly a quarter of the bank’s revenue, saw pre-tax profit sink by 21% in the first quarter. Overall, pre-tax profit at the group’s investment banking unit fell by 36%. Given this performance, shareholders may not appreciate that compensation and benefits at the unit actually rose by 2%.

What’s interesting: Credit Suisse’s travails in investment banking are pushing it to place more emphasis on its wealth-management business. Pre-tax profit in this unit grew by 15% in the first quarter, thanks to tight cost control, even though revenue at the unit fell by 1%. The bank attracted 10.6 billion Swiss francs ($12 billion) in net new assets under management in the first quarter, nearly half of which came from clients in Asia. European clients pulled 1.6 billion francs from their Credit Suisse accounts in the first quarter, a sign of the bank’s ongoing legal troubles related to tax-evasion probes. Litigation also hangs over the bank in the US, with news this week that New York regulators have opened an investigation into claims that Credit Suisse helped Americans evade taxes.