Berkshire investors are ready for a future after Buffett

It’s all but impossible to imagine Berkshire Hathaway without Warren Buffett as its chief. But stock investors appear sanguine about the decision to make Greg Abel the 90-year-old’s eventual successor.

It’s all but impossible to imagine Berkshire Hathaway without Warren Buffett as its chief. But stock investors appear sanguine about the decision to make Greg Abel the 90-year-old’s eventual successor.

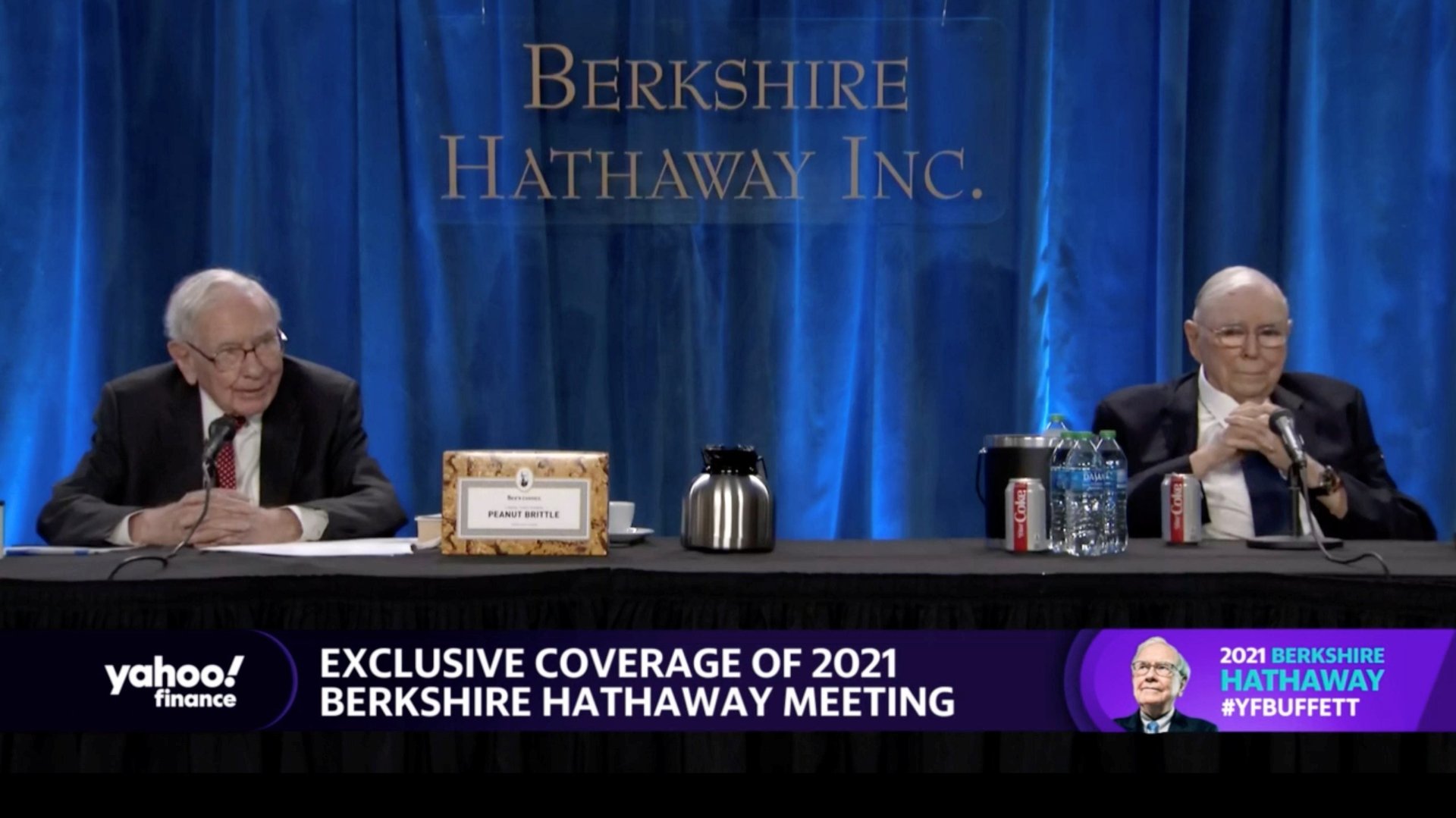

Shares of the $644 billion Omaha-based conglomerate have rallied three-straight days after it emerged during the weekend that Abel, who is in charge of the company’s non-insurance businesses, is in line to eventually take over as CEO. The news slipped out seemingly inadvertently during Berkshire’s annual meeting: 97-year-old vice chairman Charlie Munger said Abel would “keep the culture” even as the corporate behemoth, which owns everything from America’s largest railroad to Nebraska Furniture Mart, sprawls larger and becomes more complex. CNBC confirmed the succession plan. Berkshire shares have risen more than 2% since the weekend to $425,895.

That Berkshire shares perked up after the weekend suggests the news removed a smidgeon of uncertainty. Stock investors were confident that Berkshire had a succession plan in place, even though it hadn’t explicitly spelled out who would replace Buffett and Munger, each of whom are nearly a century old, said Stephanie Link, chief investment strategist at wealth management firm Hightower Advisors. “And by the way, it’s not just one person—it’s a team,” she said “They will rely on each other and that’s a good thing.”

Ajit Jain, who runs Berkshire’s insurance business, and Abel, a Canadian who climbed the rungs in the company’s energy operations and has managed some of Berkshire’s acquisitions, had been seen as likely heirs to the CEO job. Buffett told CNBC that Abel’s age—he’s 58 and Jain is 69—made him a slightly better candidate because he could have a 20-year run as chief. Buffett’s son, Howard Buffett, is reportedly planned to succeed his father as chairman. Ted Weschler and Todd Combs help manage Berkshire’s immense investment portfolio.

Even so, Buffett, who has been at the head of Berkshire for more than 50 years, and Munger are irreplaceable icons of corporate America. Until the Covid-19 pandemic forced it to go virtual, the company’s annual meeting had been a pilgrimage for the faithful to hear directly from the investing legends. It’s unlikely that their successors will have the star power (and free media exposure) they’ve commanded.

The situation resembles Apple during the Steve Jobs era. It seemed hard to imagine the iPhone maker without its founder and his Issey Miyake-designed black mock turtleneck. But Apple shares rallied four-straight years after Tim Cook became CEO in August 2011, replacing the iconic chief executive who died in November 2011. Last year Apple became the first US company to be valued at more than $2 trillion (Berkshire owns about 5% of Apple).

“Cook stayed calm, had a game plan, had a strategy, was well trained on the job,” Link said of Cook’s rise to Apple CEO. “I think the same exact thing for Charlie and for Warren. They have a game plan. They have a process.”

—With assistance from David Yanofsky