Sporting events are the perfect excuse for TV makers to sell you obscenely large screens

Soccer will save the day. Samsung’s first-quarter revenues may be up 1.5% on the same period last year, but operating profits dropped 3.3% (pdf), the company reported this morning in Seoul. But there is no cause for concern; profits will pick up ”in the second quarter and beyond, on the back of improved sales of display panels and home appliances,” Samsung says:

Soccer will save the day. Samsung’s first-quarter revenues may be up 1.5% on the same period last year, but operating profits dropped 3.3% (pdf), the company reported this morning in Seoul. But there is no cause for concern; profits will pick up ”in the second quarter and beyond, on the back of improved sales of display panels and home appliances,” Samsung says:

Orders for display panels that are used for premium smartphones and TVs are expected to increase, as new mobile devices are rolled out into the market and as consumers look forward to the upcoming World Cup in Brazil. The outlook for household appliances will also pick up on seasonal demand for air conditioners, as well as orders for high-end TVs based on the World Cup effect.

The World Cup effect is a well-documented phenomenon, driving retail sales up and normally sensible people batty for a few weeks every four years. Even way back in 2002, for example, TV sales in Asia (which hosted the event) were up 16% and 5% in football-mad Europe.

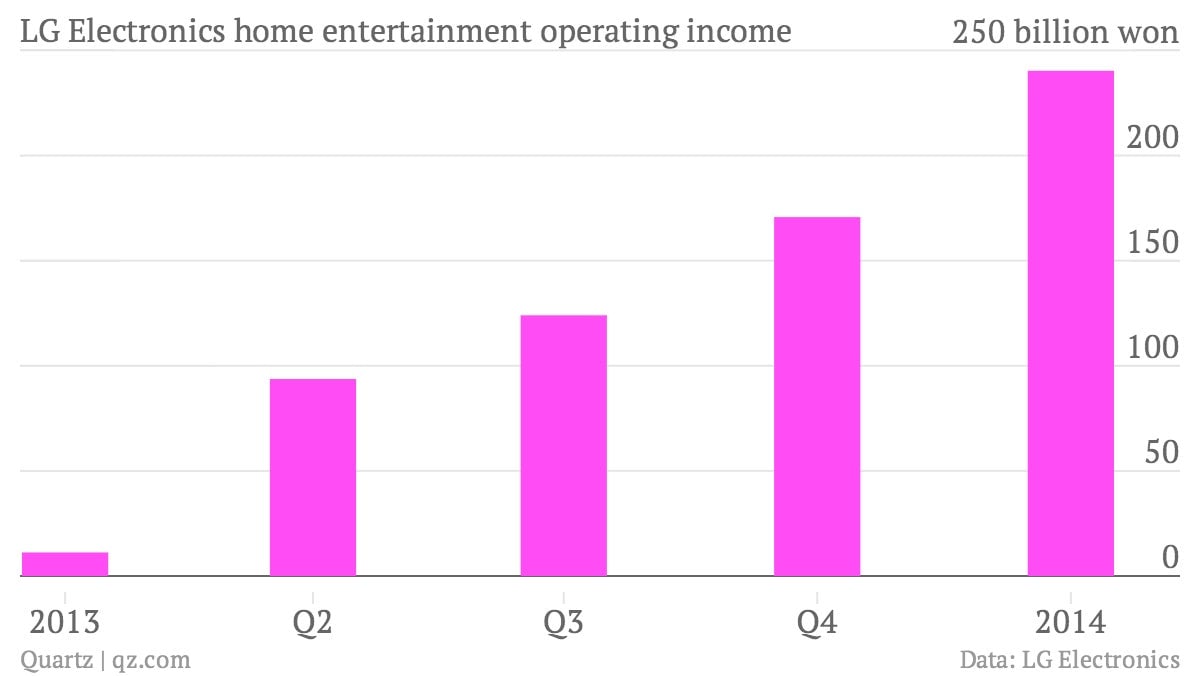

This summer, Brazil will be home to all the world’s football talent, and Latin America is already gearing up to watch. Samsung reports consumer electronics sales, which includes TVs, are up 22% year-on-year in the region (though less stellar everywhere else). LG Electronics, which also reported earnings today, saw big gains from TV sales too. Housed in the company’s home entertainment unit, TV sales helped achieve first-quarter operating profits almost double what analysts were expecting. Driving sales? The Winter Olympics and upgrades ahead of this summer’s World Cup. Samsung and LG are the world’s biggest TV makers.

So far so good. Except that the World Cup effect, at least when it comes to big-ticket items like TVs, doesn’t actually drive extra sales; it merely displaces them from one season to another. On the eve of the last World Cup in 2010, Paul Molyneux, then Sharp’s man in the UK, told the Independent newspaper, ”The World Cup tends to bring demand forward. If you look over the 12 months, the tournament doesn’t actually grow the market as a whole.”

That continues to hold true. In December, market research firm GfK told trade magazine ERT, “It will simply be a short-term effect. The retail trade will have to do what it can to maximise its share in the weeks leading up to the event, since if it misses out, it will be difficult to catch up afterwards.”

So what is a TV maker to do? Turns out the shifting replacement cycles are also the perfect excuse to push the new big, high-definition and ”ultra high-def” screens. According to GfK, sales of “superjumbo,” or 50-inch-plus screens, are booming (pdf), up 45% year-on-year in February. By contrast, ”superlarge” screens between 33 and 42 inches were up 14% and ”large” TVs (26-32 inches) were down 5.5%.

Still, this momentum can’t last forever—and it isn’t. The growth in sales of superjumbo screens dropped to 30% year-on-year in February. LG warns that Q2 numbers may not match the first quarter because it takes quite a bit of expensive marketing to get people to buy new TVs. And even Samsung knows this to be true. Though the company played up the World Cup in its press release and to the media, its earnings slides are more honest on the subject of consumer electronics, priming investors to only “expect slight demand growth driven by the impact of the World Cup and new product launches.”