Chinese online shopping could soon be worth more than Switzerland’s entire GDP

In the recent IPO filing of the Chinese e-commerce giant Alibaba, the company projects that China’s e-commerce market, already among the largest in the world, will double in size by 2016.

In the recent IPO filing of the Chinese e-commerce giant Alibaba, the company projects that China’s e-commerce market, already among the largest in the world, will double in size by 2016.

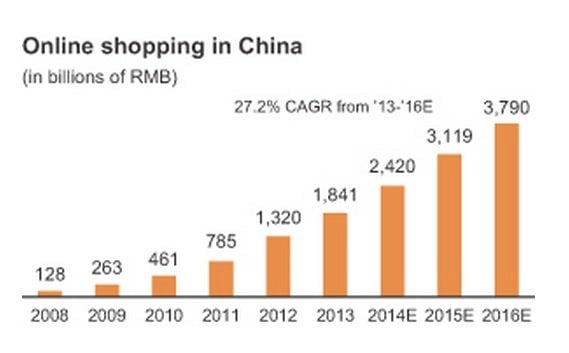

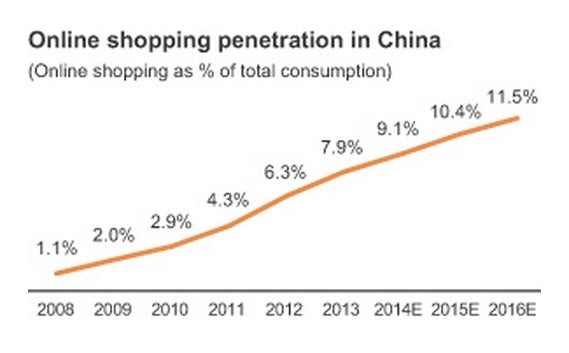

As more Chinese shop online, the company expects online sales to increase from last year’s 1,841 billion yuan ($295 billion) to 3,790 billion yuan (p. 131) in 2016—more than the nominal GDP of Sweden or Switzerland in 2013. Already, the amount of money spent in the Chinese retail cyber sphere is larger than the entire economies of Egypt or Finland (pdf).

There has been a lot of excitement over the potential of China’s expanding middle class, which is increasingly shopping online. But Alibaba’s predictions shed some light on who those online shoppers will be, and offers a glimpse of their likely shopping habits.

Hundreds of millions will start shopping online

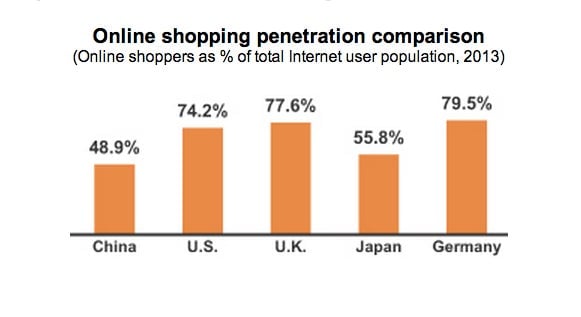

Although China is already home to the world’s largest population of internet users—around 618 million, according to government figures—a little less than half of those regularly shop online, a percentage that’s much lower than other developed markets. “We think that number will increase,” the company writes in its prospectus.

Alibaba predicts that as more families in smaller inland Chinese cities become wealthier and gain access to the internet, they’ll start spending money online because of limited options for traditional brick-and-mortar stores. (China has few national retail chains that reach all across the country and into less developed areas.)

People will spend more on their smartphones

The increasing availability of cheap smartphones is key to unlocking more online spending, according to the e-commerce firm. China’s mobile internet user base was 500 million, as of the end of last year. The more people have constant internet access via their smartphones, the more they shop.

“We believe this growth in mobile users will make access to the Internet even more convenient and will accelerate the adoption of e-commerce,” the company says. “Increased mobile Internet access through mobile devices will allow Internet users to shop anytime, anywhere.”

Spending per customer has indeed been steadily increasing: The number of orders for the average active buyer on Alibaba’s marketplaces rose to 49 last year, compared to 39 in 2012 and 33 in 2011.

Given this potential, it makes sense that Alibaba should focus on the Chinese market for the near future. But staking its future on China won’t be without certain risks.