One in five UK workers can’t afford a basic standard of living

Here are some pretty alarming numbers on wages in the UK, where the poorest workers live, and what they do.

Here are some pretty alarming numbers on wages in the UK, where the poorest workers live, and what they do.

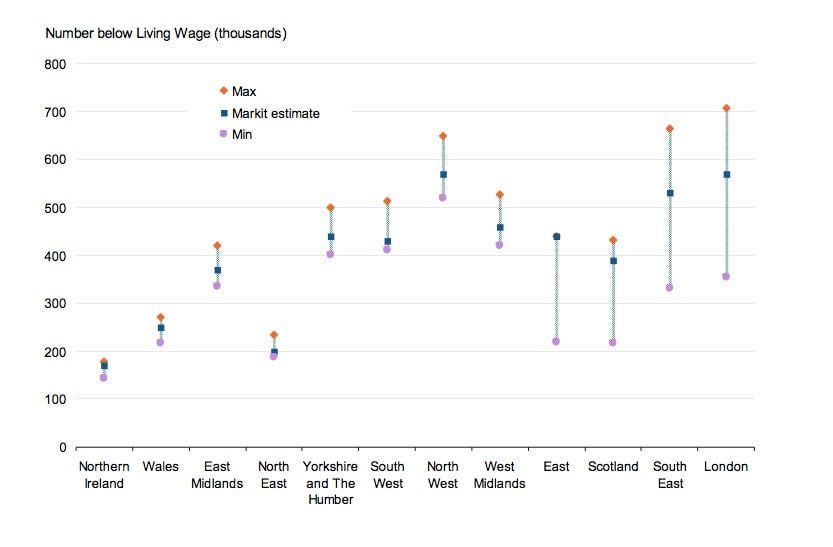

As if times weren’t tough enough, new research from KPMG says people are worse off than we thought. One in five UK workers earns less than enough to support a basic standard of living. This means that nearly 5 million workers are making do on less than a “living wage”, or £8.30 ($13) an hour in London and £7.20 in the rest of the UK.

The living wage is different than the mandated £6.19 hourly minimum rate that government has resisted raising. Rather it’s a voluntary rate that some employers such as London mayor Boris Johnson are paying staff to make sure they can afford basic essentials.

Next week is Living Wage Week, an initiative to convince employers to recognize that the mandated minimum wage isn’t enough. So far, voluntary hikes have helped 10,000 employees and added £96 million to the lowest paid, according to KMPG.

Those hardest hit workers in the survey were found in Northern Ireland where 24% are earning below a living wage. Wales is next at 23%. Not surprisingly, fewer workers were as hard hit in London and south-east of London where 16% of workers earned less than a living wage.

The worst off professions included waitstaff, kitchen workers, and cleaning people. 780,000 retail staff were not paid a living wage, while 90% of bar staff and 85% of waiters and waitresses are in the same boat.

Some other key findings:

41% of people earning below the Living Wage reported worsening finances

Six times as many saw savings fall (30%) as those that indicated a rise (5%)

Higher debt contrasted with a decline in debt among people above the Living Wage

Squeeze on cash availability much greater for people earning below the Living Wage

Actual spending rose at similar rates on both sides of the Living Wage threshold…

…but people earning below the Living Wage reported a much steeper drop in their appetite for major purchases