Should public companies be pouring billions of investors’ dollars into venture investing?

Amid the current technology boom, big tech companies are flush with cash. And now we have new data on what they’re actually doing with some of that money.

Amid the current technology boom, big tech companies are flush with cash. And now we have new data on what they’re actually doing with some of that money.

They’re putting billions of dollars into venture-backed startups.

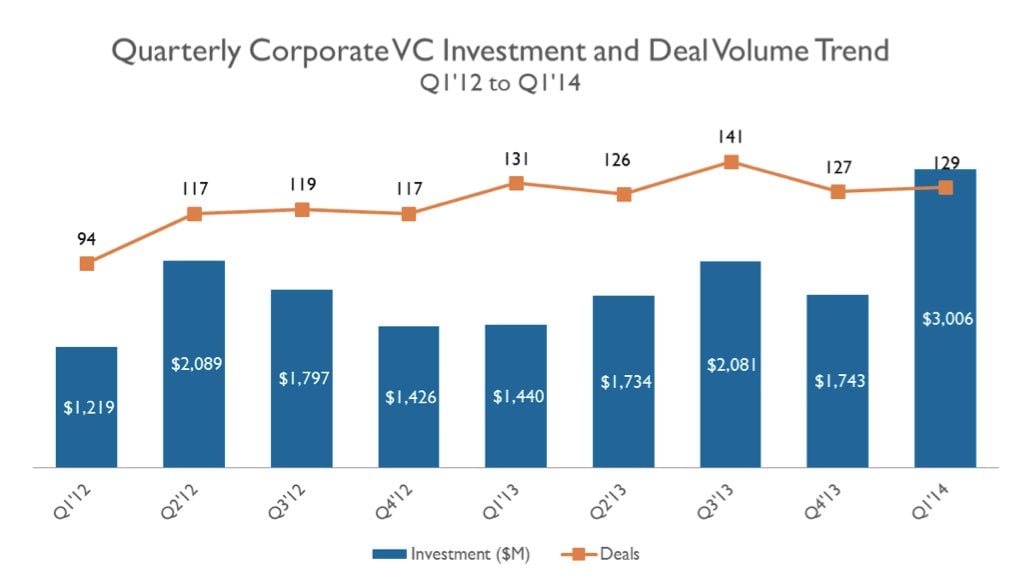

According to new analysis by research firm CB Insights, some 83 US corporate venture capital funds were active during the first quarter of 2014, nearly double the amount that were active a year earlier. They invested $3.1 billion during the quarter, the most invested by corporate VCs in at least two years. That amount represents 30% of the total funding secured by emerging US companies during the quarter.

The most active corporate VC funds during the first quarter included Google Ventures, Intel Capital and Comcast Ventures. Some of the more prominent emerging companies to attract funding included software company Cloudera, mobile-messaging app Tango, and credit-score company Credit Karma.

Some companies might think they have an advantage over other VC funds that helps them find the most lucrative investments. There can also be a strategic element to corporate VC investing. Companies can unearth technologies and acquisition targets through their VC investments. (Google Ventures, for example, was an investor in Nest before Google bought the company.)

But, as an asset class, venture capital is historically a mediocre investment, with stock indexes outperforming the average VC fund. And, one can ask whether there’s a tech startup bubble the corporate VC funds are helping inflate—we won’t opine on that impossible-to-answer issue. (But in the great tradition of “he said, she said” journalism, here is an argument for why we are in a bubble, and here are strong arguments against a bubble here and here.)

Activists have had some success lately pressuring big US tech companies to return some of their cash to investors. The surge in VC investing by public US companies is something they might start paying attention to.