American workers might finally be about to get a raise

From 2007 to 2012, median household income in the US dropped roughly 8.3%. But lately, there are indications that American wages might be about to take a turn higher.

From 2007 to 2012, median household income in the US dropped roughly 8.3%. But lately, there are indications that American wages might be about to take a turn higher.

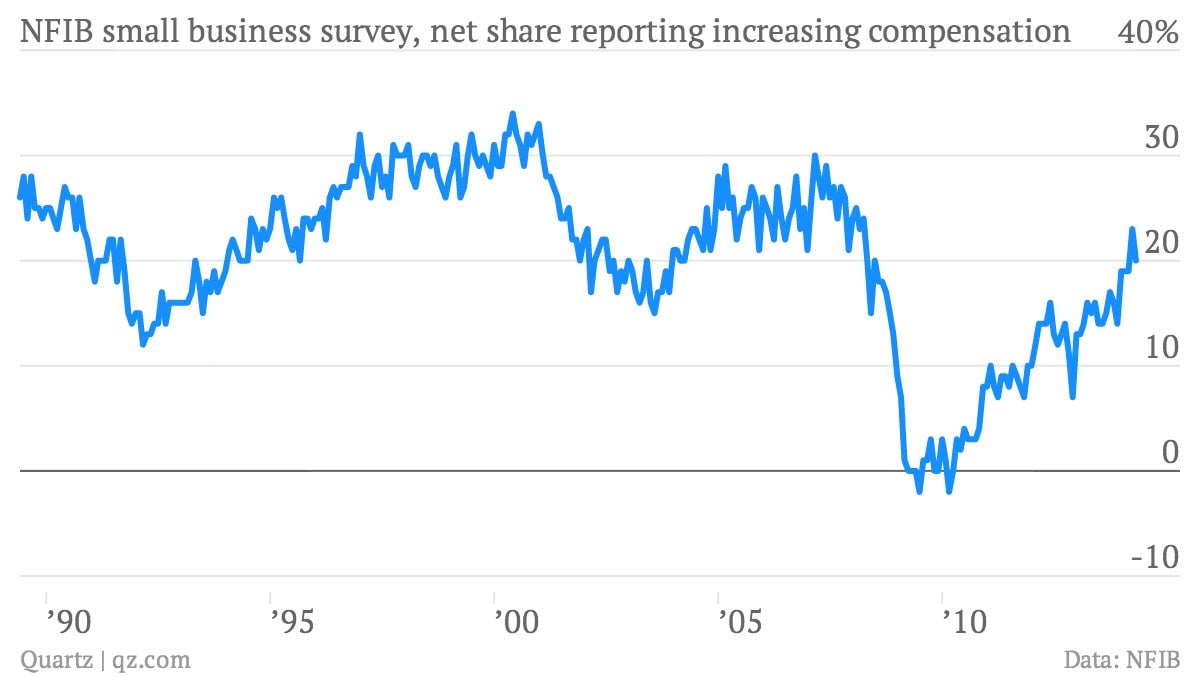

Small business surveys suggest wage hikes are more pervasive

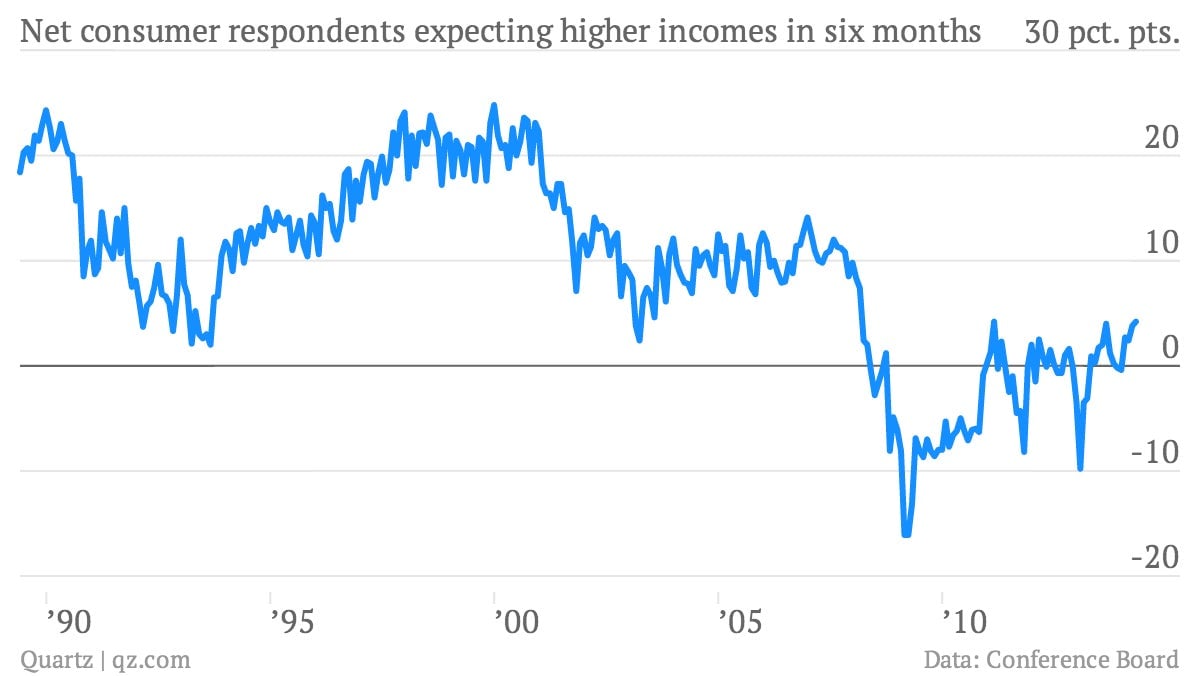

Consumers feel a bit better about where incomes are going

Average hourly earnings have bounced off the bottom

The pay increases that production workers are receiving may look puny in the context of recent history. But Barclays analysts note that the last time wages were rising this quickly, the unemployment rate was about 5.4%. (It’s currently 6.3% in the US.) That suggests that the so-called NAIRU—non-accelerating inflation rate of unemployment—is now structurally higher than it used to be.

NAIRU is an estimate of how low unemployment can go without setting off inflation, to which wage increases are a contributing factor. That may sound like a wonky thing for egg-head economists, and it is. But it’s also part of a hugely important discussion about the extent to which the financial crisis—and the jobs crisis that followed it—have structurally damaged the US economy. If wage growth starts to rise sharply, that will mean that that the 3.5 million long-term unemployed in the US were having little impact on the supply of labor. In other words, markets would be writing those people off as, effectively, unemployable.

Correction: A previous version of this post said that NAIRU could now be structurally lower than it was before for the recession. It should have said NAIRU could now be structurally higher.