Need a loan? Go to Brazil. The government is giving them out like candy

This doesn’t look like it will end well.

This doesn’t look like it will end well.

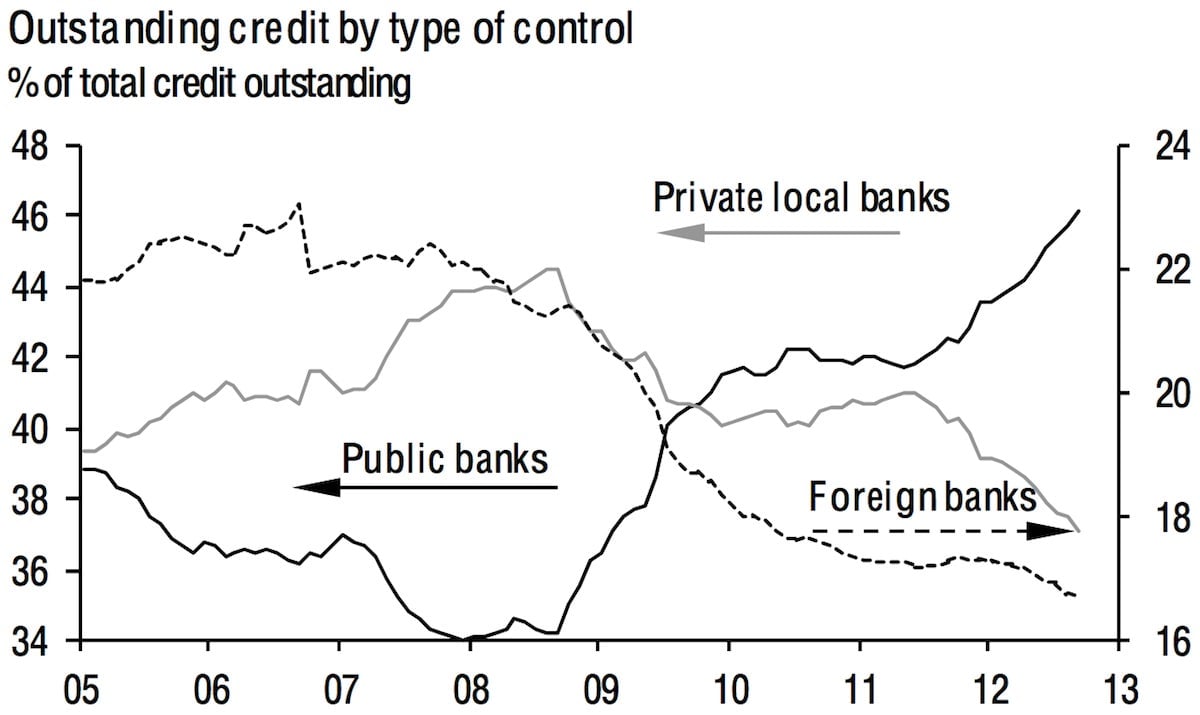

Brazil’s system of public banks is making a ton of cheap loans to consumers there, even as private sector banks look increasingly leery of lending (see chart above).

Brazil uses its system of public banks such as Banco do Brasil and Caixa Econômica Federal as a way to spur growth when the economy seems set to slow down. But in recent months the public banks have been ratcheting up their lending as the private banks cut theirs back sharply.

So what’s going on here? Well, for one thing, loan delinquencies remain high. That’s likely a turn-off to would-be private lenders, who worry that making a bad loan might cost them their job. The public banks are working from a different script, as their lending is essentially required by the government. And a boost in lending from the public sector can indeed give a kick to consumption.

But some Brazil-watchers doubt that giving consumers cheap credit is sustainable for the Brazilian economy over the long-term, and that an economic model centered on indebted consumers is the best plan. Morgan Stanley economists note, for example, that encouraging private consumption hasn’t done much for growth in industry, for example. “The problem remains—as we have argued for over two years now—that stronger consumer demand does not mean strong supply,” they wrote in a research note earlier this month. “Since March 2010, retail sales are up 19.6% in real terms while industrial production is down 2.8%.”

Where does such a path lead? Brazilians need only look north to see. The de facto policy of the US since the early 1980s has been one of making consumer credit easier to get as the share of manufacturing in the economy relentlessly shrank. That leads to a massive buildup of debt as domestic consumers increasingly borrow from foreigners to pay for spending. Brazil’s public banks (which have no direct US analogue) are now stepping in to provide the cheap credit that private banks did in the US, something the Brazilian private banks are—perhaps because of the US’s experience—already too wary to do.

Now, the US has been been able to keep this system going for decades largely because of the dollar’s status as the premier spot to park cash for safekeeping. But that doesn’t mean Brazil would be able to. And even if it could, the problematic mountains of debt in both the US and Europe should serve as a warning about where Brazil could ultimately end up.