The markets are right to ignore the ugly US GDP report

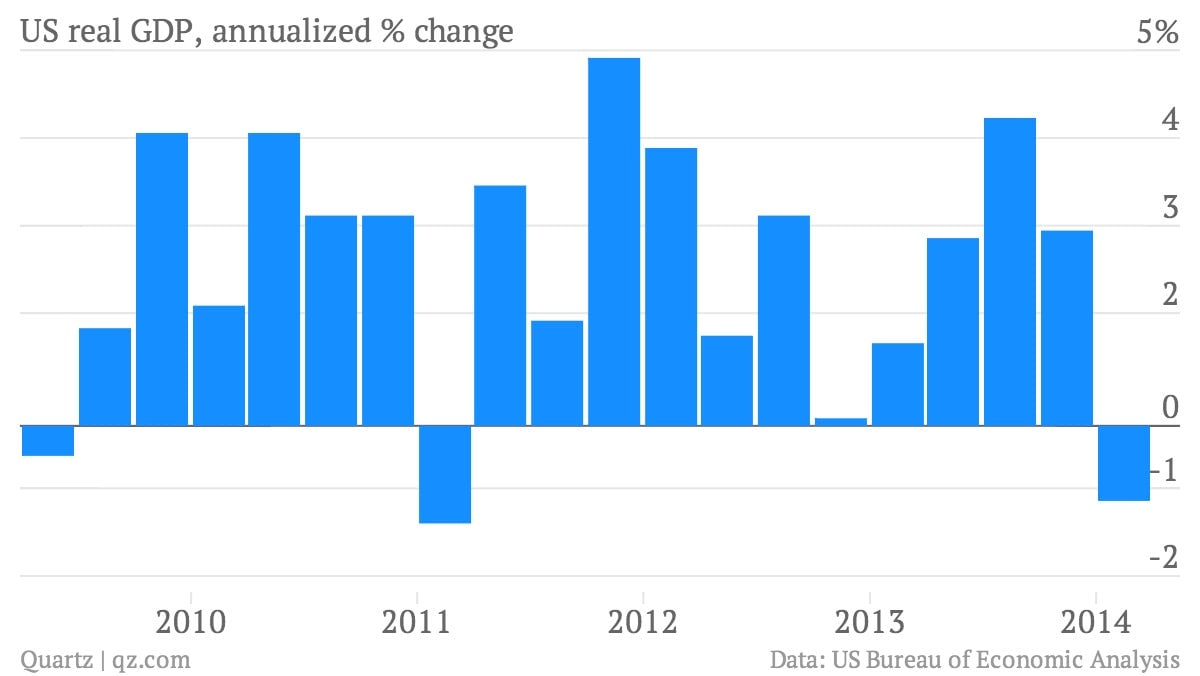

A revision to the US GDP numbers shows the American economy was even uglier than first thought in the first quarter of 2014. GDP shrank at a 1% annual clip during the first three months of the year, the first contraction since early 2011.

A revision to the US GDP numbers shows the American economy was even uglier than first thought in the first quarter of 2014. GDP shrank at a 1% annual clip during the first three months of the year, the first contraction since early 2011.

But no one seems to care. US stocks are in positive territory. Yields in the bond market, though they have been moving lower in recent days, didn’t plunge on the release of the data.

And that’s as it should be. For one thing, this is old news. Everyone already knew, from a string of previous data, that a brutal stretch of bad weather had hit consumption and other bits of the economy. And the fact that people stayed home to keep warm for the first three months means there’s a bunch of pent-up demand that should bolster the economy going forward. We’re already seeing that play out in the US job market, which has posted employment growth of over 200,000 a month for the last three months. (In April the economy created a particularly peppy 288,000 jobs.)

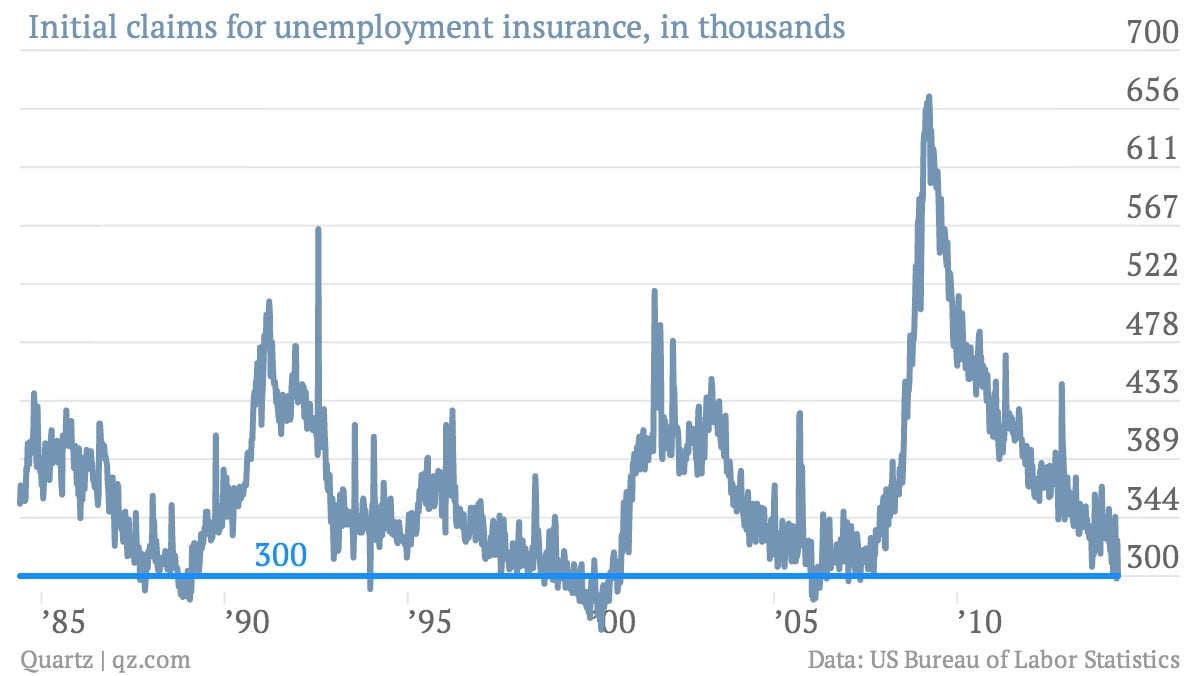

And on the jobs front, one of the best high-frequency indicators—the weekly update on claims for unemployment benefits—continues to point to a solid rebound in momentum for the economy. The most recent week showed claims for unemployment benefits falling to 300,000, a low level that we’ve traditionally seen when the economy was pretty good, like in the late 1980s and late 1990s.