Russia could disrupt a US-Europe rare earths supply chain

A US-Europe rare earths supply chain may get disrupted by sanctions against Russia, setting back Europe’s attempts to reduce reliance on China for the critical materials.

A US-Europe rare earths supply chain may get disrupted by sanctions against Russia, setting back Europe’s attempts to reduce reliance on China for the critical materials.

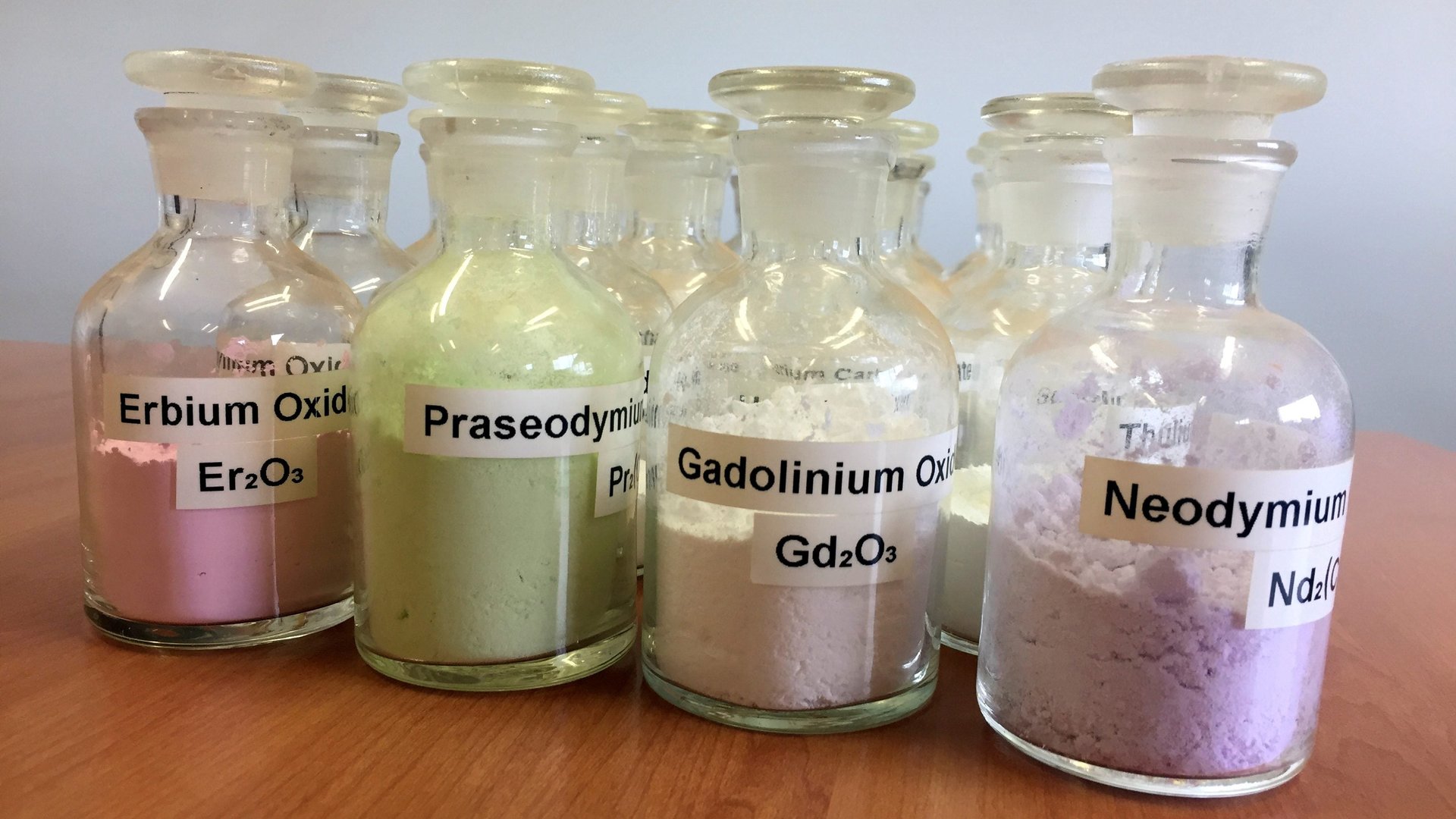

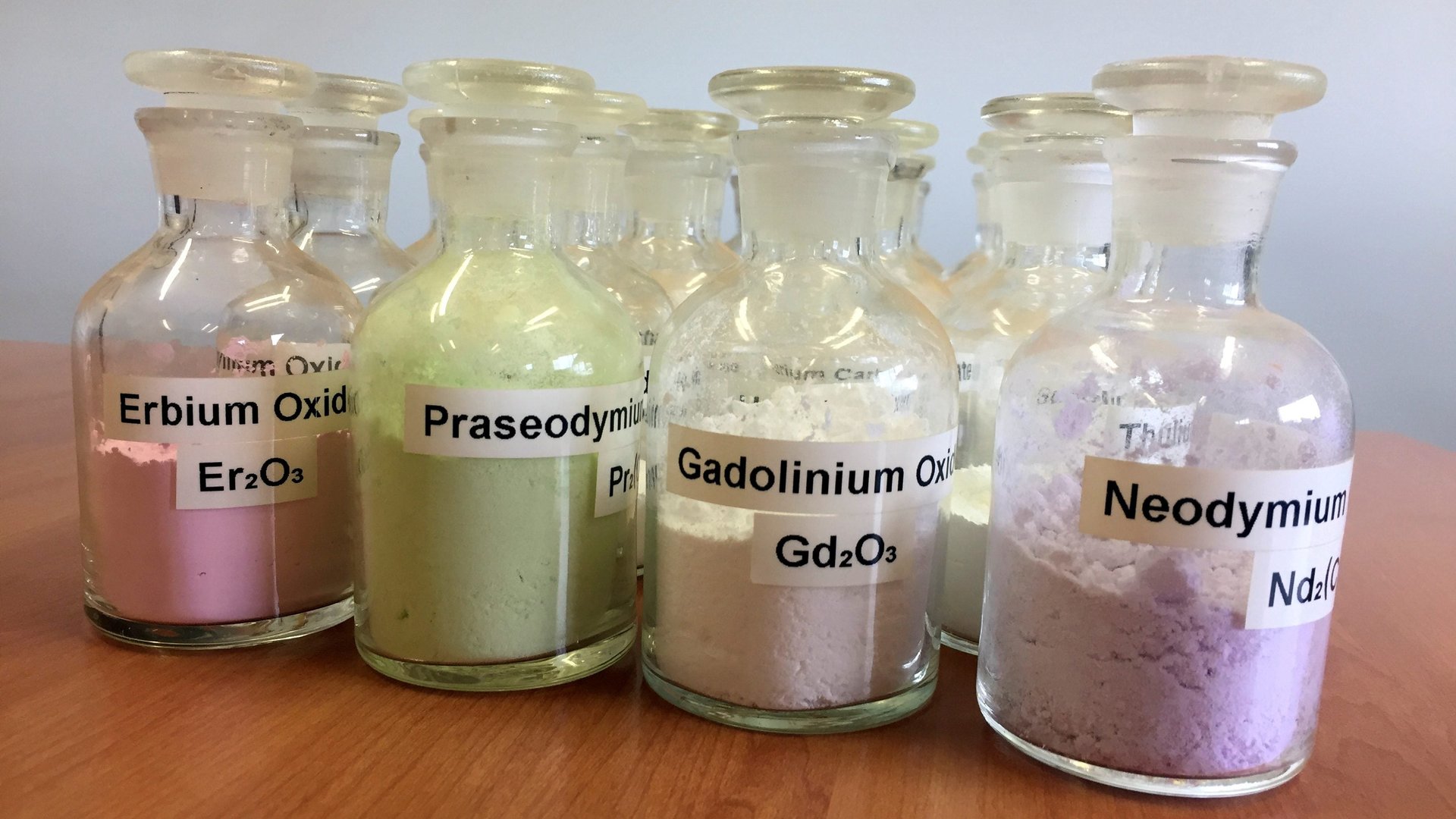

Launched last year by two North American companies, the initiative begins in Utah where a mining byproduct called monazite is processed into mixed rare earth carbonates. That is then shipped to Estonia for separating into individual rare earth elements, which are sold to downstream firms for producing things like rare earth permanent magnets, which are used in high-tech products such as electric vehicles and wind turbines.

The Silmet rare earth separation plant, located in the Estonian seaside town of Sillmäe, is run by Canada-listed Neo Performance Materials and is Europe’s only such commercial facility. But while Silmet does source mixed rare earth material from the US-headquartered Energy Fuels, 70% of the rare earth feedstock it processes actually comes from a single company in Russia, according to Neo.

“Unfortunately, with the war in Ukraine and the sanctions regime, there’s uncertainty hanging over [the Russian supplier],” CEO Constantine Karayannopoulos said during an earnings call earlier this month.

Contingency planning for sanctions

While the Russian supplier, Solikamsk Magnesium Works, has so far not been sanctioned, its ability to supply Neo with raw rare earth would be curbed if it does become subject to expanded US and European sanctions.

According to Karayannopoulos, Neo is now working with a global law firm with sanctions expertise to scrutinize the legal aspects of the firm’s operations. Neo is also talking with “half a dozen emerging producers” worldwide to examine ways to diversify its rare earth feedstock sources beyond Solikamsk in Russia and Energy Fuels in the US. While Energy Fuels could increase its supply to Neo, that depends on its ability to source additional monazite sands.

That said, Neo also has rare earth separation facilities in China, “so the dependence on Silmet is not totally dramatic,” noted Thomas Krümmer, director of Ginger International Trade and Investment, a Singapore-based firm focused on rare earth supply chain management.

Increasing European dependence on China?

Still, a protracted supply disruption at Neo’s Silmet plant due to sanctions on Russia would have ripple effects across Europe.

“European ‘consumers’ of the downstream rare earth products that Neo Performance Materials produces would likely need to look to China if Neo’s production was disrupted by feedstock shortages longer term,” said David Merriman, research director of metals and mining at Wood Mackenzie, a consultancy. “This is because there are few alternatives to Neo outside of China when it comes to separated high purity rare earth compounds, particularly when considering those with product for spot purchase.”

Europe currently sources 98% to 99% of rare earths from China, according to a 2020 European Commission report. But while accounting for a tiny share, Russia also supplies Europe with rare earths, and a disruption there would force the latter to turn to China.

“Europe depends on Russia for a number of [rare earth] materials including the refined ones, so if sanctions affect these supply chains, the next choice is only China in the short term,” said Nabeel Mancheri, secretary-general of the Brussels-based Rare Earth Industry Association.