Why more and more Americans are renting cars instead of buying them

Large chunks of the American public are now choosing to rent their cars, instead of buying them.

Large chunks of the American public are now choosing to rent their cars, instead of buying them.

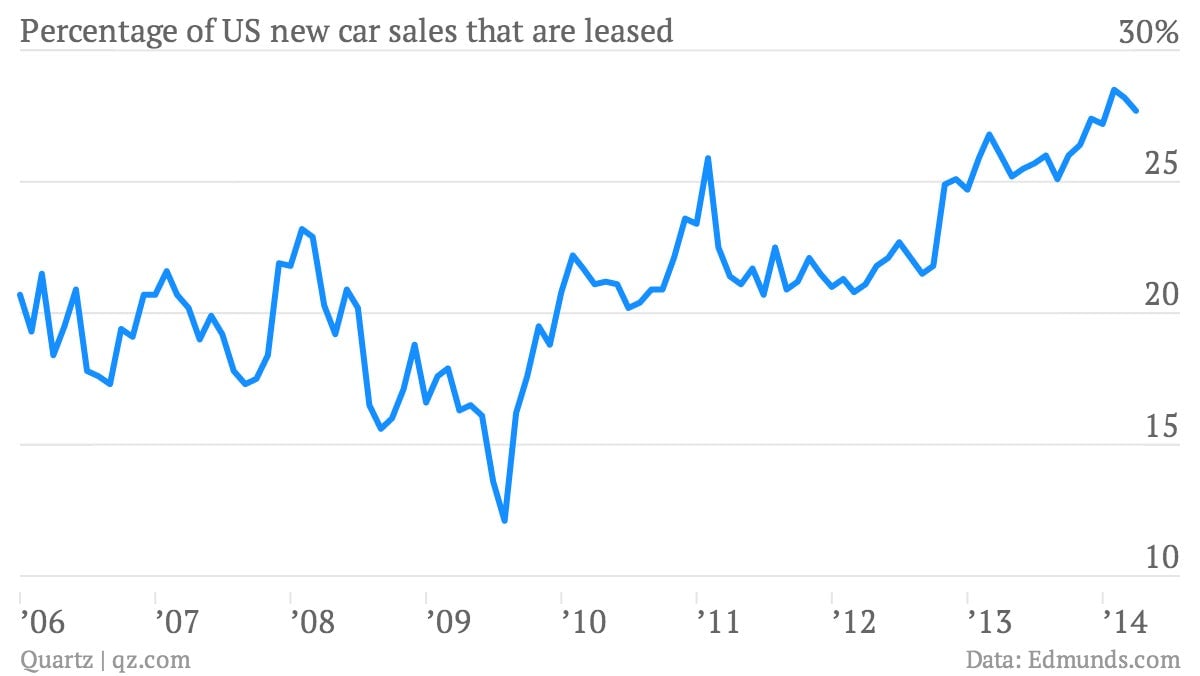

Roughly a quarter of the new cars purchased in the US during the first quarter of 2014 were leased, the highest since 2000.

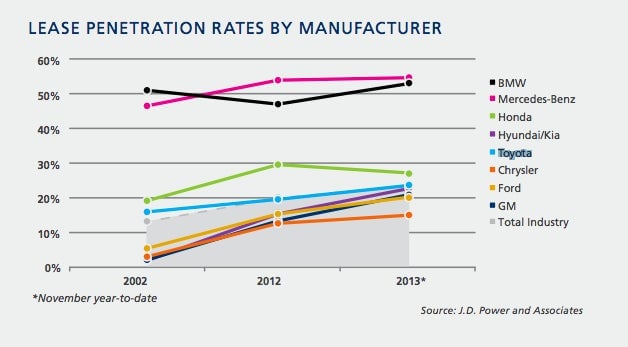

It’s not just the proportions; the kinds of cars being leased are also changing. Leasing has long played a large role in the US market for luxury vehicles, but in recent years it’s gained traction for cheaper cars.

For instance, back in 2002, the share of new Ford, GM, Hyundai and Kia cars that were leased rather than bought was negligible. Now it’s 20% or more, according to J.D. Power & Associates data, and other manufacturers of mass-market cars have seen increases in leasing too:

What’s going on? Well, a few factors are likely in play here.

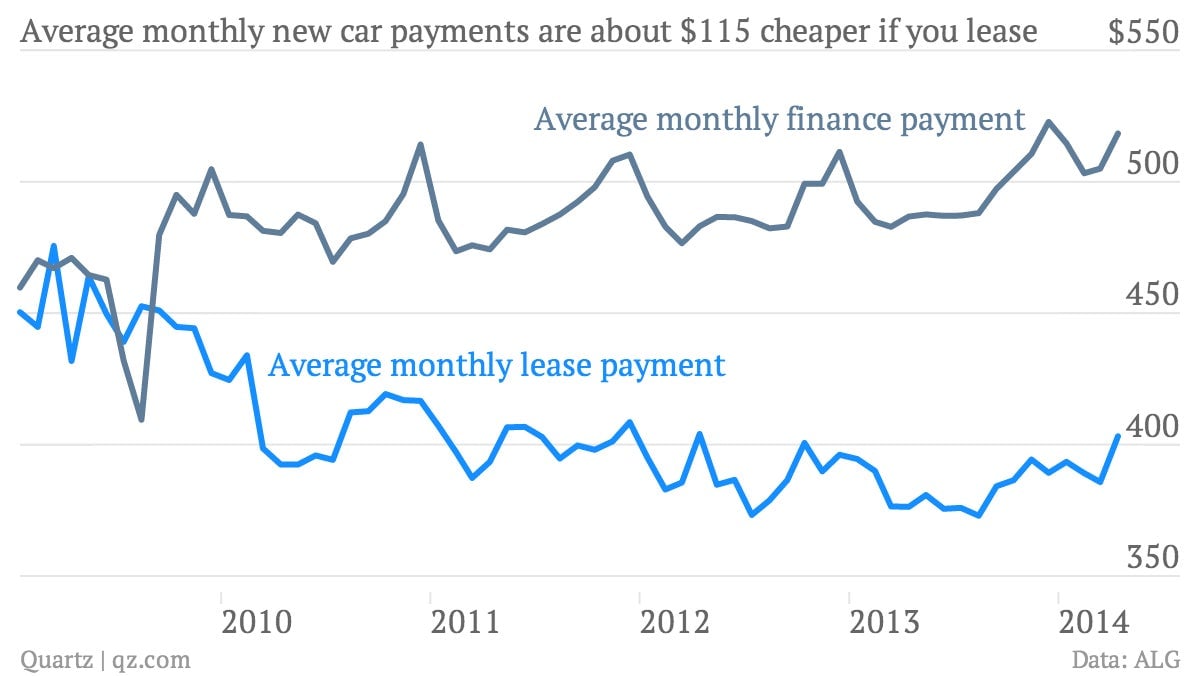

The first and most obvious is that in the last few years, leasing has become quite a bit cheaper than buying, at least in terms of the monthly payments.

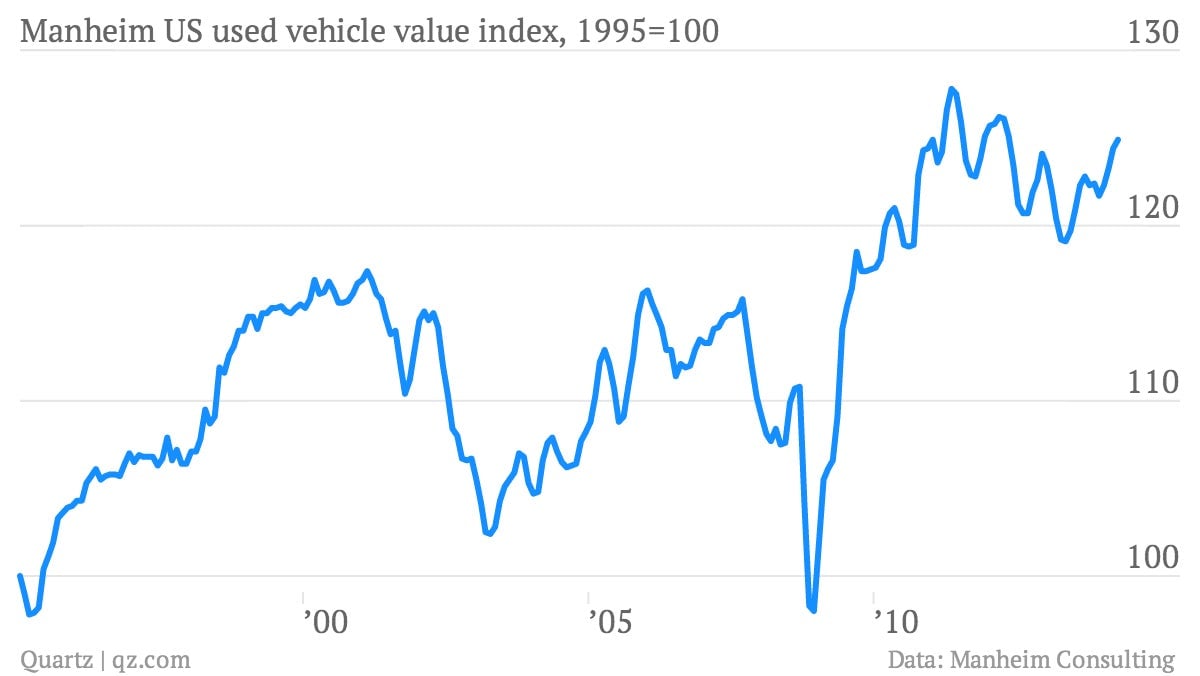

And why is that? Basically because of used car prices, which have been historically strong in recent years, thanks to a dearth of supply. That dearth stems from a sharp decline in car sales during the Great Recession. The market’s lack of used cars is an echo effect of that sales slump between 2008 and 2010.

The reason this makes leasing cheaper is that when you lease a car, your monthly payments are basically paying for the depreciation—the decline in value—of the vehicle between the moment you lease it and then moment when you return it. If used car prices are high, vehicle values aren’t falling as fast, so the leasing company will be able to sell the car for more when it’s done with it. That translates into lower lease payments.

And those lower payments are a big deal, to Americans who are increasingly price-conscious in the wake of the Great Recession. “Monthly payment is really the be-all, end-all for consumers,” said Eric Lyman, vice president of industry insights at ALG, an auto leasing research company.

The rental society?

Some argue that the American swing toward auto leasing is part of a much bigger societal shift away from the traditional concept of ownership. For instance, in the aftermath of the US housing bust, home ownership rates have plummeted. Just 64.8% of American families owned houses at the end of 2013, the lowest level since 1995.

In housing, the story is pretty clear. Excessive borrowing pushed US homeownership to an unsustainable peak. The housing bust—and the Great Recession that followed—left the US economy in tatters and millions unemployed. Many homeowners lost their homes, many prospective homeowners found it harder to get credit, and people just became more cautious about buying.

Caution and lack of credit may play a part in the shift towards leasing cars too. But there’s also a generational reason.

The impact of the Great Recession arguably fell hardest on young Americans—the tech-savvy cohort commonly called “millennials.” This generation came of age on the internet, so they’re also the ones most likely to use services only the internet makes possible: services like Spotify, Netflix, Zipcar, or Airbnb, which give customers more flexibility and access to a wider range of goods (music, movies, cars, apartments) by selling access to the goods for a period of time, instead of outright ownership.

This approach has a lot of different names: Non-ownership consumption. Collaborative consumption. Access-based consumption. ”Instead of buying and owning things, consumers want access to goods and prefer to pay for the experience of temporarily accessing them,” wrote academics who studied the issue for a 2012 paper that appeared in the Journal of Consumer Research. And some argue that this is part of a permanent cultural shift away from the idea of ownership and towards a more sharing- and leasing-based economy.

That may be true, at least for things like music. But over the next few years, a lot of the people who’ve leased cars for the first time will be bringing them back to dealerships. And that’s when they’ll discover the downside of leasing, as dealers attempt to ding them for excessive mileage and wear-and-tear—some of the reasons why experts say owning is still the better financial bet over the long term. Moreover, as the post-recession slump in car sales works its way out of the market, monthly payments for buying and leasing will probably converge again, making the latter look less attractive.

In other words, it’s a bit premature to call the death of American car ownership.