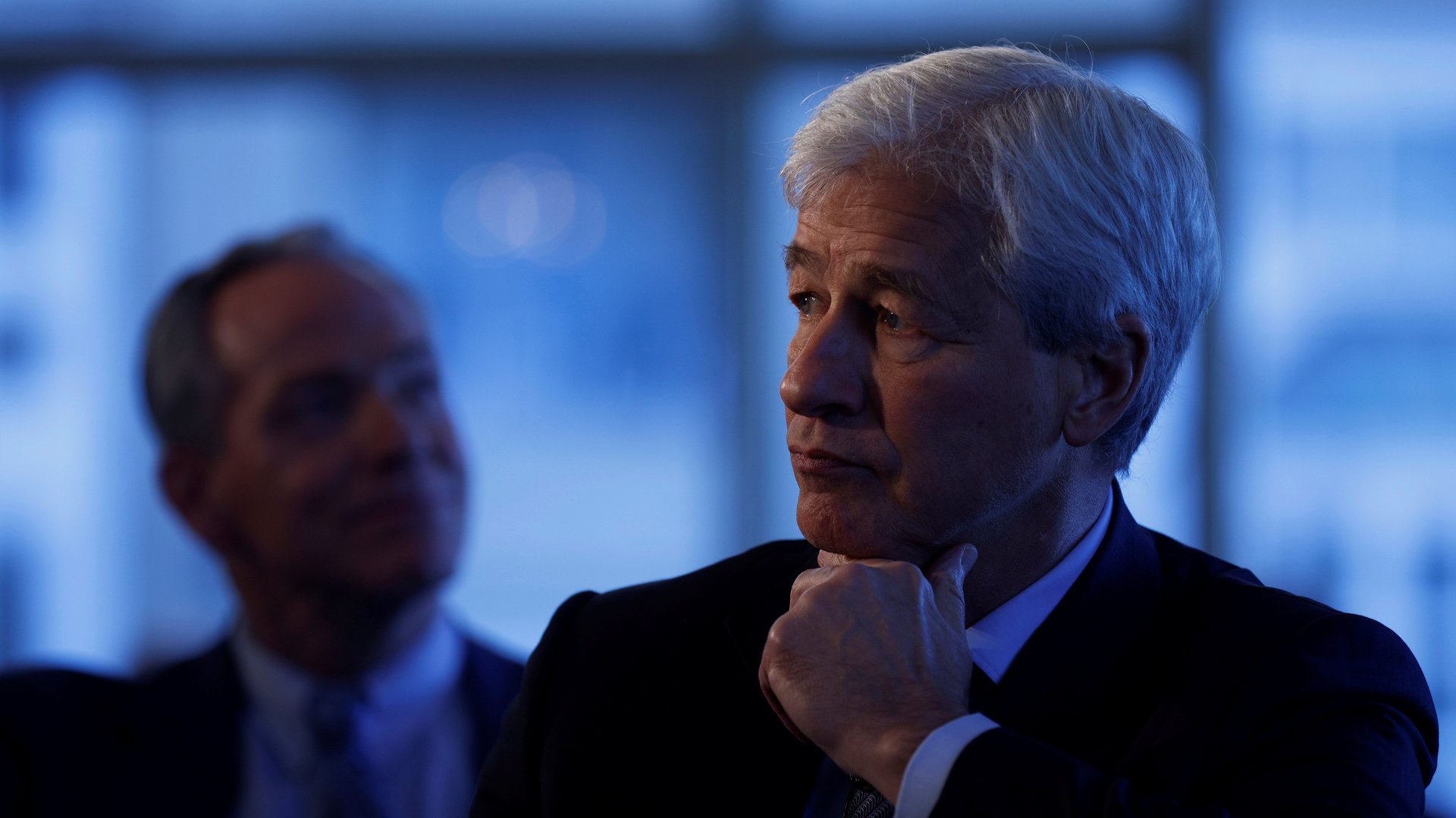

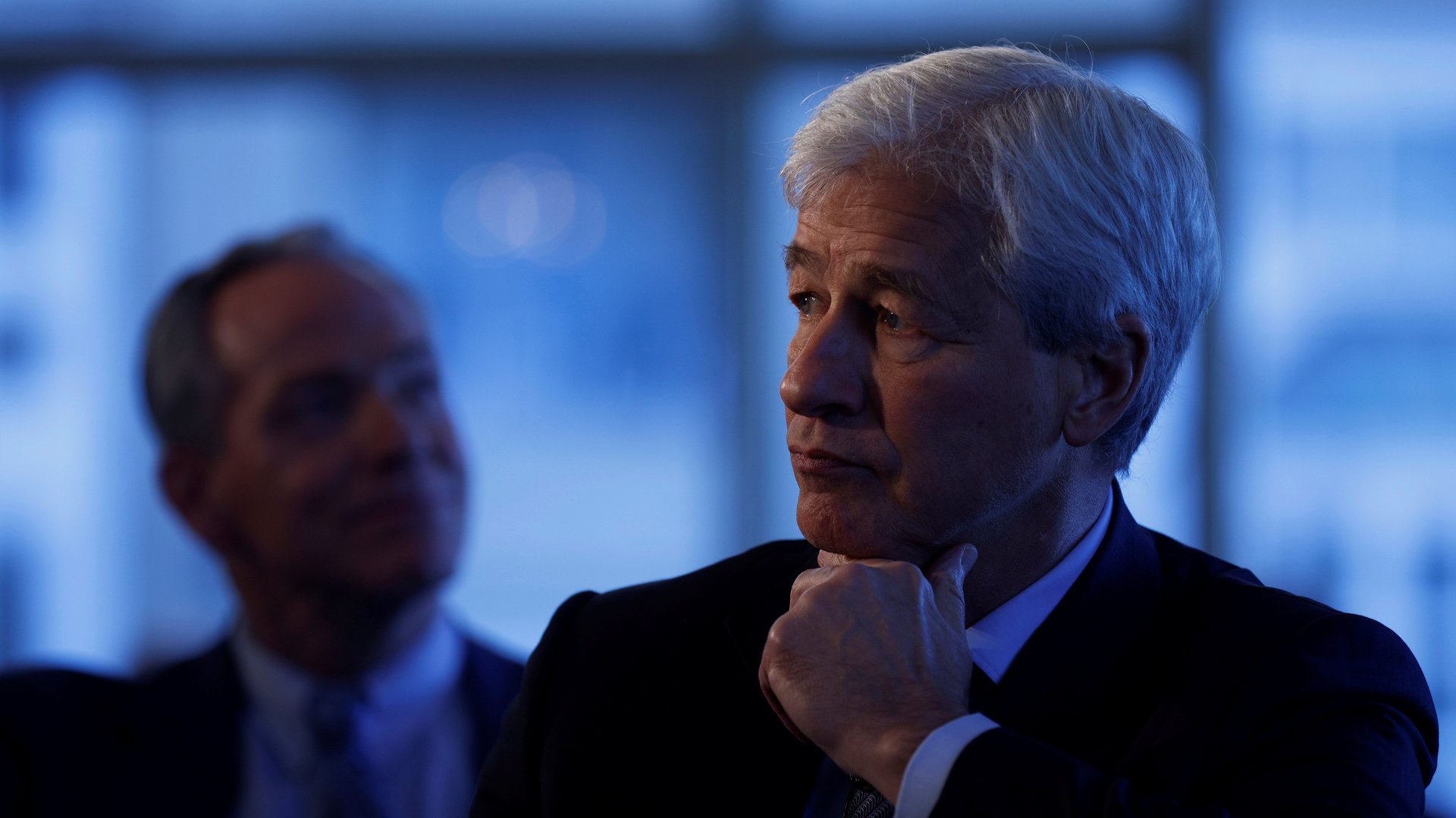

Jamie Dimon wishes the Fed “all the best” on slowing inflation

Jamie Dimon is glad he’s running the US’s largest bank and not the US Federal Reserve as it struggles to tame inflation—or at least he said as much in his annual letter to investors.

Jamie Dimon is glad he’s running the US’s largest bank and not the US Federal Reserve as it struggles to tame inflation—or at least he said as much in his annual letter to investors.

“The Fed has a hard job to do so let’s all wish them the best,” the JPMorgan Chase CEO wrote.

Dimon said that he doesn’t envy the central bank’s difficult job, what with supply chain shortages, Russia’s Ukraine invasion, and “unparalleled inflation.”

“The Fed needs to deal with things it has never dealt with before (and are impossible to model),” he added.

By how much will the Fed raise interest rates?

Dimon is predicting the central bank will raise interest rates by more than what the market is expecting this year. “If the Fed gets it just right, we can have years of growth, and inflation will eventually start to recede,” he wrote. But he also warned about “lots of consternation and very volatile markets” along the way.

The CEO had some pointers for the Fed as it goes about the hard task ahead: That it not restrict itself to steady, 25 basis-point rate hikes, but instead be ready to respond to new economic data as it comes in.

Dimon didn’t mention it, but on the flipside, the Fed’s flexible average targeting framework means that it doesn’t have to bring inflation back down to 2% immediately, but can average it out over time. Either way, the Fed’s job will be tricky to balance given how blunt interest rate increases are as an anti-inflation instrument.

Dimon said Americans got too much government money

Even as he admitted “it’s easy to second-guess complex decisions after the fact”, Dimon had some criticism. The US’s fiscal and monetary stimulus was, in his view, “probably too much and lasted too long.”

While Dimon advocated for a more equitable labor market, he made no mention of what the stimulus’ role was in the US’s recovery of 6.4 million jobs in 2021, or that the extra cash the government put in Americans’ pockets is not the main driver of inflation.

Other countries that didn’t deliver as much stimulus as the US, like Germany and Spain, are facing similarly high rates of inflation.