There was only one story in the financial markets this week

And it wasn’t the World Cup.

And it wasn’t the World Cup.

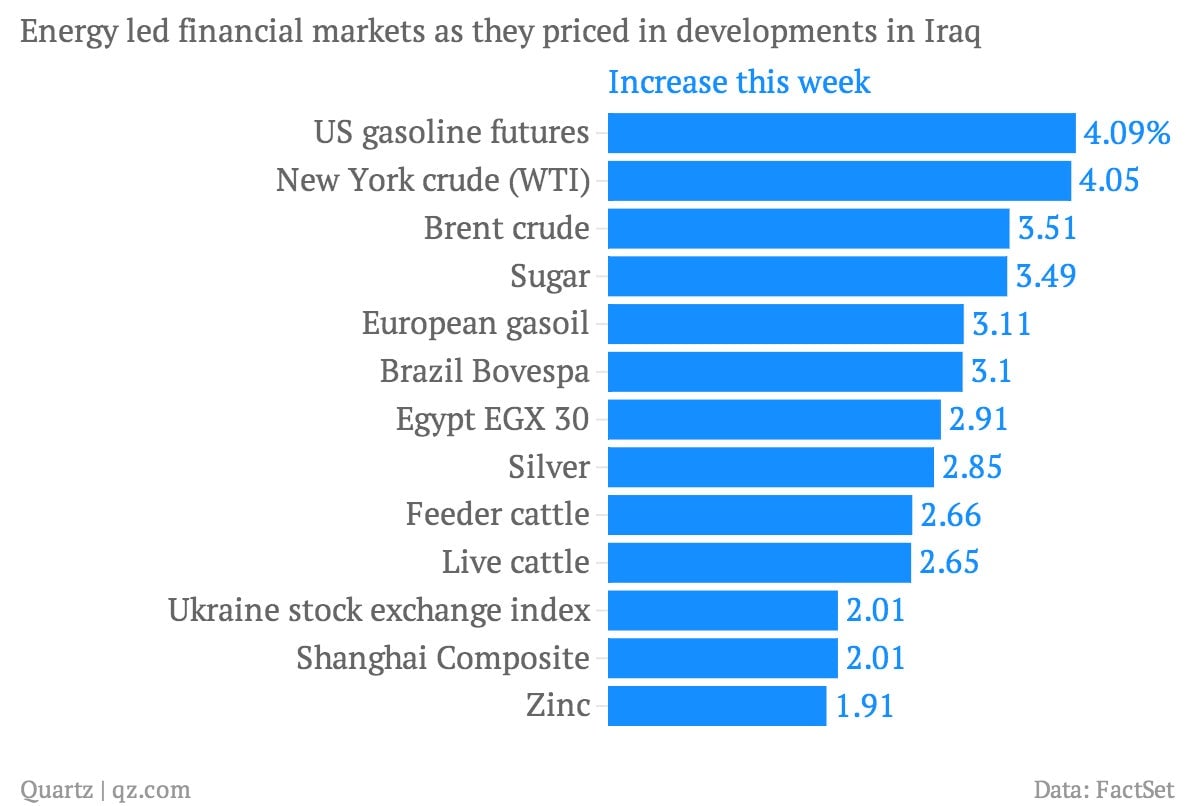

Traders were transfixed by unsettling developments in Iraq where an all-out sectarian civil war seems to be unfolding. Islamist militias took control of Iraq’s second-largest city, Mosul, which also happens to be the gateway to the nation’s northern oil fields. And they seem intent on marching on Baghdad itself.

It’s just the latest example of the recurrent chaos—the Arab Spring, Nigeria, Russia-Ukraine, Iran—that is beginning to look like the outright failure of the modern petro-state. The repercussions are global, of course. Especially in the US, where consumers will soon feel the pinch of rising gasoline futures, which jumped 4.1% this week. And prices for hamburgers won’t be going lower any time soon either, if futures prices for cattle continue on their current trajectory. All in all, the disruptions shouldn’t be enough to dislodge other improvements in the US economy. (But the specter of a return to unpleasantness in Iraq likely won’t help the US consumer mood much.)