Four charts showing that the Chinese housing market slump can still get a lot worse

The Chinese government has been working furiously these last few months to keep the economy from weakening. But that barrage of stimulus measures—or, as the Chinese state press is now calling them,”microstimulation policies“—seem to have come too late to shore up the housing market.

The Chinese government has been working furiously these last few months to keep the economy from weakening. But that barrage of stimulus measures—or, as the Chinese state press is now calling them,”microstimulation policies“—seem to have come too late to shore up the housing market.

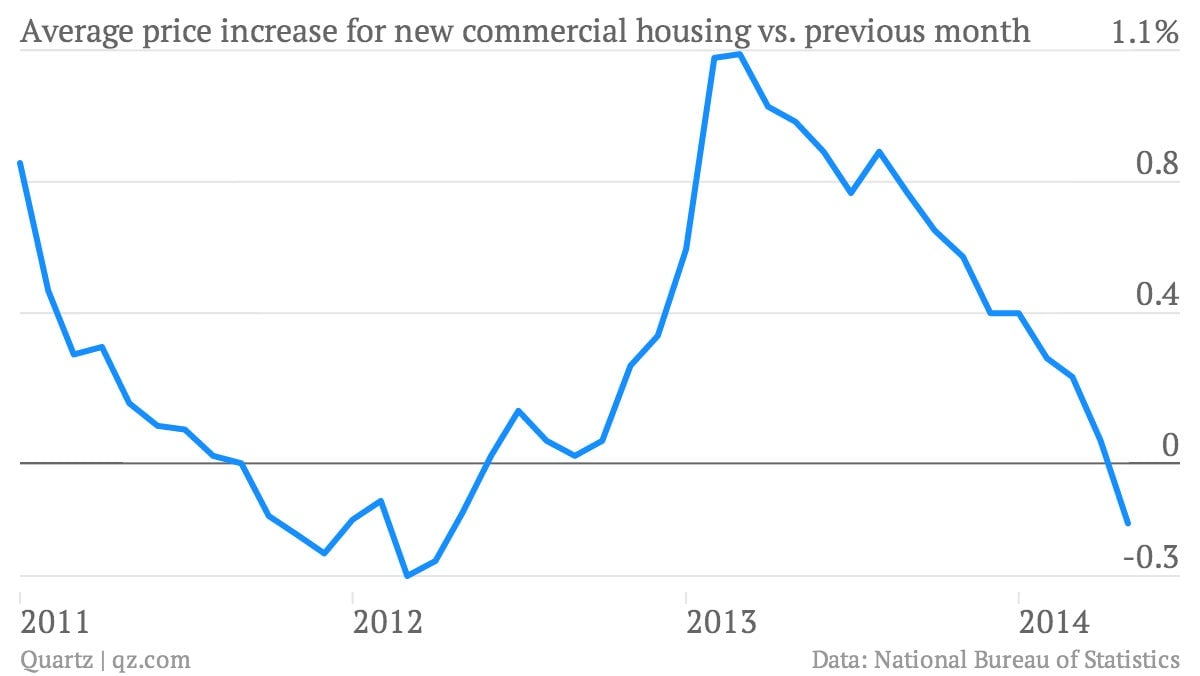

In May, the average new home in 70 of China’s biggest cities sold for less than it did in April, the first time in more than two years that prices have fallen versus the previous month. Here’s a look at the trend:

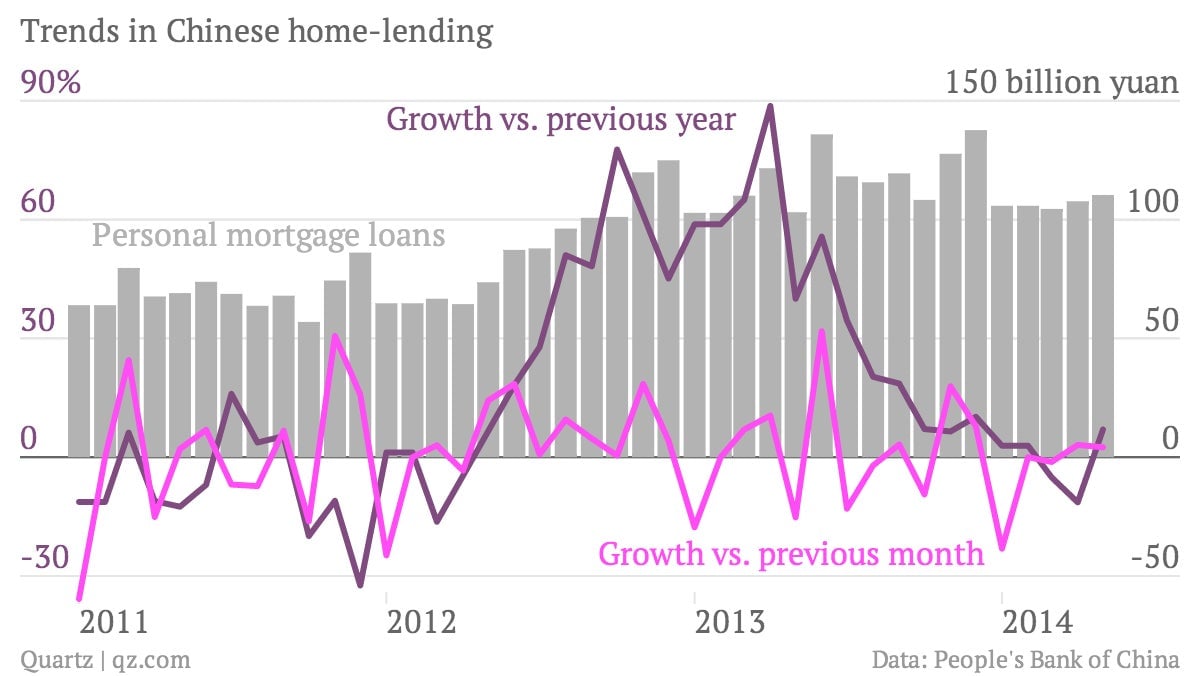

That’s even as government pressure on banks to up their mortgage lending appeared to have had some effect in May:

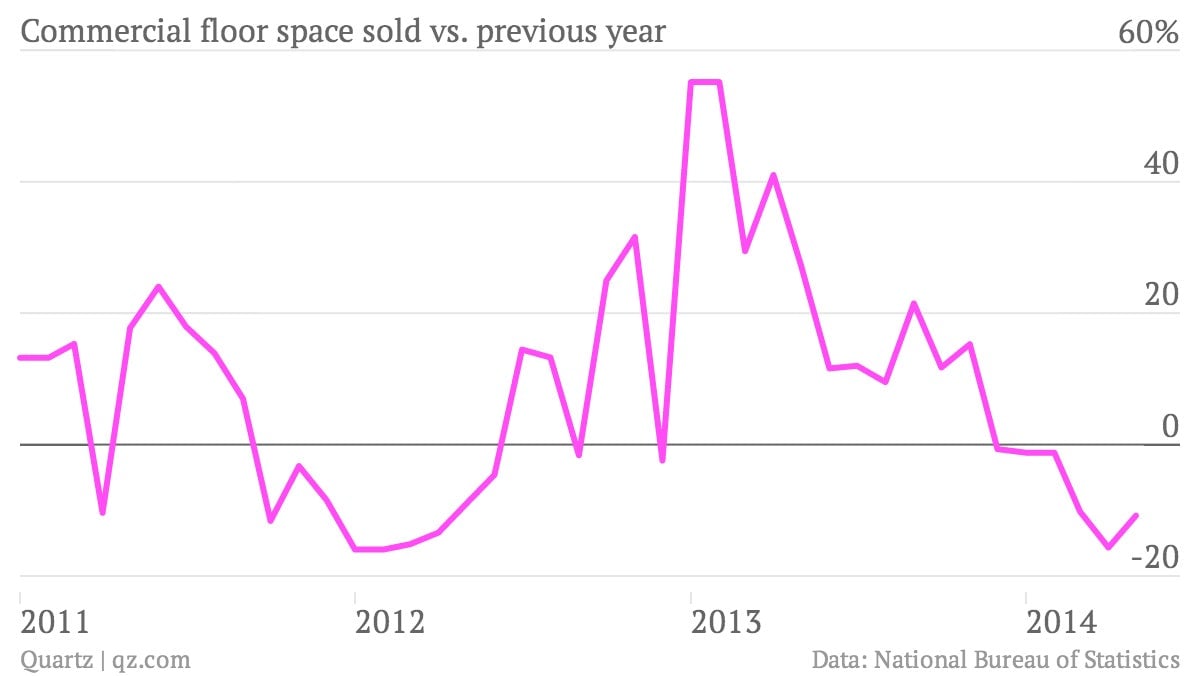

Today’s data suggests the government’s pressure on banks to boost home loans might not be doing the trick. As Junheng Li of JL Warren Capital explains, the housing market hasn’t risen accordingly. For instance, though May was slightly less terrible than April, data on total floor area of new commercial homes sold was still down dramatically versus 2013:

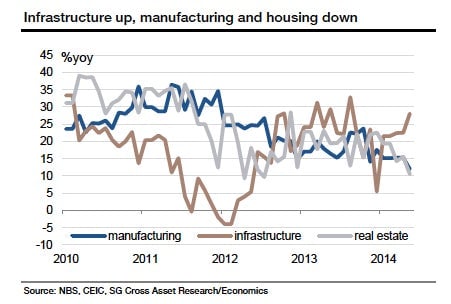

And lousy home sales are putting a big dent in Chinese housing investment, as you can see in this chart from Société Générale:

One reason prices might keep falling even as mortgages are up is that the problem isn’t buyer appetite alone. The easy credit of the last several years encouraged property developers to borrow excessively, often via China’s off-bank-balance-sheet shadow banking channels. Tighter regulation of shadow lending means now they are struggling to raise new funds to cover debts. So they’re slashing prices on housing inventory to raise cash—which is why last month’s real estate prices dropped. Even big property developers such as Evergrande are reportedly discounting their inventory by as much as 20% compared with similar properties in a given area, says JL Warren’s Li.

Does that May drop in home prices mean the housing market collapse is upon us?

Not necessarily. Local governments all over the country are loosening housing restrictions. And Chinese leaders are rolling out more of those “microstimulation policies,” recently launching another round of cuts to the reserve requirement ratio (RRR) for various commercial banks, which in theory will pump more loans into the economy. Target banks this time include the big mortgage lender China Merchant Bank, as well as China Minsheng Bank and Industrial Bank. All three are among the most active of China’s many shadowy lenders.

There’s also a lot of room for things to get worse, though. As Li points out, most of the biggest developers—Vanke, Longfor and Greenland, for example—aren’t running out of cash yet. However, those developers recently said at a government-sponsored housing market conference that, thanks to disappointing sales in the first half of 2014, they plan to start adjusting pricing in June and July based on what they see happening in the market. And the market clearly isn’t signaling that prices are going up.