UK shoppers are turning German when they walk into a supermarket

The quarter that ended May 24 was the worst one in decades for the UK’s top food retailer, Tesco.

The quarter that ended May 24 was the worst one in decades for the UK’s top food retailer, Tesco.

The company, which is the third-largest supermarket chain in the world behind France’s Carrefour and Wal-Mart, saw comparable store sales fall 3.7%—excluding gasoline. Analysts didn’t like the look of it. “Everything is kind of negative and suggests that there’s no underlying upgrade there,” HSBC’s David McCarthy told Tesco executives during its post-earnings conference call.

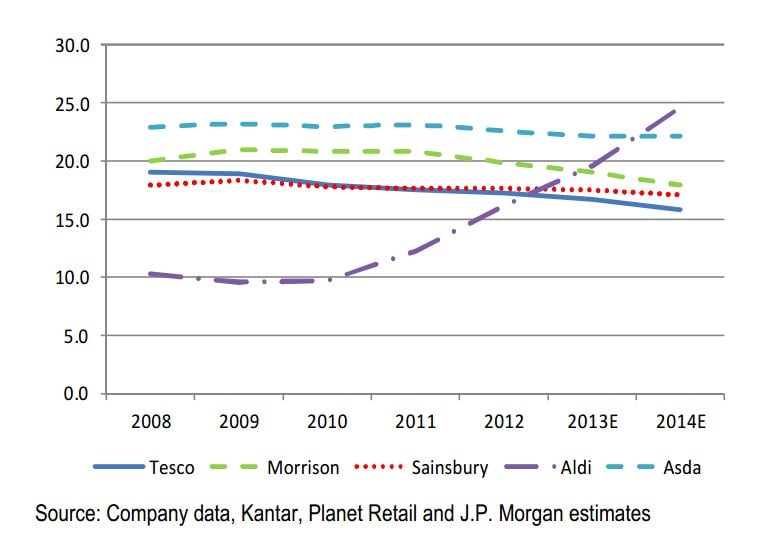

He’s right. The British grocery-store business is going through a brutal revamp at the moment, and Tesco is bearing the brunt of it. But it’s not uniformly bad for everyone. In fact, Aldi—Germany’s famed discount grocer—is eating away at Tesco’s market share with abandon. Here’s a chart from JPMorgan Cazenove analysts that shows sales-per-square foot metrics at the UK’s top grocery stores.

In fact, Aldi executives sound downright buoyant. “All the signs are there that we are going to have a nice happy end to the second quarter and the third quarter and the fourth,” they recently told the British trade magazine, the Grocer.

The plain fact is that Germany’s discount grocery players—Aldi, and also its chief competitor Lidl—are shaking up the the UK grocery business. Consumer price index data for May, released earlier this week, showed outright declines in prices for food.

And the decline in prices dragged down overall sales in the food sector in May.

The German discounters are largely responsible, as their business models were forged by decades of dealing with Germany’s famously price-conscious consumers. In a chat with analysts back in May, the head of fast-food giant McDonald’s European division voiced his thoughts on Germany’s food consumption habits.

“The German consumer tends to be very frugal,” McDonald’s Doug Goare told analysts. “And I would say they don’t have the same appetite for great-tasting food—I’ll get in trouble saying this—that the French have, okay? Food is a staple. And so there is a tremendous attention to value for the money.”

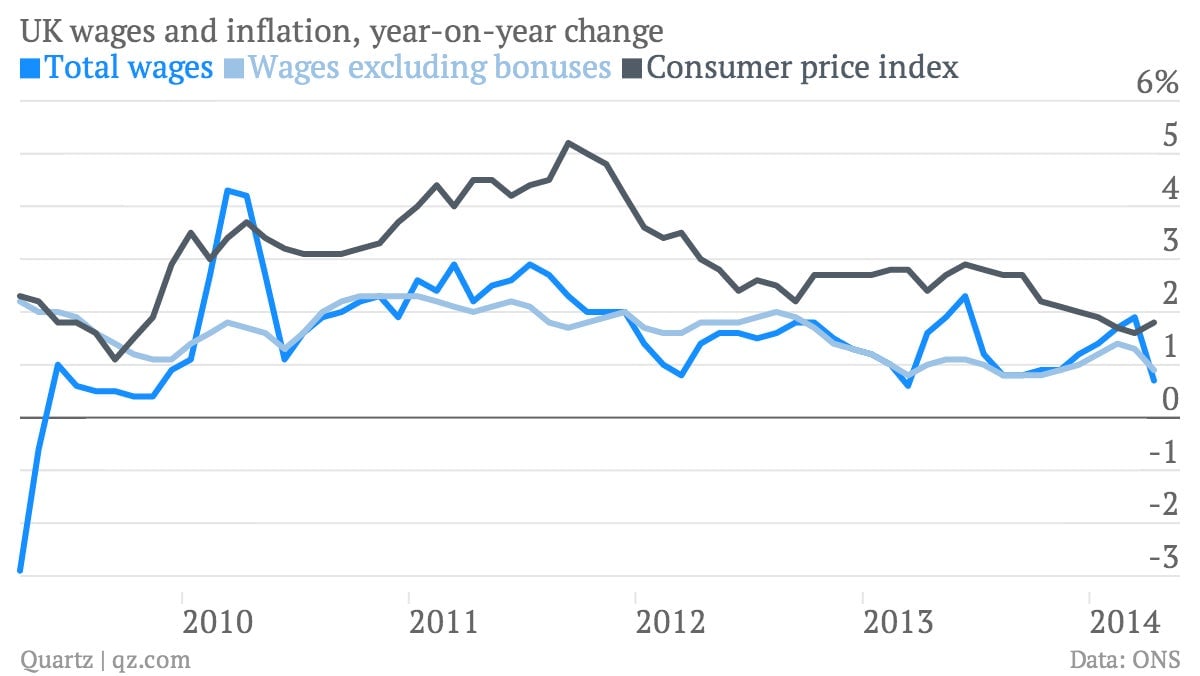

But why have Britons embraced the Teutonic model of no-frills, rock-bottom discounting? The reason is simple. Brits are increasingly pressed to make ends meet. Growth in wages—after inflation—has been negative for years now.

And the decline has transformed the UK’s standard of living, compared to its continental neighbors. Now, that’s not to say that things aren’t improving, for instance unemployment is coming down quickly. But wages haven’t budged, meaning British consumers are on a tight budget until further notice. And that means the companies that serve them have to adjust too.