Something is making Chinese consumers want to save more and spend less

You’ve probably read it a zillion times now: In order for China to wean itself off its debt habit, it has to “rebalance” the economy away from its reliance on investment.

You’ve probably read it a zillion times now: In order for China to wean itself off its debt habit, it has to “rebalance” the economy away from its reliance on investment.

That doesn’t just mean “stop investing so much,” though. China’s leaders have to rework their whole financial system so that it stops forcing households to save so that their deposits can fund China’s investment binge.

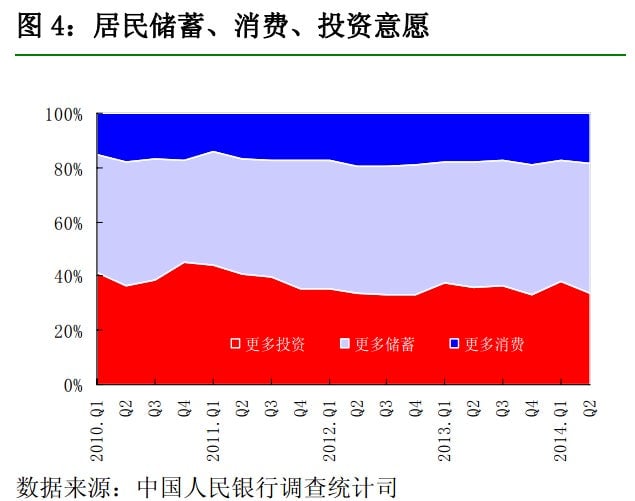

So far, no dice. Each quarter, the People’s Bank of China surveys 20,000 urban bank customers in 50 major cities to gauge spending and savings habits. One question examined whether respondents were inclined to invest, save or spend more, compared with the previous quarter. The chart below, taken from the PBoC’s most recent report (pdf, link in Chinese), shows investment in red, savings in lavender and consumer spending in blue:

As you can see, in Q2 2014, 48% of residents said they planned to save more, up from 44% in Q1 (pdf, link in Chinese); only 18% are up for spending more, up 0.8 percentage-points from the last quarter.

That’s just one quarter of data, but it doesn’t imply an imminent revival of consumer spending. (And, yes, it’s a revival that China needs.) Though the above chart makes the trends look fairly static, using a longer time-series shows just how much the last decade of Chinese government policies have crimped consumption.

This chart from Q4 2010 (pdf, link in Chinese) shows the same metric as above, except “spend more” is in the middle, rather than at the top. As you can see, it was only fairly recently that the percentage of Chinese households planning to spend more shrank from more than 30% (with the exception of Q4 2007, when China’s stock market started crashing):

The current ebbing enthusiasm for spending seems to square with research by China Beige Book, a research firm, that shows retail revenue dropping unexpectedly in Q2. For instance, in the PBoC survey, the percentage of those hoping to buy a car or big-ticket items like electrical appliances or furniture in the next three months both declined (however, a bigger share is planning to spend on traveling).

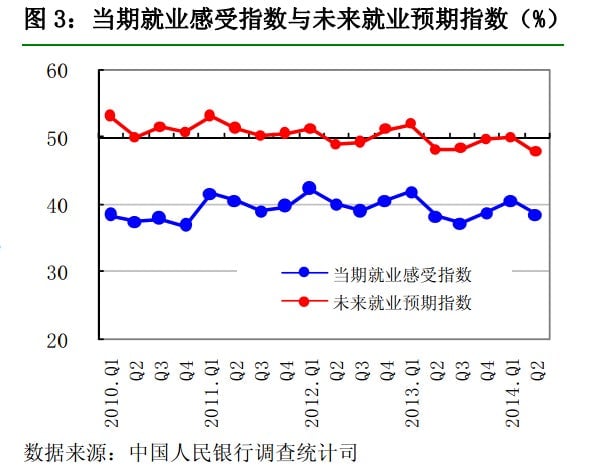

It’s not clear exactly what’s making people keen to save more. The economy’s shaky state might have something to do with it. Despite China’s tight labor supply, only 13% find the employment situation to be peachy, down 1.5 ppts from Q1. While the blue line shows respondents’ feelings about Q2 employment conditions, the red line in this chart shows expectations for the next few months:

The housing market could be a factor as well. Only 21% of interviewees in Q2 said they expect housing prices to go up, down from 28% in Q1.

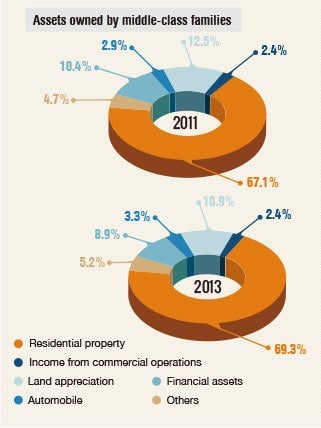

Why is that a problem? Nearly seven-tenths the average middle-class family’s wealth comes from their home value. In Beijing, where prices surged in 2013, the average resident holds 84% of his assets in property.