Manufacturing numbers continue to disappoint in Britain and Greece. But good news from Ireland

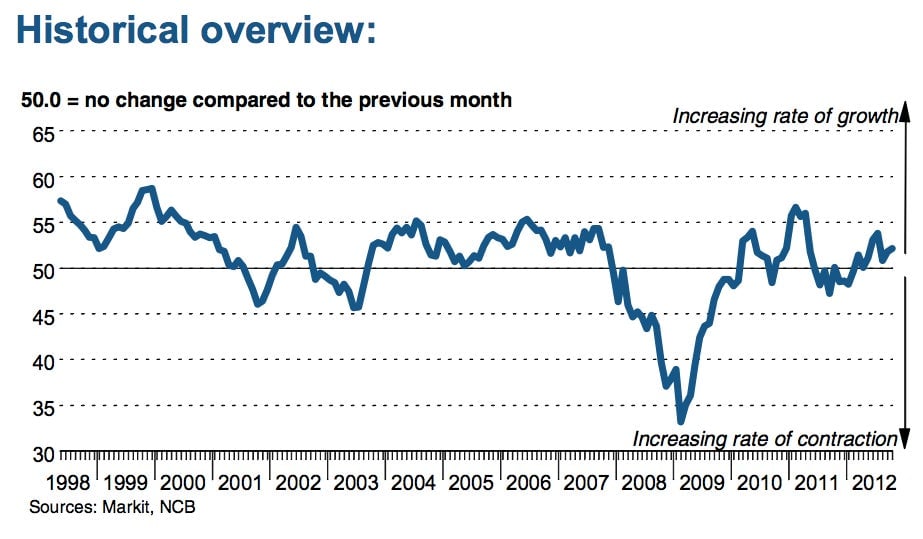

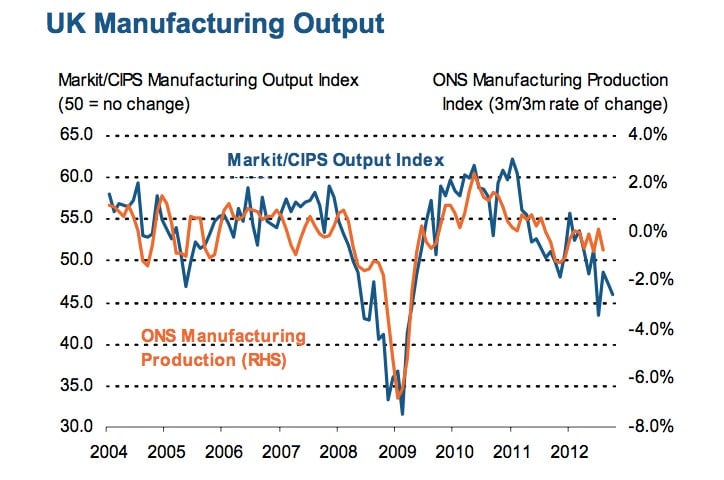

Just a week ago, Britain was celebrating an end to its double-dip recession with GDP growth of 1% for the latest quarter. Today’s poor manufacturing data from the latest purchasing managers’ survey (PMI), however, suggests the positive sentiment may be short-lived.

Just a week ago, Britain was celebrating an end to its double-dip recession with GDP growth of 1% for the latest quarter. Today’s poor manufacturing data from the latest purchasing managers’ survey (PMI), however, suggests the positive sentiment may be short-lived.

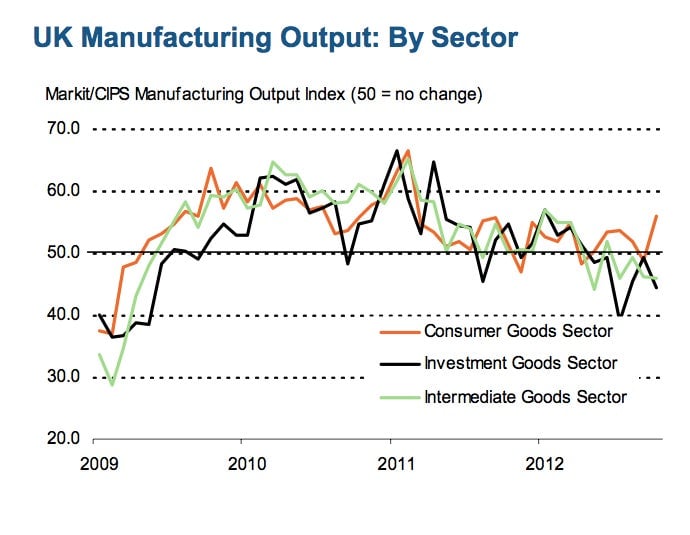

The monthly survey of industrial leaders showed manufacturing conditions deteriorating with a sharp decline in new orders as export demand remains weak. Concerns over costs are leading to job losses, stock depletion, and lower purchasing. There was one bright spot. The consumer goods sector bounced back after a lousy September on increasing demand for consumer goods both domestically and abroad.

David Noble, chief executive officer at the Chartered Institute of Purchasing & Supply said:

The UK’s manufacturing industry continues to suffer from a potent cocktail of declining export sales, depressed demand and rising cost pressures which have resulted in a hangover that the industry has been struggling to shake off all year.

There is little in last month’s figures to encourage the industry. Where once it looked like high growth areas in Asia might offer opportunities to offset the acutely fragile situation in the Eurozone, it now looks like the global economic slowdown is stifling demand in Asia which is threatening to depress the manufacturing industry in the UK still further.

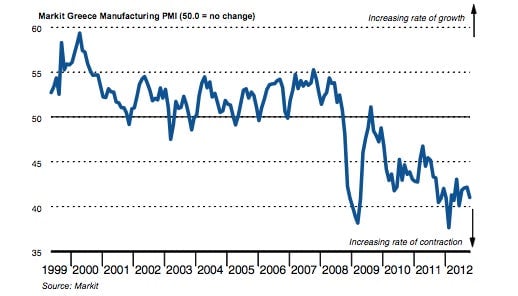

The news could have been worse of course, like in Greece. October PMI data, also out today, showed a sharp decline in manufacturing, reflecting not only falling domestic demand, but a severe drop in new export orders, which fell at the steepest rate since early 2009. Employment also suffered in the sector, declining at the fastest pace in six months.

Then again, Ireland shamed other nations with rosy manufacturing data, showing increasing output, new orders, and employment growth in the sector for an eighth month in a row.