The latest evidence that tech companies are waiting longer to cash out

It has, of course, been a bumper year in US tech financing, with companies like Airbnb and Uber raising monster funding rounds. But there’s also an interesting shift going on in the kind of financing being doled out, which tells us something about the changing nature of the tech industry. That’s the insight from the latest report on venture-capital (VC) funding from CB Insights.

It has, of course, been a bumper year in US tech financing, with companies like Airbnb and Uber raising monster funding rounds. But there’s also an interesting shift going on in the kind of financing being doled out, which tells us something about the changing nature of the tech industry. That’s the insight from the latest report on venture-capital (VC) funding from CB Insights.

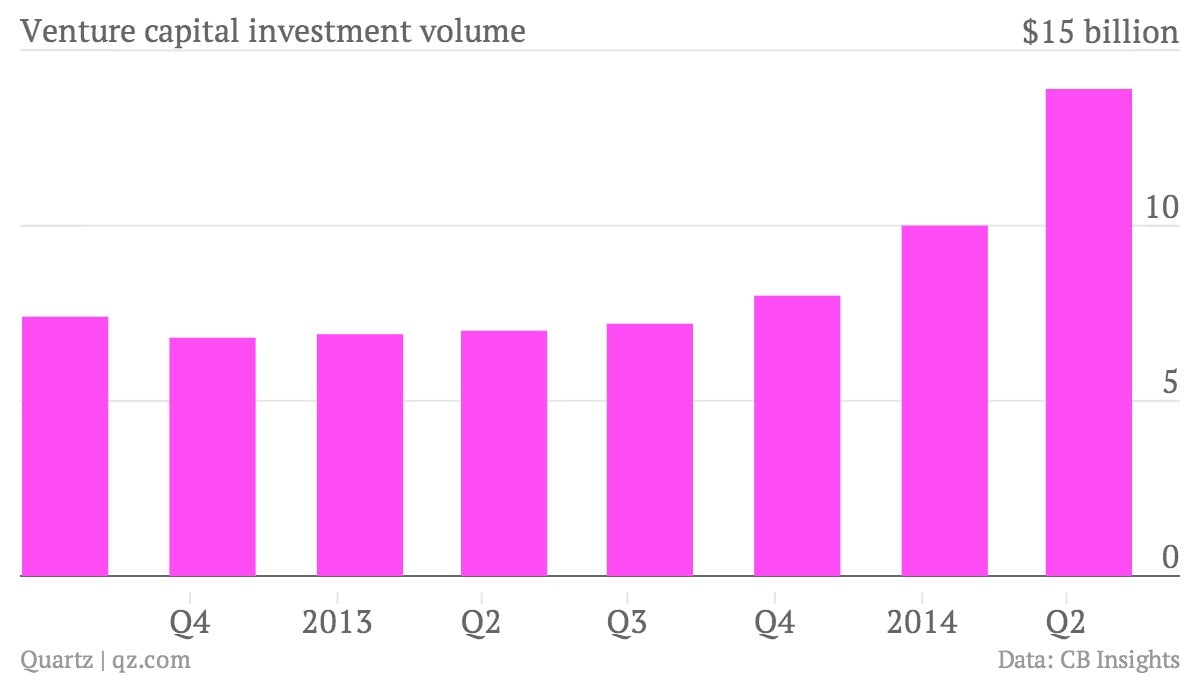

First, the headline numbers. More than $13 billion has been invested in the second quarter alone—the most VC dough shelled out in one quarter since the tech-inspired boom days of 2001.

The first half of the year has had nearly $24 billion in venture investments, 71% better than the first six months of 2013.

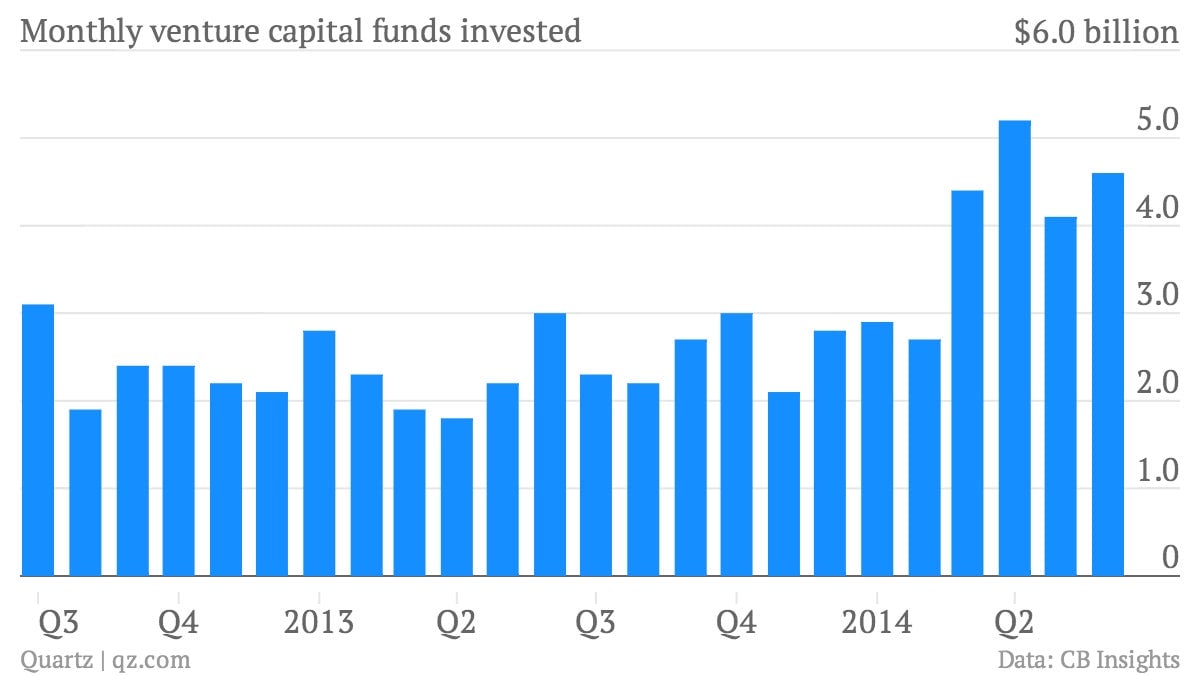

A closer look at the month-by-month figures shows that, though venture capital has cooled somewhat since reaching a $5.2 billion peak in April, it’s still staying well above average compared with the previous 18 months or so.

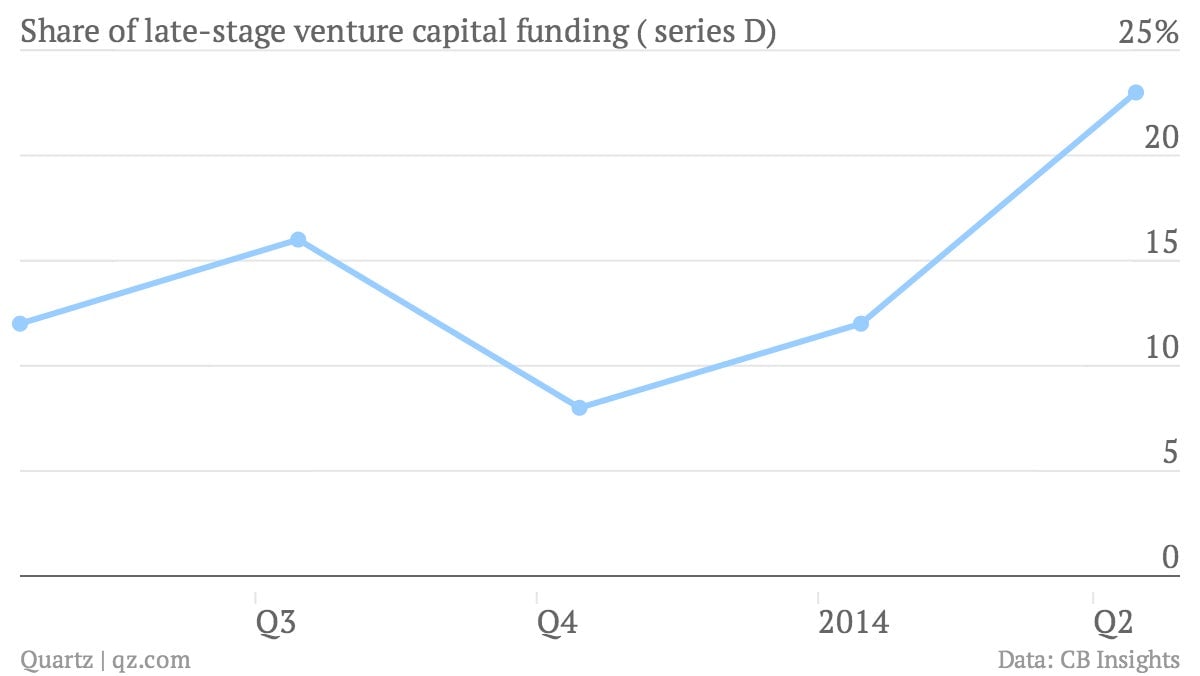

But the more interesting trend is that late-stage VC investing is on the rise. “Early stage” or series A funding is associated with young startups (but ones that have moved beyond “seed” or “angel” investing, which is the kind you associate with a company in the founder’s garage or her parents’ basement). Right now VC firms are plowing a growing share of their dollars into more mature companies, such as the aforementioned Uber and Airbnb. Here’s a chart highlighting the growth in late-stage series D funding:

Why the growing appetite for later-stage investing? It’s hard to be sure, but it’s likely to be partly thanks to the US’s JOBS (Jumpstart Our Business Startups) Act, a law that makes it easier in some ways for startups to go public, but also gives them more leeway to raise funding and keep growing while staying private. (For example, it loosens a limit on the number of shareholders a private company can have.) Also, as Marc Andreessen, one of the godfathers of US venture capital, has argued recently, heavier regulation and changes in the market in recent years mean public companies have to deal with much more intense scrutiny than they used to. That involves costs that only bigger companies can handle.

These companies need ever-larger dollops of late-stage VC financing. And as we’ve written, a growing number of investors—big mutual funds in particular—are willing to give it to them. So while this has also been a bumper year for tech companies both to go public and to be bought up by others, staying private also seems to be a booming business.