Investors are completely baffled by Banco Espírito Santo

“Remain calm.” In general, no authority figure says this unless there is reason to panic.

“Remain calm.” In general, no authority figure says this unless there is reason to panic.

But that is what the prime minister of Portugal exhorted the markets to do today as one of the country’s largest banks, Banco Espírito Santo, teetered. Trouble in a complex web of family shareholdings that are connected to the bank spooked investors, who are trying to figure out how vulnerable the bank is to the turmoil.

The bank detailed its exposure (pdf) to other parts of the Espírito Santo group late yesterday, after its shares were suspended following a precipitous 17% decline earlier in the day. Its capital buffers are large enough to weather any write-downs or defaults by related parties, it said. Portugal’s central bank also weighed in today, stressing that “depositors may rest assured.” (There’s that disheartening call for calm again.)

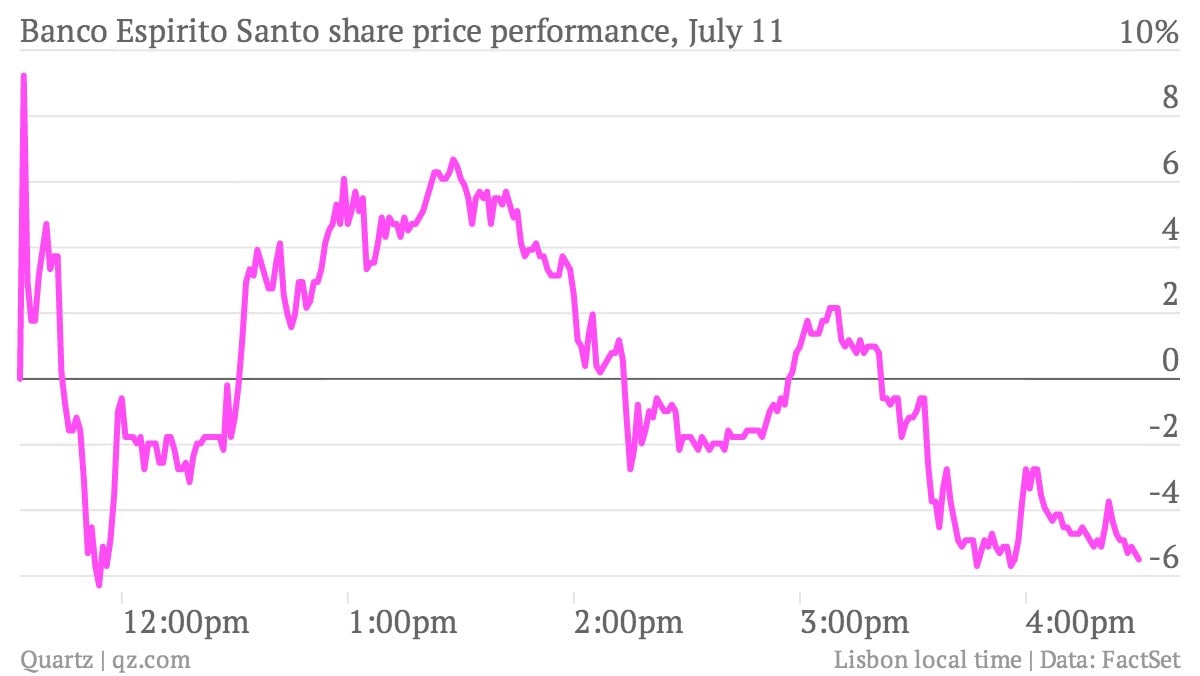

Despite these explanations, when Banco Espírito Santo’s shares reopened for trading today, it became clear how little the markets understand the labyrinthine connections between the bank and its various partners and owners. The stock seesawed violently, eventually ending the day down by more than 5%. At just 48 euro cents, you can’t even buy a pastel de nata with a share of the country’s largest listed bank.

The huge swings—up 9%, down 6%, up, down, up, down—indicate deep confusion about the central question: If (or when) debts are restructured in other parts of the Espírito Santo group, what will be the impact on the bank?

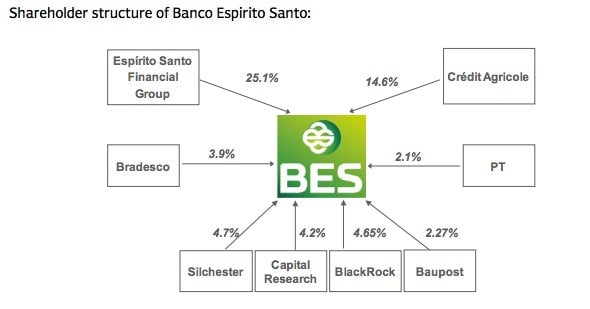

Instead of a clear answer to that question, traders have spent the past two days mulling the implications of diagrams like this:

And this:

And one more for the road:

And these just show the direct shareholder connections. Various intergroup loans and securities issued by non-financial units of the Espírito Santo group (but sold by the bank) create even more, and even murkier, linkages.

It’s no wonder that investors aren’t sure what to make of it all, despite the reassurances from officials.