Alibaba now wants to be the Netflix of China

The Chinese internet behemoth Alibaba, which is preparing for a blockbuster IPO in the United States, has struck a deal with Lionsgate the production house behind the Hunger Games and Twilight young adult film franchises, and the iconic TV series Mad Men, for a subscription-based streaming television service in its home market.

The Chinese internet behemoth Alibaba, which is preparing for a blockbuster IPO in the United States, has struck a deal with Lionsgate the production house behind the Hunger Games and Twilight young adult film franchises, and the iconic TV series Mad Men, for a subscription-based streaming television service in its home market.

As we discussed earlier this year, Alibaba has its finger in just about every pie in China. It’s not just the country’s Amazon, but also its Dropbox, PayPal, Uber, Hulu, ING Direct, and more. To that list we can now add Netflix. Alibaba has spent more than $3 billion since March on content initiatives, according to Reuters, as part of an aggressive push into home entertainment. In March, it paid $804 million for a controlling stake in the production house China Vision Media, and in April it invested billions in Youku Tudou, a YouTube-style service and Wasu, another internet TV company.

Alibaba’s strategy thus far has been somewhat different from Netflix’s: Like Amazon, it is selling set-top boxes. But the new service with Lionsgate looks like the most Netflix-style thing it has done. It will feature the production company’s biggest hits and be available exclusively in mainland China, the companies said.

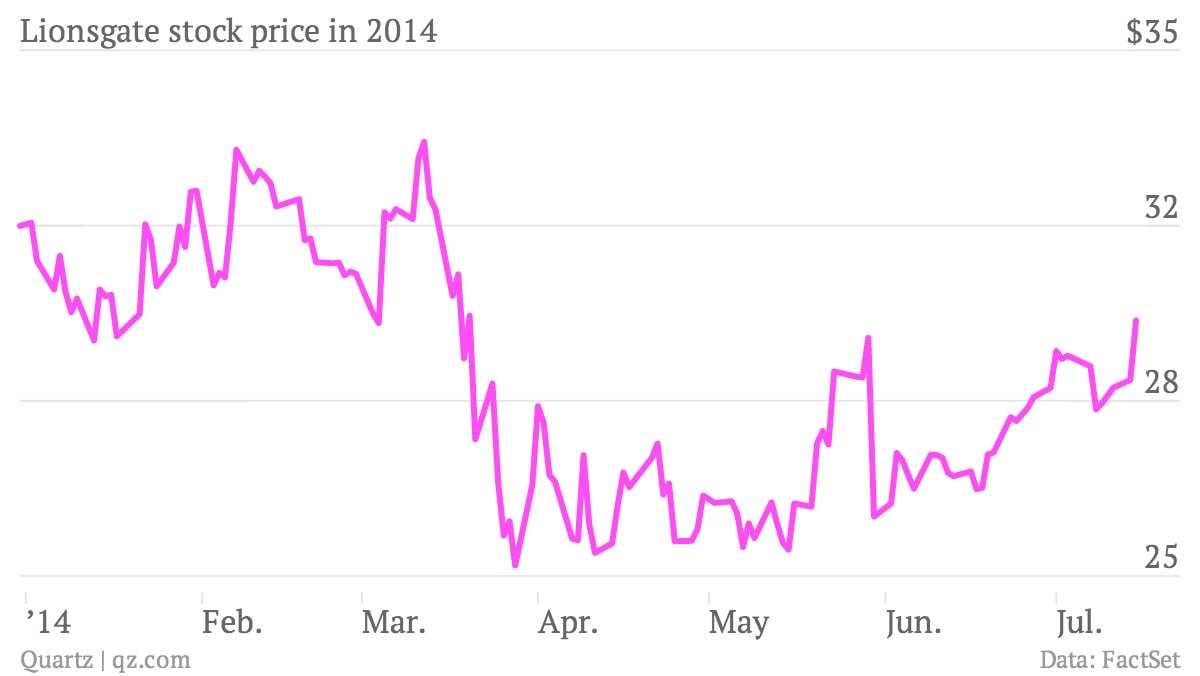

And it looks like a win-win arrangement for the two companies. Shares of Lionsgate have been under a bit of pressure in 2014. Investors are concerned that the production company won’t be able to find another bankable teen hit movie franchise to replace the Hunger Games and Twilight. (Divergent, its latest attempt at a young adult hit series, did OK at the box office, but did not match the returns of its predecessors.) News of the deal with Alibaba is today providing the stock price with a nice lift.

Lionsgate has already split Mockingjay, the third installment in the book trilogy on which the Hunger Games film series is based, into two films that will be released over the next two Novembers. Mad Men, its most critically acclaimed television show, which airs on cable network AMC, is also in the home stretch. (The show’s final season has also been split into two parts, with the second expected to run in the spring of 2015.)

Piper Jaffray analyst James March said the deal is positive for Lionsgate, because it provides additional revenue at little cost, and, more importantly, “we think [it] could set the stage for a deeper relationship with Alibaba.”