Don’t give up on America’s long-term unemployed just yet

Federal Reserve researchers argue that the central bank has been right not to give up on the ranks of America’s long-term unemployed.

Federal Reserve researchers argue that the central bank has been right not to give up on the ranks of America’s long-term unemployed.

The plight of the long-term jobless has been at the heart of Fed chair Janet Yellen’s position that the US central bank can and should continue to provide support for the US economy in the form of low interest rates and an ongoing—though tapering—bond-buying program.

Opponents have said there isn’t much that Fed policy can do, and that unduly long periods without a job have rendered large swaths of American workers unemployable through a process known to wonks as hysteresis.

But new Federal Reserve research contradicts this pessimistic assessment, and suggests that the recent decline in US unemployment has been driven, largely, by improvement in long-term unemployment. The researchers write:

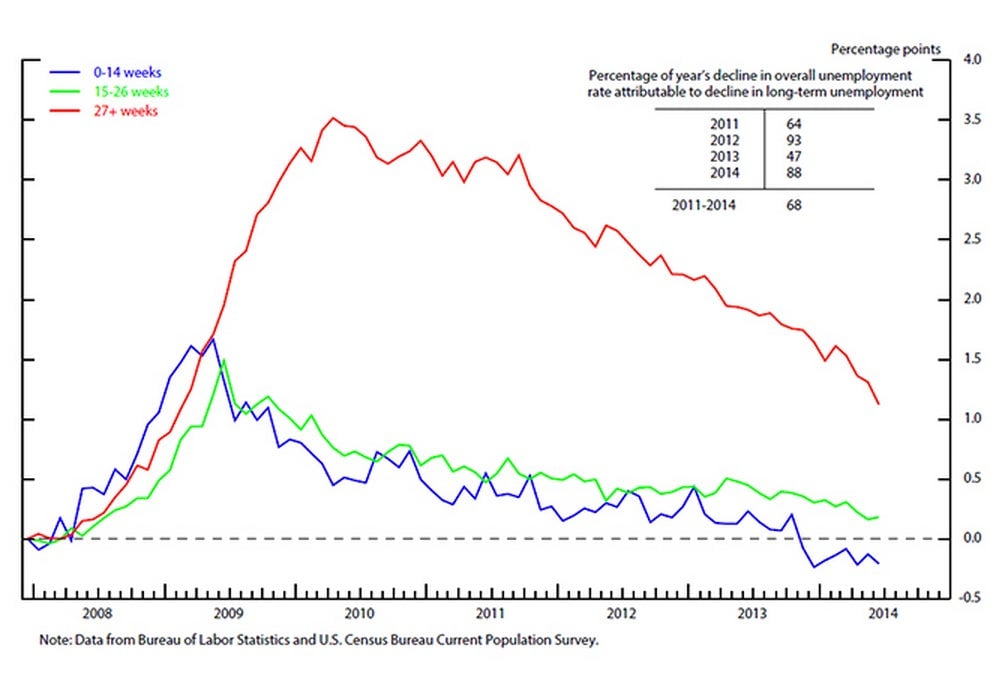

In many ways the fight against unemployment during the recent recovery has been mainly one of bringing down the long-term unemployment rate. By the end of 2010, short-term unemployment rates (the blue and green lines) were only 1/2 percentage point above their pre-recession levels, while the long-term unemployment rate (in red) was markedly elevated. Since then, about two-thirds of the decline in the aggregate unemployment rate can be accounted for by a retracing of the long-term unemployment rate.

Importantly, Fed researchers make the point that the improvement in long-term unemployment isn’t just a matter of people dropping out of the labor force. (In other words, the lower rate can’t be attributed simply to unemployed workers giving up altogether, and not looking for jobs anymore, which would lower the rate.)

This is a bit surprising. After all the Bureau of Labor Statistics publishes data on Americans’ transitions between being employed and unemployed each month. And those numbers haven’t been showing a ton of improvement. The Fed’s researchers argue that the monthly data blurs the picture, because long-term unemployed workers often weave in and out of participation in the labor force. The best metric to look at, they say, is year-on-year transitions between long-term unemployment and employment.

Importantly, at the yearly frequency, the long-term unemployed are currently more likely to transition to employment than to nonparticipation, in stark contrast with the monthly flows data. This is consistent with the interpretation that the labor market status of long-term unemployed is blurred by their frequent monthly transitions into nonparticipation and back.

In other words, the monthly numbers seem to be missing the people who are among the long-term unemployed, then give up on looking for jobs for a while, and then end up getting jobs. So what’s the takeaway? Well, on the one hand this is just pure, good economic news (especially for those unemployed people who are now working).

But for markets geeks, this is also an important glimpse of how Yellen & Co. are looking at the data on falling long-term unemployment, which is a key goal of the central bank. If improvement in these metrics continue, it might mean that the end of the era of super easy money is a bit closer than some might think.