India has its task cut out for mobile as it gears up for the high speed 4G internet: getting more people to use 3G.

“In terms of preference for technology used for internet access, 3G services continue to lag behind 2G,” CARE Ratings said in a recent report (pdf).

Telecom companies in India once said 3G will usher in a new era of high speed connectivity and paid huge amounts to win spectrum so that they can start offering these services. To get more users on board, the companies even relaxed the tariffs reducing the price difference between 2G and 3G services.

Still, 3G hasn’t quite taken off.

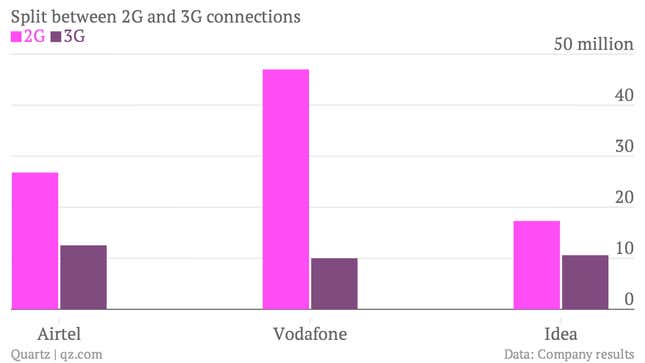

The chart below shows the difference between the 2G and 3G connections in India’s top three telecom operators based on their latest earnings results.

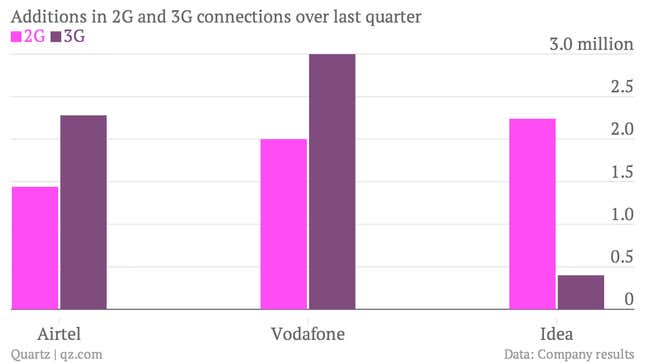

And growth in 3G is not as fast as companies want it to be.

(2G connections have been calculated by subtracting 3G connections from total data connections)

This raises one key question: is India killing access to mobile data because of the high prices telecom companies paid during the spectrum auction?

The short answer is yes.

Spending large amounts of money during auctions meant tariffs for 3G had to be higher than 2G. Stiff competition among telecom companies, however, doesn’t leave enough room for increasing 3G tariffs. “Anybody trying to increase price will be hurt by competition,” says Mahesh Uppal, a Delhi-based telecom analyst.

Therefore, rollout of 3G services has been slow as the companies are very picky about the areas where 3G services should be introduced to maximize their returns. “If you are investing in networks, you have to worry about returns on investments,” Uppal said.

Another major factor hampering 3G adoption, as CARE Ratings points out, is that the difference between 2G and 3G speeds is not completely discernable in many parts of the country due to inconsistent roll out of 3G infrastructure.

All of this doesn’t augur well for 4G, which still has lot of ground to cover in India. “4G devices are few and far between,” says Uppal.

Reliance, which owns country-wide licenses to run 4G, is expected to launch the service in 2015.

There are silver linings, however.

India is the largest mobile market with around 800 million mobile connections. A report by Gartner says India’s smartphone market grew by 167%—fastest in the world—and a smartphone can be bought for as low as Rs4,000 ($67).

CARE says mobile data will be one of the key drivers of growth for Indian telecom companies, signs of which have already started to appear.

Messaging services such as WhatsApp have already started eating into revenues from text messages—one of the biggest source of income for telecom companies.