This week the markets sent a clear message about China

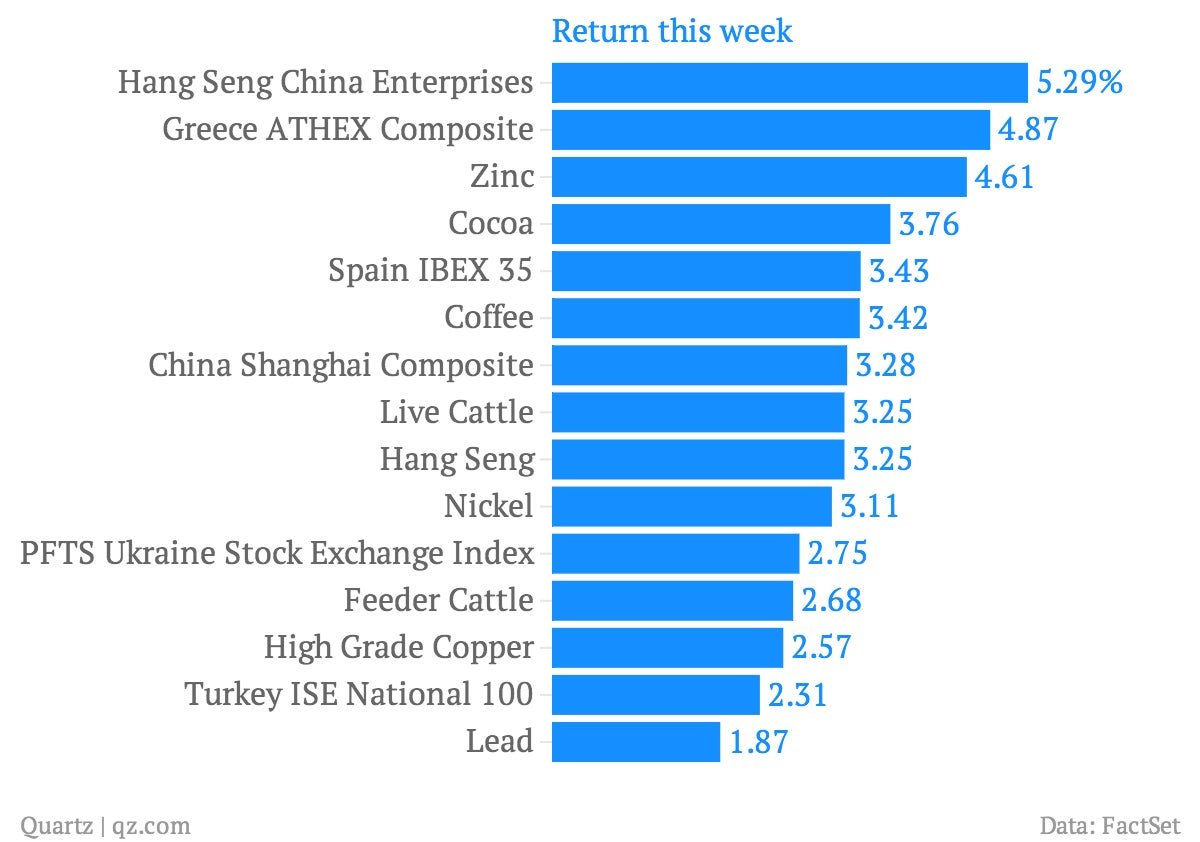

The makeup of market gains this week suggests investors think China might make a more meaningful contribution to global growth over the coming months. Key equity gauges—both on the mainland and Hong Kong—had some of their best weekly gains in months. The Shanghai Composite was up 3.3%, as was the Hang Seng in Hong Kong. The Hang Seng’s China Enterprises index of mainland companies surged 5.3%.

The makeup of market gains this week suggests investors think China might make a more meaningful contribution to global growth over the coming months. Key equity gauges—both on the mainland and Hong Kong—had some of their best weekly gains in months. The Shanghai Composite was up 3.3%, as was the Hang Seng in Hong Kong. The Hang Seng’s China Enterprises index of mainland companies surged 5.3%.

Elsewhere, metal markets also telegraphed improving sentiment on the world’s second largest economy with significant gains in industrial metals such as lead, nickel and copper. Those are closely associated with Chinese industrial growth.

The source of the optimism seems to be the unofficial HSBC/Markit purchasing managers index, which showed a better-than-expected uptick in activity at Chinese factories.

It will take some time before it’s clear that this week marks important turning point for investors. Chinese markets have been laggards this year. Even with this week’s gains, China’s Shanghai Composite is only up 0.5% in 2014, far behind India’s Sensex (+26%), Brazil’s Ibovespa (+12.3%) as well as gains from more developed markets such as the US, where the S&P 500 is up 7%, and Europe’s Stoxx 600 (+4.2%.)

Other strong performers this week included equity markets in troubled European countries such as Spain and Greece, where the ever-so-tiny signs of progress are attracting the attention of investors.