Don’t misread the rhodium rally

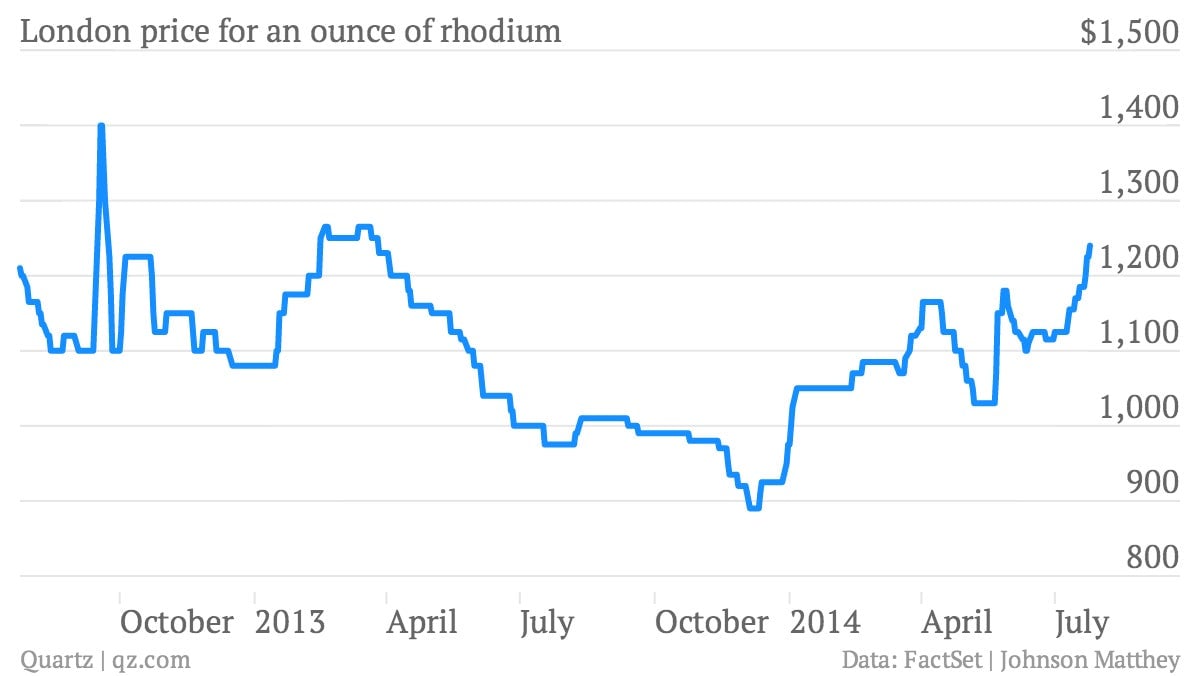

Prices for rhodium, the precious metal used in the catalytic converters that curb harmful automotive emissions, are on a run. Bloomberg reports that they’re at their highest in 16 months and are poised for their best monthly gain since 2009.

Prices for rhodium, the precious metal used in the catalytic converters that curb harmful automotive emissions, are on a run. Bloomberg reports that they’re at their highest in 16 months and are poised for their best monthly gain since 2009.

Is this as sign of a resurgence of the global auto demand? Maybe. Auto sales have been buoyant in the US. And Europe, which has been a drag in recent years, shows signs of a long-hoped-for bounce.

But prices are always a mix of supply and demand. And supply shortages have really been the story with rhodium and other platinum group metals. Roughly 80% of the world’s rhodium comes from South Africa, where a five-month strike that ended in June has crippled production, Bloomberg reports.

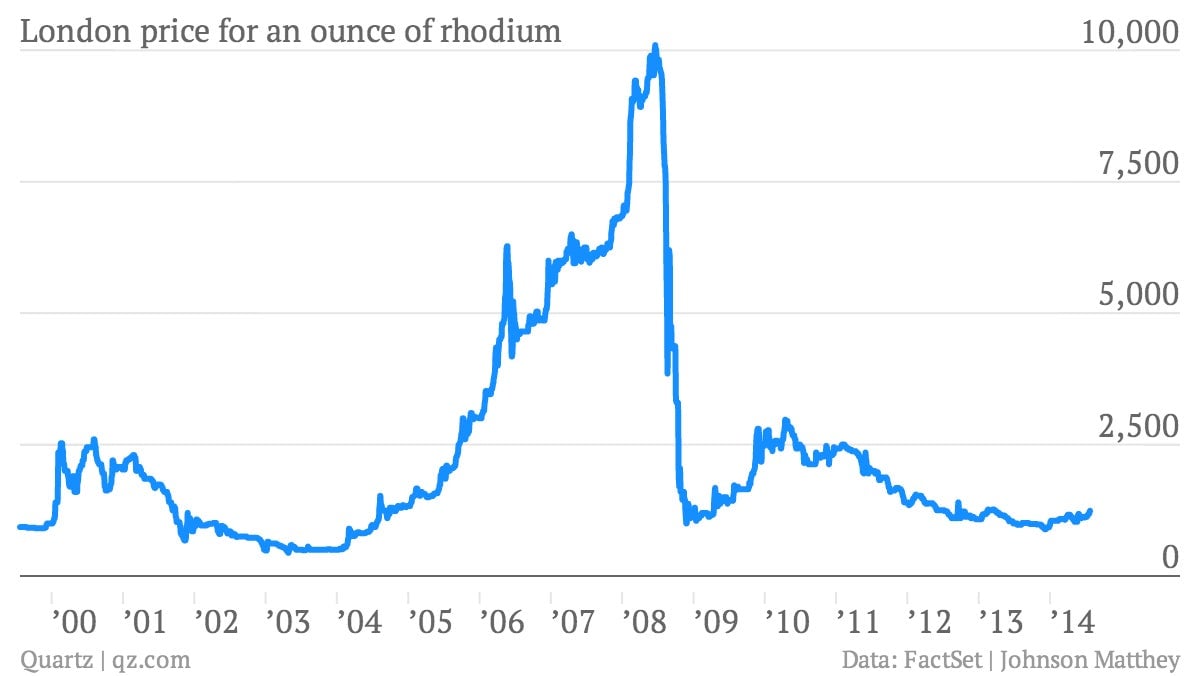

With demand recovering and a scanty supply, prices for rhodium seem set for something of a recovery. But be careful not to make too much of it. Rhodium prices remain roughly 90% below their 2008 peak of more than $10,000 a troy ounce, set back in June of 2008.