Manchester United is battling to defy the odds on the soccer pitch and in the stock market

Manchester United, by some counts the world’s biggest soccer club, is trying to recover from a dreadful season in 2013-14 and again challenge for honors in the English Premier League. But the Red Devils may have an even taller task proving it can flourish not only as a team but as an investment.

Manchester United, by some counts the world’s biggest soccer club, is trying to recover from a dreadful season in 2013-14 and again challenge for honors in the English Premier League. But the Red Devils may have an even taller task proving it can flourish not only as a team but as an investment.

Since it went public on the New York Stock Exchange in mid-2012, Manchester United’s share price has risen more than 30%—which sounds decent, but actually trails the 38% gain in the benchmark S&P 500 over the same period.

The club’s controlling shareholders, the Glazer family (which also owns the Tampa Bay Buccaneers NFL franchise), are taking advantage of a recent uptick in the stock price, fueled by the signing of lucrative commercial deals and the appointment of a new manager, to unload some of their holdings. This week, they plan to sell about 5% of the company for more than $100 million in proceeds, while maintaining their controlling stake.

The history of publicly listed, professional sports teams in the US is an undistinguished one. The Cleveland Indians baseball team went public in 1998, but the stock languished and the team was acquired about a year later. Then there’s the Green Bay Packers, which the Wall Street Journal once described as the worst stock in America. (Shares in the NFL team don’t pay dividends, have no rights to earnings, and aren’t readily tradable.)

Other teams are held by public companies that aren’t pure-play sports investments, like the Atlanta Braves and the New York Knicks (owned by Liberty Media and Madison Square Garden, respectively). Europe has a number of publicly listed soccer teams, but they have relatively small market values and thinly traded shares.

What makes Manchester United any different? The sheer scale of its global fan base, for one thing. Last Saturday, the team faced Spanish giants Real Madrid in front of 109,000 fans at the “Big House,” the University of Michigan’s football stadium. Tonight, the team faces its bitter domestic rival, Liverpool, in Miami, and another big crowd is expected.

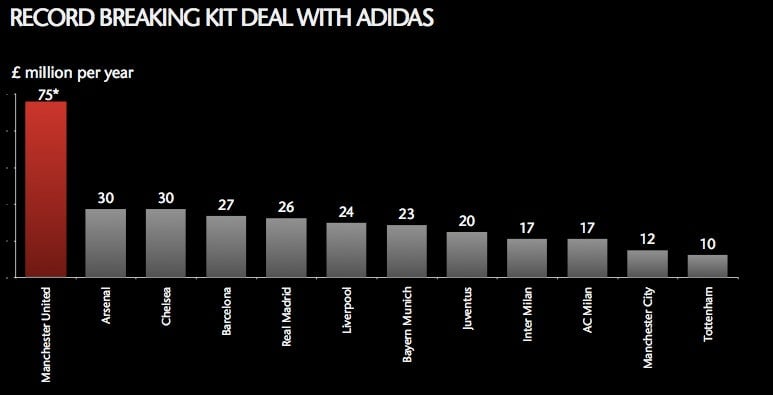

Manchester United’s huge following, especially strong in Asia, helps explain why despite the dismal season last year, it still managed to secure the largest clothing sponsorship deal in the history of the sport.

The record contract with Adidas, worth £750 million pounds ($1.26 billion) over 10 years, followed the signing in February of a lucrative jersey sponsorship deal with Chevrolet, the General Motors car brand.

Commercial sponsorship deals were 42% of Manchester United’s revenue last year, outpacing growth in revenue from booming broadcast deals and from matchday income.

There undoubtedly are risks to the Manchester United investment story. Another poor season could weaken the interest of potential sponsors and reduce gate takings while forcing the team to spend more on players to upgrade its squad.

But between its massive, global fan base and diverse revenue streams, Manchester United arguably has the best chance yet for a professional sports team of succeeding on the stock market. Over to you, Louis.