The markets clearly had something to say about Europe this week

It was a big week for US economic activity—with jobs and GDP statistics and a meeting and decision from the Fed—but it was Europe that was whipsawed the hardest, with major equity markets tumbling.

It was a big week for US economic activity—with jobs and GDP statistics and a meeting and decision from the Fed—but it was Europe that was whipsawed the hardest, with major equity markets tumbling.

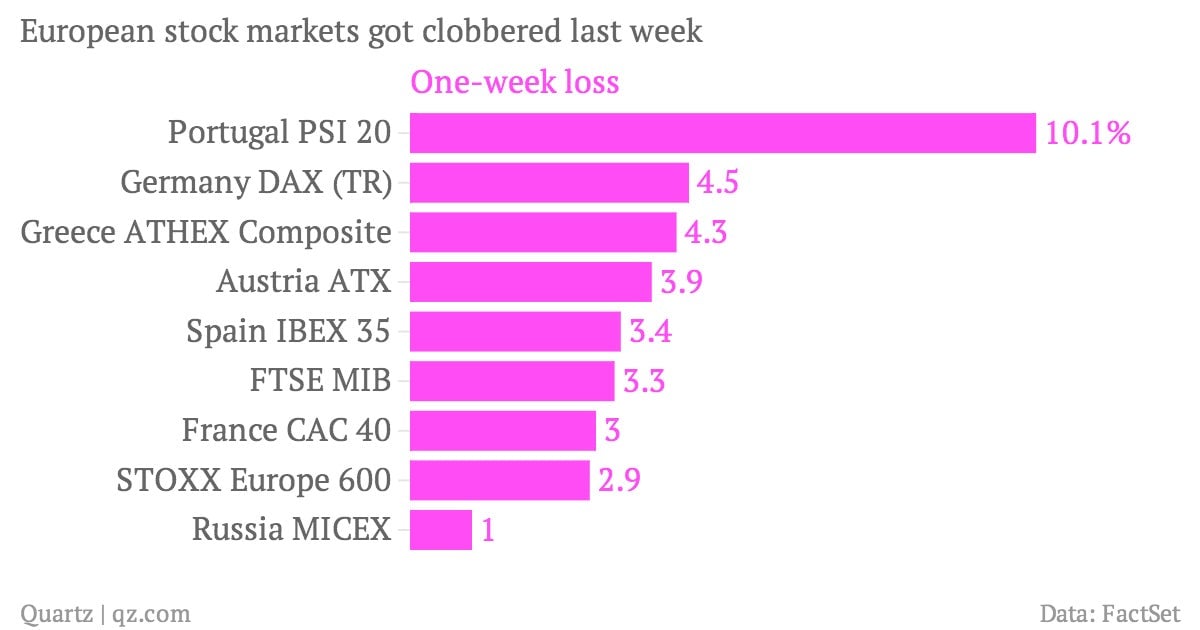

Portugal was a big loser, as Banco Espírito Santo reported the largest-ever loss for a Portuguese company, sending its shares spiraling and prompting probes into possible accounting fraud at the family-controlled bank. Germany’s stocks also were hard hit as investors worried that stepped-up sanctions on Russia—a crucial supplier of natural gas to Germany—would weigh on the German economy. But aside from the bank stability concerns raised by the Banco Espírito Santo mess and the potential threats looming from the Russia situation, the data out of Europe actually suggests that the economic situation is improving. In June, unemployment unexpectedly declined to 11.5%—still terribly high, but moving in the right direction.

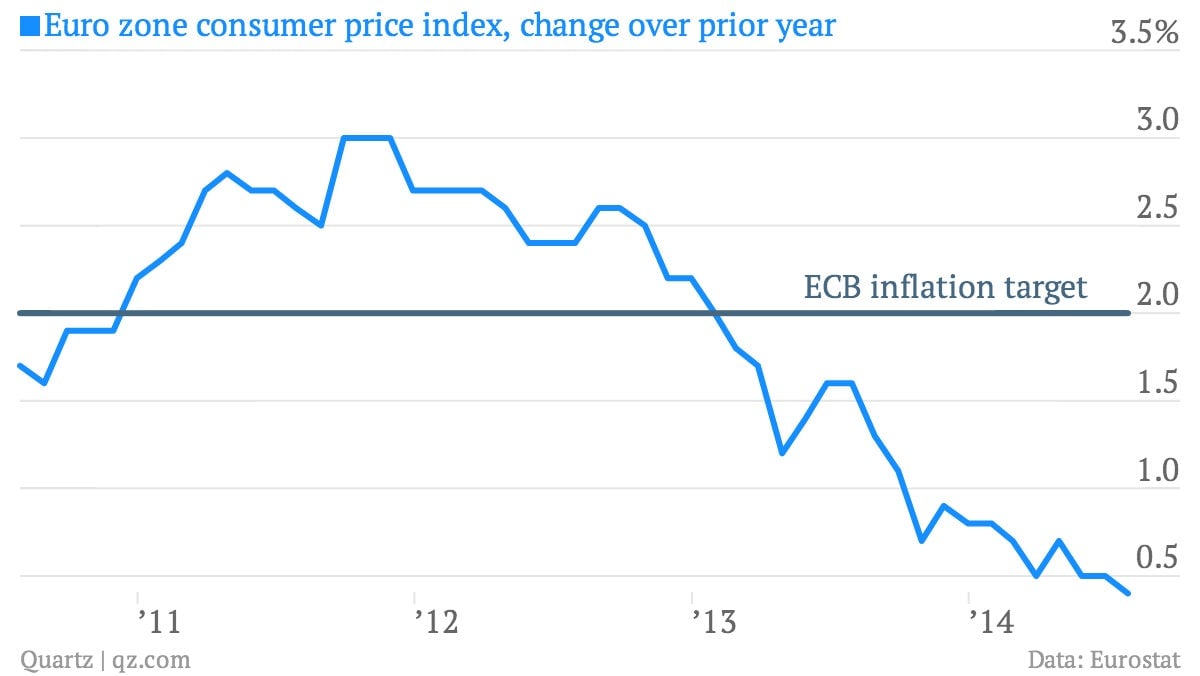

Meanwhile, the region continues to flirt with the prospect of deflation, with euro zone wide prices rising a scant 0.4% in July from the prior year. In isolation, that’s not good news. But it does allow Mario Draghi’s ECB more leeway to take much-needed action to stimulate growth without setting off a round of squawking from inflation hawks.

The sharp sell-off in Europe would seem to share a certain overdue quality with the decline in US stocks this week. After all, European markets have been rallying for months. The Stoxx Europe 600 index was up more than 30% over the last two years, before this week’s slump. The rally had made European shares less of a bargain.

In other words, the sharp selloff of European shares this week doesn’t necessarily mean we’re about to enter another pocket of market turbulence. It might just mean a much-needed cooling off period has arrived.