Wall Street is betting on boom times in mergers and acquisitions

While some would argue it never really left, Wall Street’s swagger is back, at least when it comes to the lucrative business of corporate matchmaking.

While some would argue it never really left, Wall Street’s swagger is back, at least when it comes to the lucrative business of corporate matchmaking.

High-profile deals like Facebook’s $19 billion proposed purchase of messaging company WhatsApp and Dollar Tree’s $8.5 billion bid for rival discount chain Family Dollar have helped put mergers and acquisitions on their best pace in years. Some of the newfound M&A activity has been spurred by corporate executives itching to put capital to work and by a new class of so-called tax-inversion deals (paywall) meant to allow companies in one country to benefit from lower taxes in another.

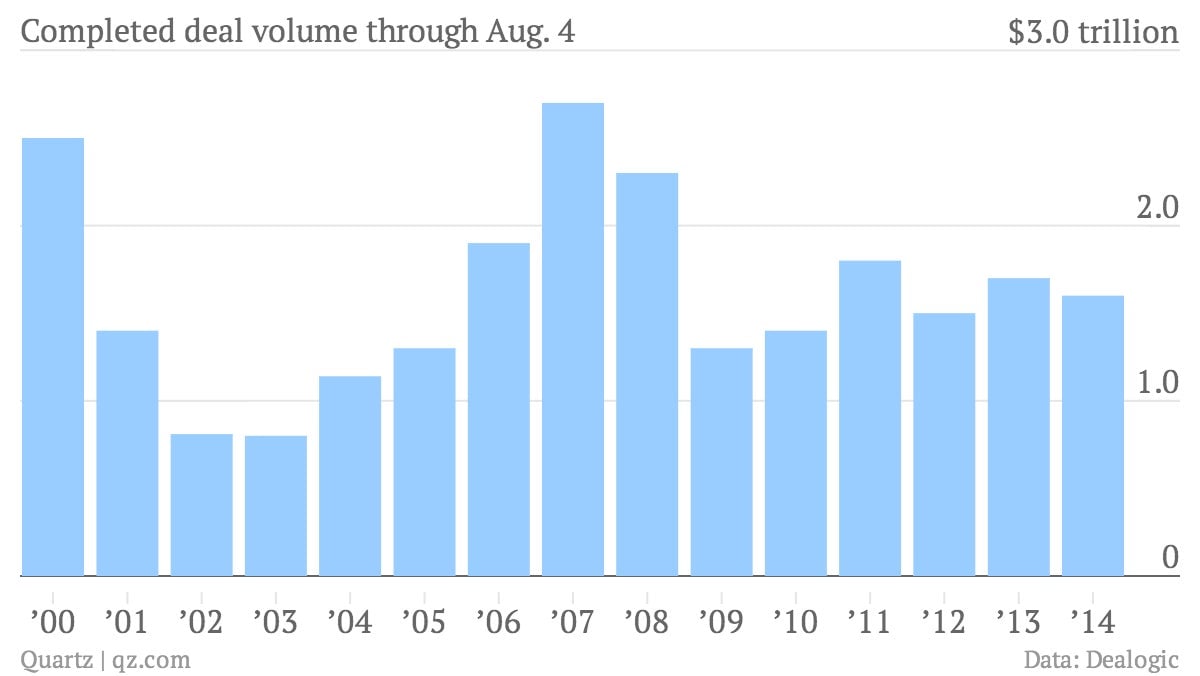

So far in 2014, there have been roughly $2.3 trillion in announced M&A transactions. That’s 44% higher than in the same period last year, when $1.6 trillion in deals were in the works. (Activity still lags the 2007 high of $3.1 trillion in deals proposed through the beginning of August.)

Perhaps all the activity, not just to date but also in terms of what’s expected to come, is why M&A bankers are becoming a hot commodity at banks like Goldman Sachs. Goldman reportedly has hired Paul Parker, formerly a rainmaker at UK investment bank Barclays, to serve as co-chairman of Goldman’s M&A group. The firm has been working to bolster its M&A business, as its trading arm has turned out to be less of the roaring profit engine it once was. Goldman CEO Lloyd Blankfein has said fostering growth in M&A can spark business in other areas, like debt and equity financing as well as trading.

It’s not just Goldman counting on M&A to replace revenue that’s been drying up in other areas. Citigroup, JPMorgan Chase, Morgan Stanley and other firms have high hopes for continued strength in M&A. But as is so often the case, there are warning signs on the horizon. For starters, announced M&A volume is much headier than deals that actually have been completed this year. The $1.6 trillion in M&A transactions finalized so far this year is little changed from recent years, and even slightly below last year’s pace through early August.

M&A also is sensitive to global economic gyrations and geopolitical tumult—and certainly there has been plenty of both going around that could potentially reverse M&A’s momentum in a hurry.