China’s food safety problems could be good for the world’s biggest pork producer

Shares in the world’s largest pork producer, China’s WH Group, surged as much as 10% today in the company’s first day of trading in Hong Kong. The third-largest Asia Pacific IPO this year comes at a time when anxiety about food safety is at a high in China, a potential boost for the company that spent $4.7 billion on the American hog producer Smithfield last year, in part to bring Western expertise to China.

Shares in the world’s largest pork producer, China’s WH Group, surged as much as 10% today in the company’s first day of trading in Hong Kong. The third-largest Asia Pacific IPO this year comes at a time when anxiety about food safety is at a high in China, a potential boost for the company that spent $4.7 billion on the American hog producer Smithfield last year, in part to bring Western expertise to China.

Speaking to reporters today, WH Group chairman Wan Long said the deal was “good for the country, the company, and China’s agricultural industry,” comments that seem aimed at consumers wary about the country’s seemingly endless food scandals.

China is home to the world’s largest pork industry, which raises and consumes about half of the world’s pigs. But consumer mistrust of the country’s lightly regulated agricultural industry and convoluted supply chain abound. Chinese meat suppliers are under scrutiny after local media accused a Shanghai factory of using rotten meat in products sold to McDonald’s, KFC, Pizza Hut and other fast food chains.

For WH Group, which changed its name from Shuanghui to adopt a more international identity, this anxiety may work to its advantage. By exporting meat from hogs raised in the US, WH Group is using Smithfield’s brand as well as its industrial technology to attract customers. WH Group now has access to Smithfield’s approximately 460 farms that raise around 15.8 million hogs a year, as well as the company’s cold-chain system that keeps pork products good for as many as 50 days.

But the scandal has also illustrated that there are no easy fixes: the Shanghai factory was owned by a US company, OSI Group, which proves that Western expertise is not a panacea.

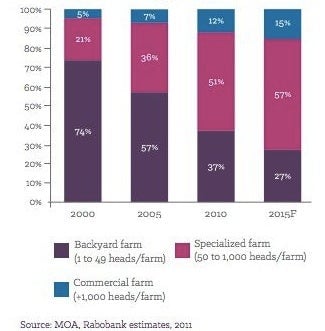

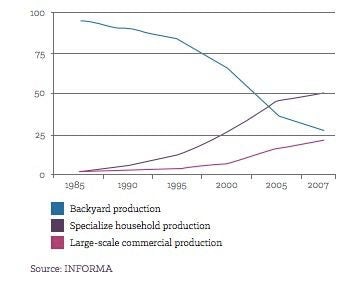

Even though food scandals have become an inescapable part of life in China, nothing suggests that the country is losing its taste for pork: per capita consumption is about 39 kg a year (pdf. p. 14), compared to 27 kg per person in the United States. Moreover, although Chinese consumers have long preferred fresh pork bought small producers, wealthier Chinese families are increasingly opting for industrially produced (pdf, p. 22) pork, seen as safer and produced under stricter management. As a result, mass commercial pork production in China is growing while the number of small-scale, or backyard farmers, is shrinking.

WH Group has already started selling Smithfield-branded meat at stores in Henan province, where the company is based, and will start selling outside of the province next year.