The Italian economy has gone precisely nowhere in the past 14 years

There is a welter of woeful data out in the euro zone today. (Even more woeful than usual, that is.)

There is a welter of woeful data out in the euro zone today. (Even more woeful than usual, that is.)

Greece is still suffering from deflation, which isn’t too surprising. In Germany, industrial orders took an unexpected dive, registering their sharpest monthly drop in nearly three years. That’s much more worrying.

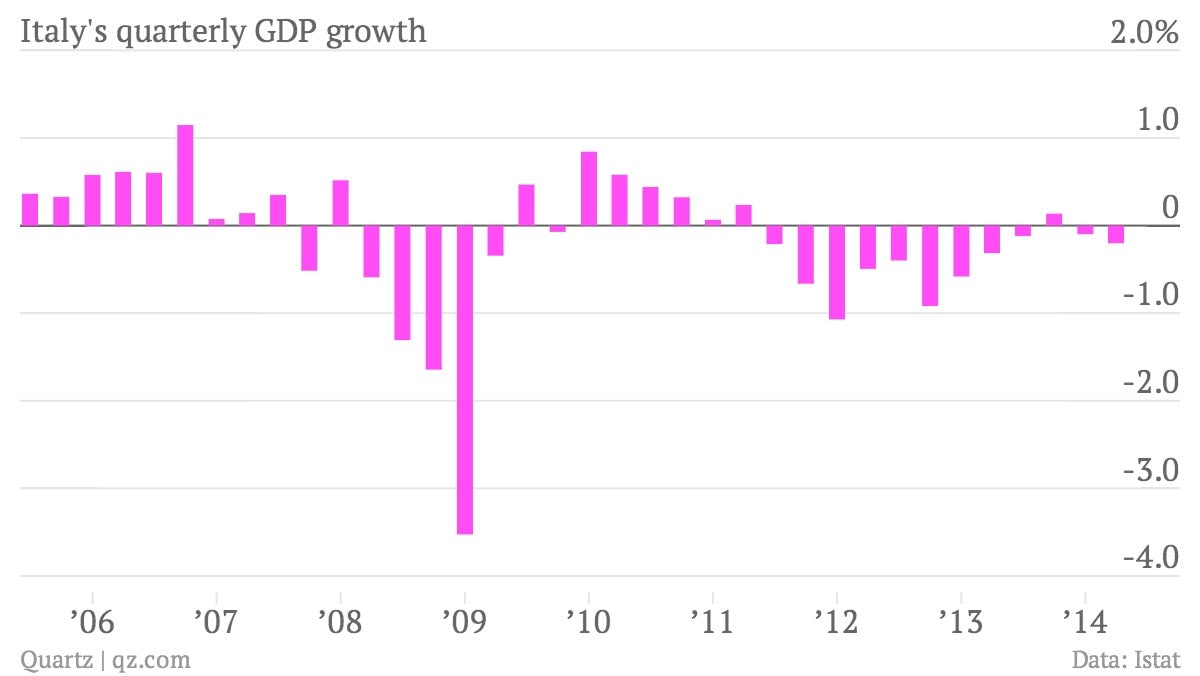

The most depressing news, however, came from Italy. The country’s GDP shrank by 0.2% in the second quarter, defying expectations for modest growth. Following a 0.1% contraction in the previous quarter, that means the country is now officially in a triple-dip recession:

Over the past nine years Italy has been in recession as long as it has been in growth. The economy has shrunk in 11 of the past 12 quarters. The Italian economy is still 9% smaller than it was at its peak in 2007. Perhaps most damningly, Italy’s economy is almost exactly the same size as it was back in 2000:

Italy’s young and ambitious new prime minister, Matteo Renzi (pictured above), has pledged to break the country out of its long funk. But he can’t sweep away the country’s infamous bureaucracy overnight—indeed, his first reform bill has been bogged down in the senate by nearly 8,000 amendments, of which only a handful have been addressed so far in debate.

In the meantime, Italy is falling further behind the rest of Europe, including former basket cases like Spain. “What we have seen this year is the outperformance of countries that have implemented structural reforms and improved their competitiveness like Spain and Ireland,” according to Azad Zangana, an economist at asset manager Schroders. “Countries that have been slow and unwilling to embrace reforms such as Italy and France, have been a drag on the wider euro zone economy.”