America’s tax-cut obsession is colliding with reality in Kansas

It’s hard to overstate the appeal of tax cuts in the US, a nation that was primarily formed in opposition to government revenue collection.

It’s hard to overstate the appeal of tax cuts in the US, a nation that was primarily formed in opposition to government revenue collection.

The traditional champions of tax cuts, conservative Republicans, haven’t occupied the White House since 2008, when Barack Obama was elected as president. In many “red” states, however, Republicans are in charge. And they are making policy along rigid conservative lines.

Kansas may be foremost among them. Its governor Sam Brownback, a former US congressman and senator, led an aggressive effort to cut taxes soon after winning office. The idea is that tax cuts would reinvigorate job growth and bolster the state’s economy, replenishing state coffers along the way.

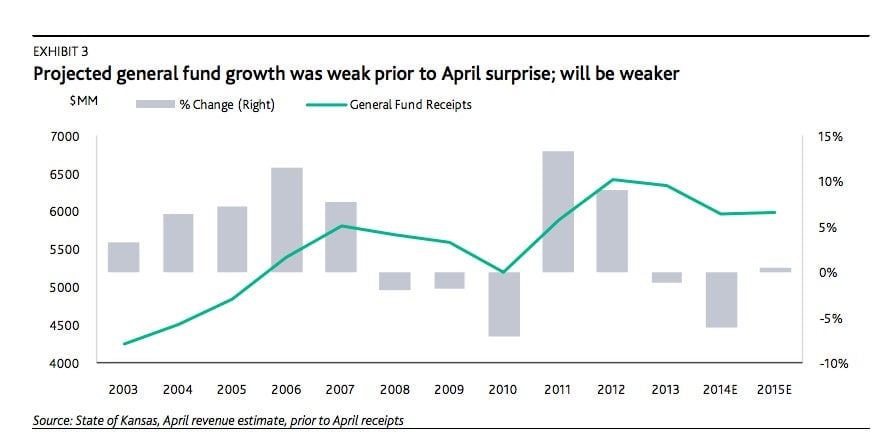

It hasn’t worked out all that well. Kansas’s job picture has improved since 2011 when Brownback took office. But rates of job growth have been slower than the country as a whole and compared with nearby states like Nebraska and Missouri. Meanwhile, and predictably, revenues have fallen faster than spending, forcing the state to dip into reserves.

Moody’s downgraded its debt rating on Kansas in April, citing ”sluggish economic recovery and a structurally imbalanced budget.” S&P followed, axing Kansas’s debt rating today. S&P analysts say that “substantial shortfalls in individual income taxes” will likely eat into the state’s cash cushion at a very low 0.6% of expenditures, far too thin for a period of economic expansion.

It shouldn’t be a surprise that tax cuts, without more difficult spending cuts, leave governments on unstable financial footing. After all, federal deficits exploded under president Ronald Reagan, the patron saint of Republican tax-cutting. (Arthur Laffer, an architect of Reaganomics, is a key adviser to Brownback.)

But from a political tactician’s standpoint, undermining state finances probably isn’t a bad thing. After all, the backdrop of declining state finances makes it much easier to argue that the time for steep spending cuts has come.

In that sense, the tax cuts look more like political posturing than a sincere effort to balance the budget. In other words, voters, not bond analysts, will decide how effective the tax cuts have been when Brownback fights for re-election against Democratic challenger Paul Davis this November.