The fickle business of corporate matchmaking is tormenting Wall Street banks

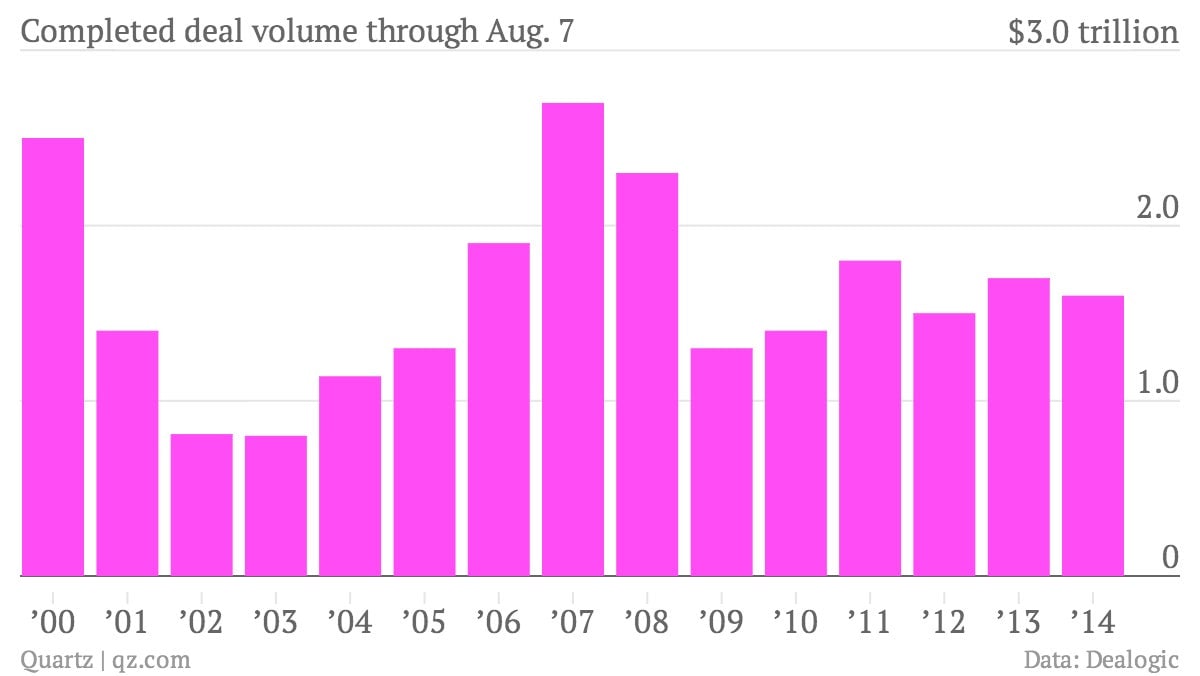

This was supposed to be the year that global corporate mergers and acquisitions took off, especially if you listen to the investment banks that profit from advising on the deals. Announced global M&A deals hit a seven-year high of $2.3 trillion through Aug. 4, as Quartz reported earlier this week.

This was supposed to be the year that global corporate mergers and acquisitions took off, especially if you listen to the investment banks that profit from advising on the deals. Announced global M&A deals hit a seven-year high of $2.3 trillion through Aug. 4, as Quartz reported earlier this week.

But on Tuesday, a spate of blockbuster deals collapsed, including media mogul Rupert Murdoch’s $80 billion campaign to merge his 21st Century Fox empire with Time Warner. Telecom company Sprint also abandoned its attempt to scoop up rival T-Mobile. The financial blog Zerohedge termed the two-deal bust ”Termination Tuesday”:

Termination Tuesday gut-punched investment funds, which made big bets on the completion of those splashy M&A transactions. The Wall Street Journal reported (paywall) that so-called “merger arbitrageurs” suffered their worst rout since the 2008 financial crisis as a result of Tuesday’s busted deals.

Then there are the advisors, bankers and lawyers who took it on the chin. Based on Thomson Reuters estimates, banks on the 21st Century Fox deal lost their share of a roughly $275 million fee pool, Financial News reports.

Those soured deals could put a big damper on future mergers and acquisitions. ”The mood is not good,” King She, an analyst at Susquehanna International Group told the Journal. “One deal blows up, it can ruin your year.”

Investment banks in particular are at risk, since they depend increasingly on M&A revenues. Also, the pace of M&A action typically slows later in the year.

The signs of decay are already starting to show. Check out the lag to-date in completed M&A deal volume (which represents completed deals only):