Banking’s trading nightmare is far from over

Can it get any worse for Wall Street’s wearied traders? It looks like it.

Can it get any worse for Wall Street’s wearied traders? It looks like it.

Formerly the lifeblood of the large investment banks, trading activity already has suffered a serious shock delivered by new regulations and thin demand in the markets. Apparently comments from Marianne Lake, the chief financial officer at JPMorgan Chase, suggest things will get worse before they get better.

Analysts at Nomura, who recently spoke with Lake, report that she predicts further shrinking in the space. Their conclusion: “… Other players may see the need to narrow their focus, as at some point it may become harder for those without the benefit of scale to compete effectively.”

In other words, more banks will retreat from less-profitable trading segments—which likely means more layoffs at trading desks.

For powerhouse trading shops like Goldman Sachs, cost cutting by way of trimming headcount may be one of the easiest levers to pull as it combats the weakening in trading. For its part, JPMorgan is turning more to electronic trading to manage costs, Lake told Nomura.

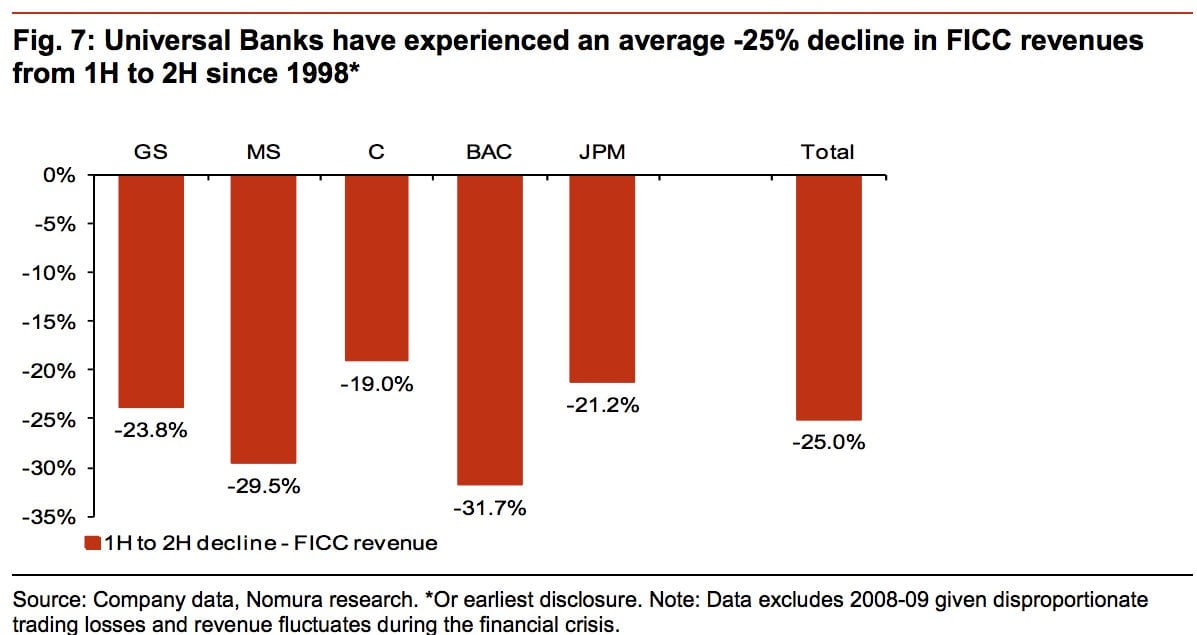

Those tactics may not be able to stem the effects of the traditional second-half trading slowdown. Fixed-income, currency, and commodities trading revenue at the big banks typically drops off by an average 25% from the first half of the year to the second, according to Nomura research.