Banks can’t seem to kick the habit of underwriting risky loans

Sometimes banks are like kids. You tell them not to climb up that tree and they do it anyway. The US banking world, for example: It has certainly gotten into some scrapes, but that doesn’t seem to stop it from taking risks.

Sometimes banks are like kids. You tell them not to climb up that tree and they do it anyway. The US banking world, for example: It has certainly gotten into some scrapes, but that doesn’t seem to stop it from taking risks.

The latest evidence of this tendency is a Moody’s Investors Service research report indicating that banks have reverted back to the practices that helped land them in the financial morass of 2008. In May, regulators at the Federal Reserve and the Office of the Comptroller of the Currency (OCC) threatened to take more action to ensure banks complied with lending guidelines requiring banks to rein in their freewheeling ways (reiterating comments they’d made back in March 2013).

We’ve reported on some of this loosening in underwriting. So-called leveraged lending, where loans are provided to companies already carrying a lot of debt, has been on the rise since 2009. These riskier loans provide richer fees, which are especially attractive amid a low-interest-rate environment.

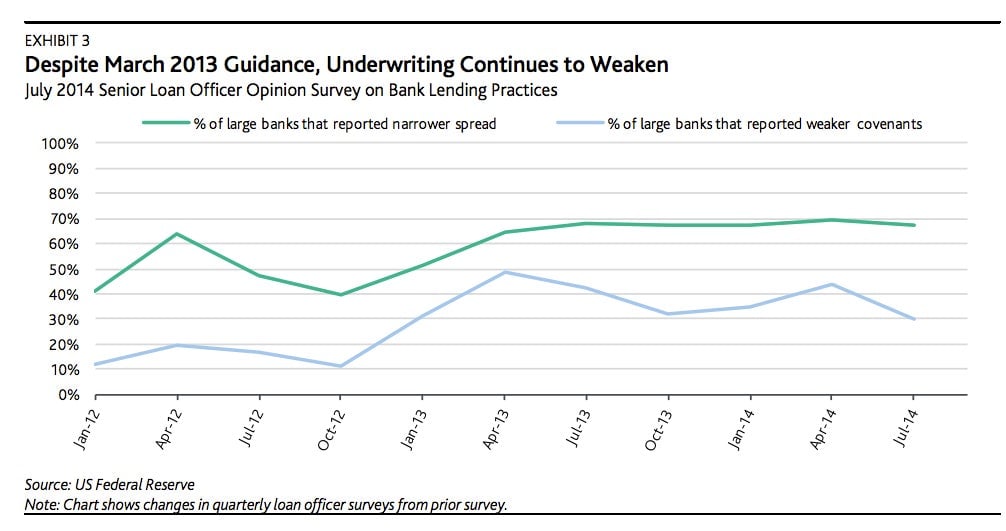

Indeed, based on a recent survey of senior loan officers (reflected in the above chart) Moody’s reports that the loosening of underwriting loans is continuing unabated. The share of banks reporting weakening covenants is marginally lower but still very high, compared with two years ago.

Another big concern is that non-traditional lenders or so-called “shadow banks” such as hedge funds and private equity funds, who do not have the same regulatory requirements as big banks, are replacing traditional banks. That’s resulting in greater jockeying between banks and these so-called non-banks for corporate borrowers. More lenders mean more loans that are being offered on looser terms to corporate borrowers.

Hence the intractable kid analogy. Banks probably won’t easily cede lucrative lending opportunities to rivals unless they fear that they are going to be disciplined. So if regulators at the Fed and the OCC want to see better behavior, then now’s the time for less talk and more action.