The Wall Street Journal reports that there are signs of risky behavior returning to the leveraged loan market (paywall). To which most people respond: What is the leveraged loan market?

It’s not really that complicated. But it doesn’t help that finance people use a bunch of different names to describe leveraged loans, including “bank loans,” “senior loans,” “syndicated loans,” “floating-rate loans,” and ”adjustable-rate loans.”

But first things first. Leveraged loans are loans. That is, they’re negotiated lending agreements, usually between a large bank and a corporate entity, and they’re usually secured by specific corporate assets such as plants, property or equipment.

The word “leveraged” seems to refer to the fact that these loans are typically made to companies that are heavily leveraged—or as most people would say, indebted. That is, they’re kind of like junk bonds. As with junk bonds, because lenders are taking a bigger risk by lending to an already indebted company, they charge a higher interest rate.

One other thing to know about leveraged loans: They tend to be floating-rate loans. That is, the interest rate borrowers pay changes depending on market conditions. Investors who think interest rates might rise often find floating-rate lending attractive. (Fixed-rate investments fall in value as interest rates rise. But floating rates don’t suffer as much from such interest-rate risks.)

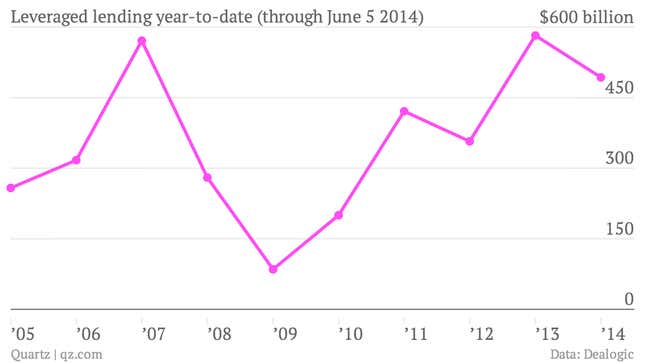

In fact, the higher yields and floating rates are so attractive right now that people are pouring money into leveraged loans as an asset class. The Journal notes that last year was the busiest for leveraged loan issuance since 1987. And with $531 billion in issuance so far, this year is not far off that pace.

After they make the loan, the large banks usually syndicate—or chop up and sell off—parts of the loan to other investors, including institutional investors such as insurance companies, hedge funds, mutual funds and pension funds.

With investors in such a rush to throw money at heavily indebted borrowers, there are some indications that lending standards are falling. (That’s essentially what the Journal’s story is about.) Regulators are concerned that excessively lax leveraged lending could be a risk to the financial sector. But since these loans are highly profitable, banks are pushing back hard on any proposed tightening of restrictions.