Like its customers, Wal-Mart is struggling

The world’s biggest retailer is struggling—and it doesn’t expect things to get better any time soon.

The world’s biggest retailer is struggling—and it doesn’t expect things to get better any time soon.

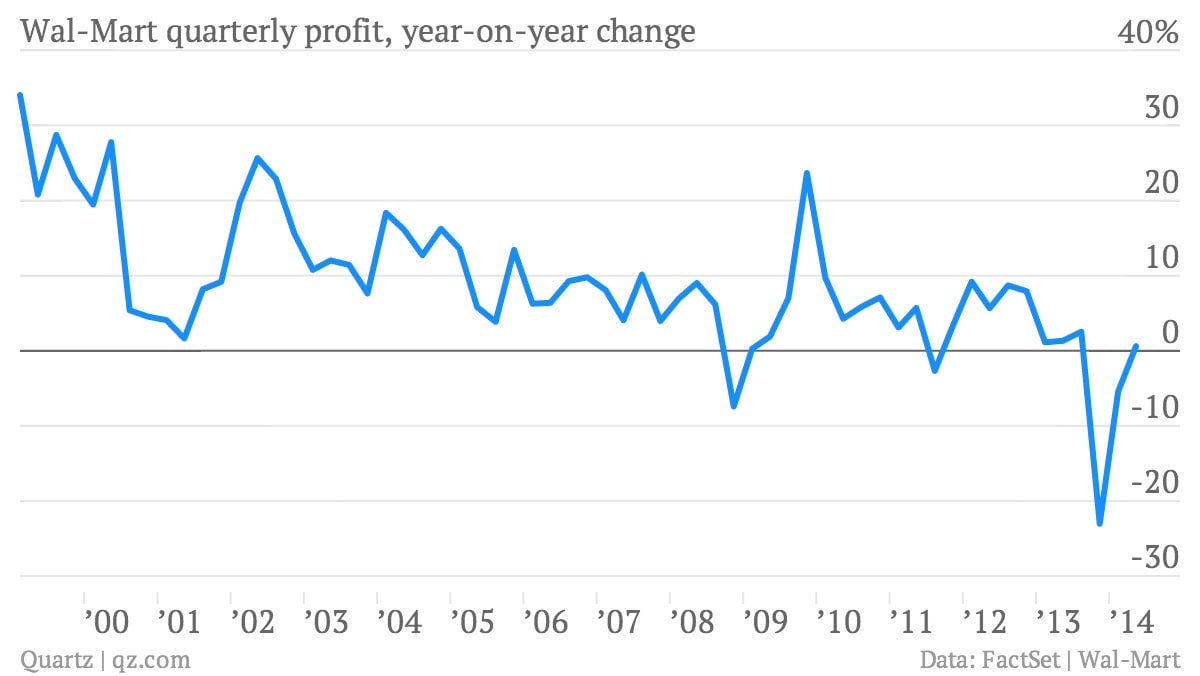

In its quarterly financial report released today, Wal-Mart Stores chopped its annual profit forecast as it eked out a 0.6% profit increase in the second quarter. While skimpy, the profit rise was a modest improvement over first and fourth quarters when profits tumbled by more than 5% and 20%.

As the largest US retailer—and private sector employer—Wal-Mart holds a particularly important position in the US economy. For years, its focus on delivering rock-bottom prices to America’s most cost-conscious consumers bore fruit. (Year-on-year profit growth averaged 13% between 1999 and the end of 2007.)

But while the broader economy has picked up, the lower-income Americans who are Wal-Mart’s core customers continue to struggle. During the worst of the recession, Wal-Mart Stores and other discounters noticed a shopping cycle timed to the deliver of US food stamp benefits.

The company’s profits remain linked to the government payments that many of its consumers rely on. The expiration of a temporary boost in food stamps in November 2013 slammed the company’s fourth-quarter profits, helping to drive them down by more than 20%. And the decline in nutritional assistance to poor Americans continues to weigh on Wal-Marts results.

Wal-Mart and the other discounters that focus on delivering low prices are basically facing a fundamental problem. Their customers don’t have money for anything but absolute necessities, which means food, a low-margin product category. And that’s not exactly a recipe for robust margin growth or profits.