There’s a massive rush to safety in the markets because of Ukraine

The markets do not like the look of this.

The markets do not like the look of this.

Sketchy reports of actual fighting between Ukrainian and Russian forces have put the global markets on a war footing.

Yields on German government bonds, where European investors go for safety, fell sharply to new all-time lows. (Bond yields fall when bond prices rise.)

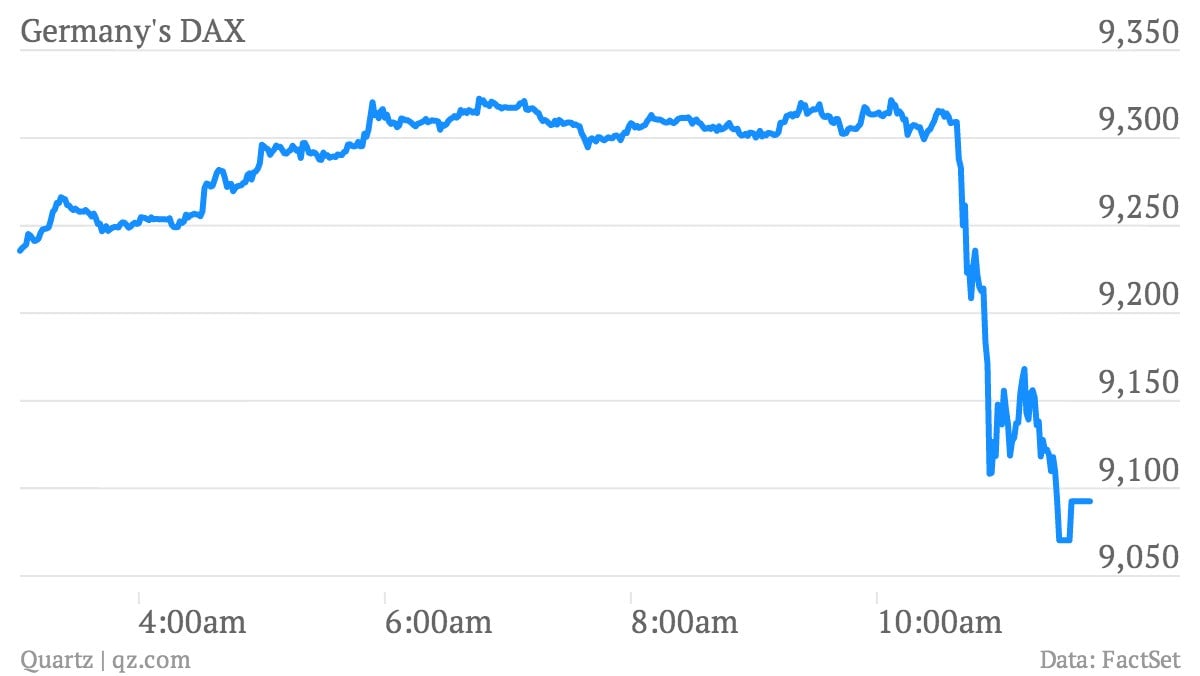

Investors are dumping German stocks:

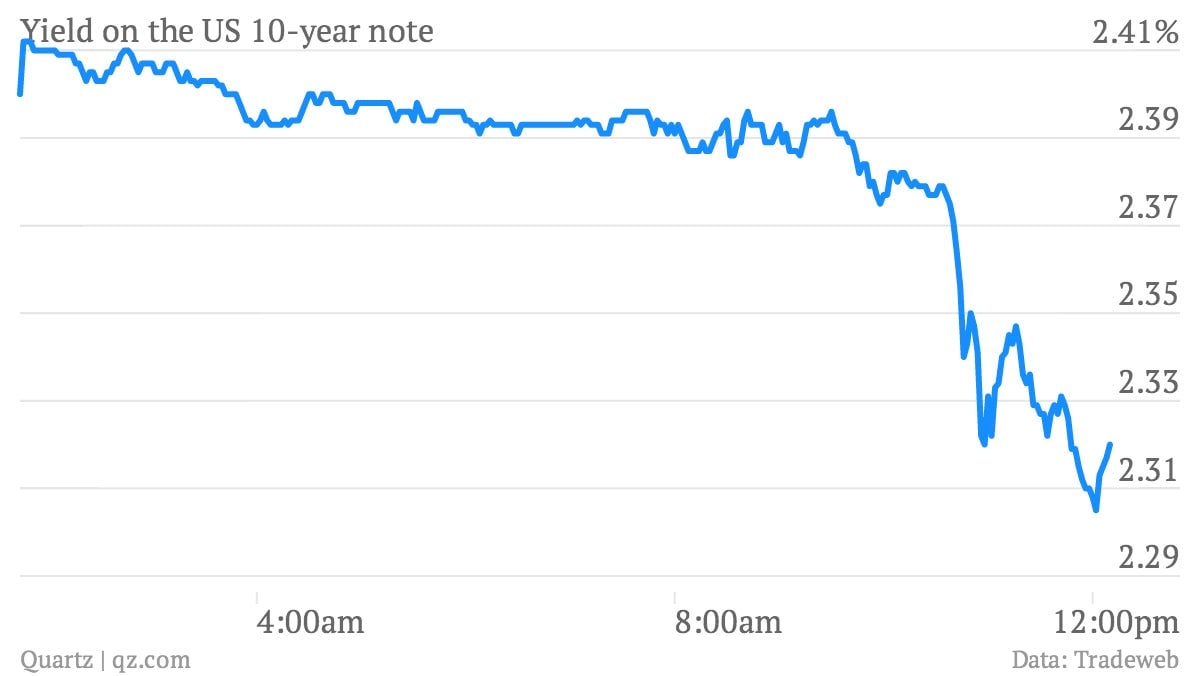

Yields on US Treasury bonds, the global safe haven, have fallen sharply to their lows for the year:

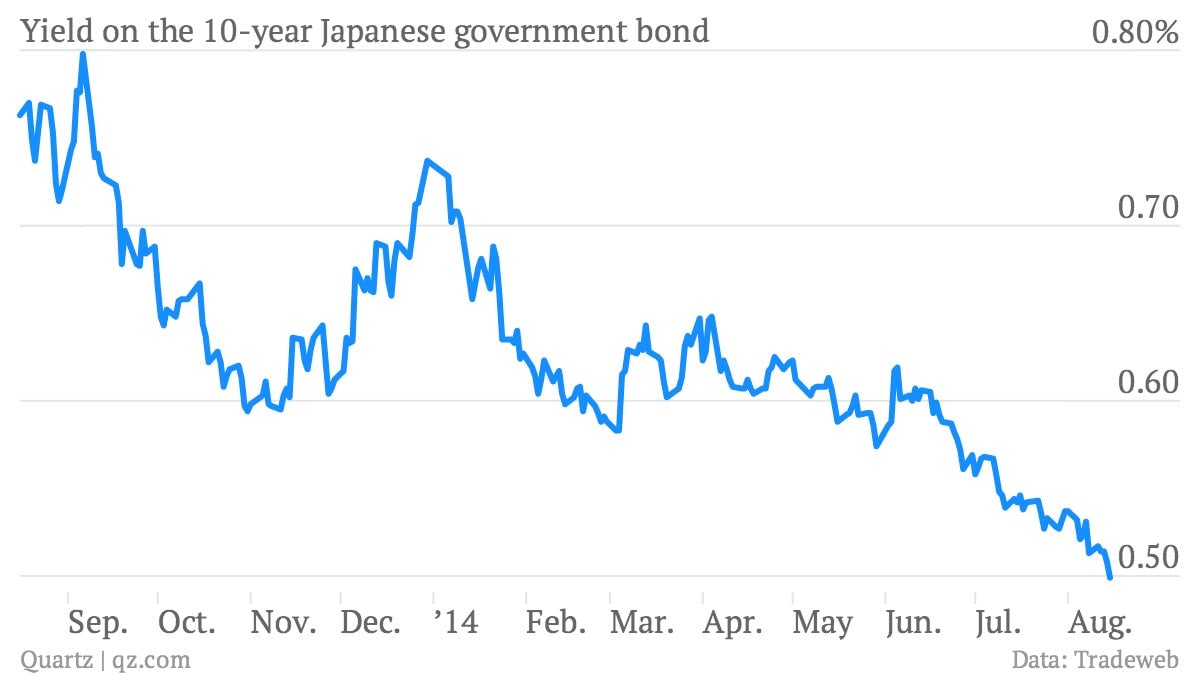

The flight to safety is even touching Japanese government bonds, where yields are hitting their lows for the year:

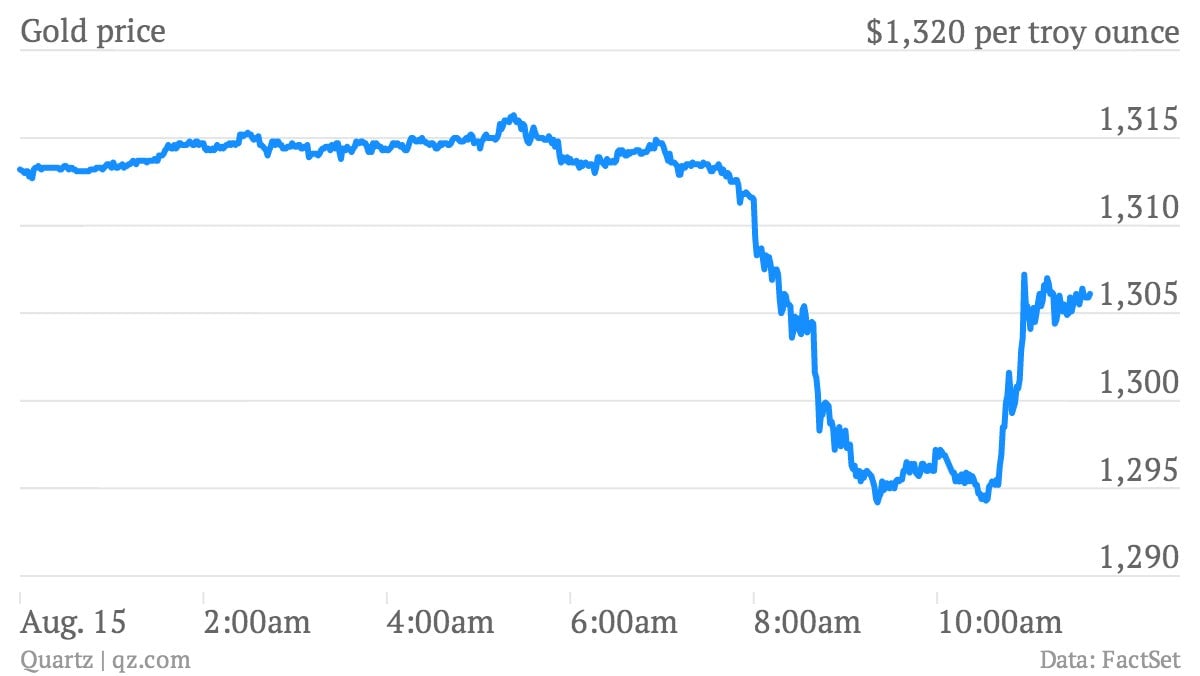

After an early slide, gold is rallying:

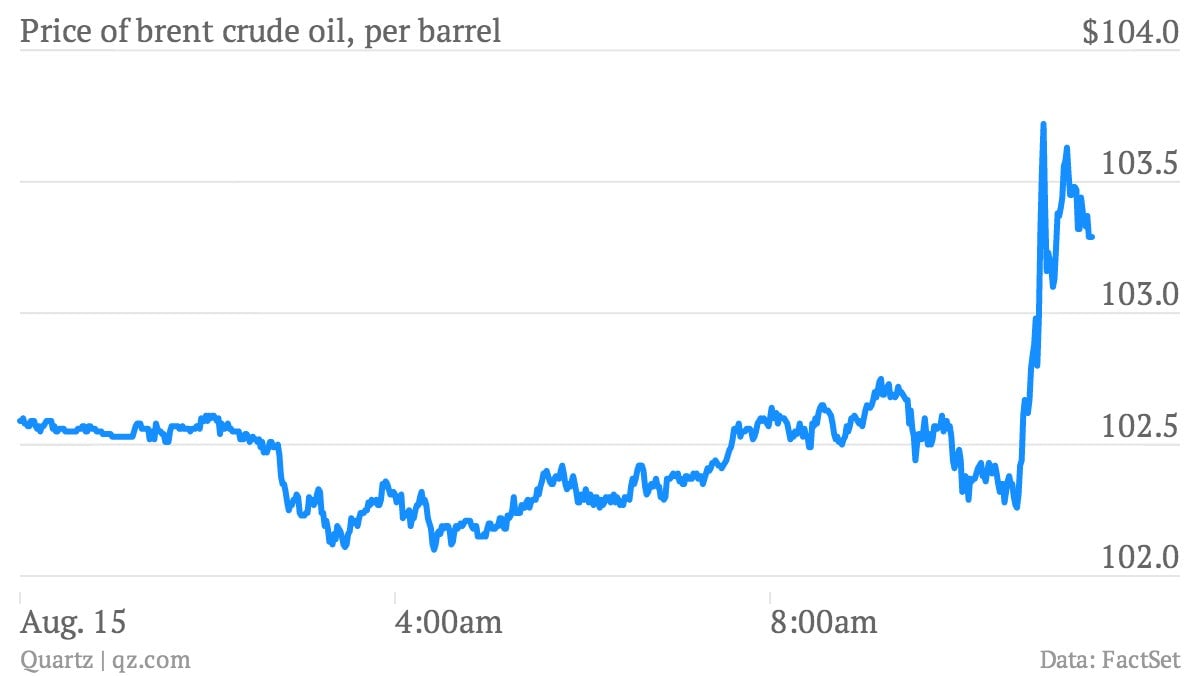

And the Brent crude oil futures contract, the European benchmark, jumped on the prospect of disruptions to Ukraine’s crucial energy infrastructure:

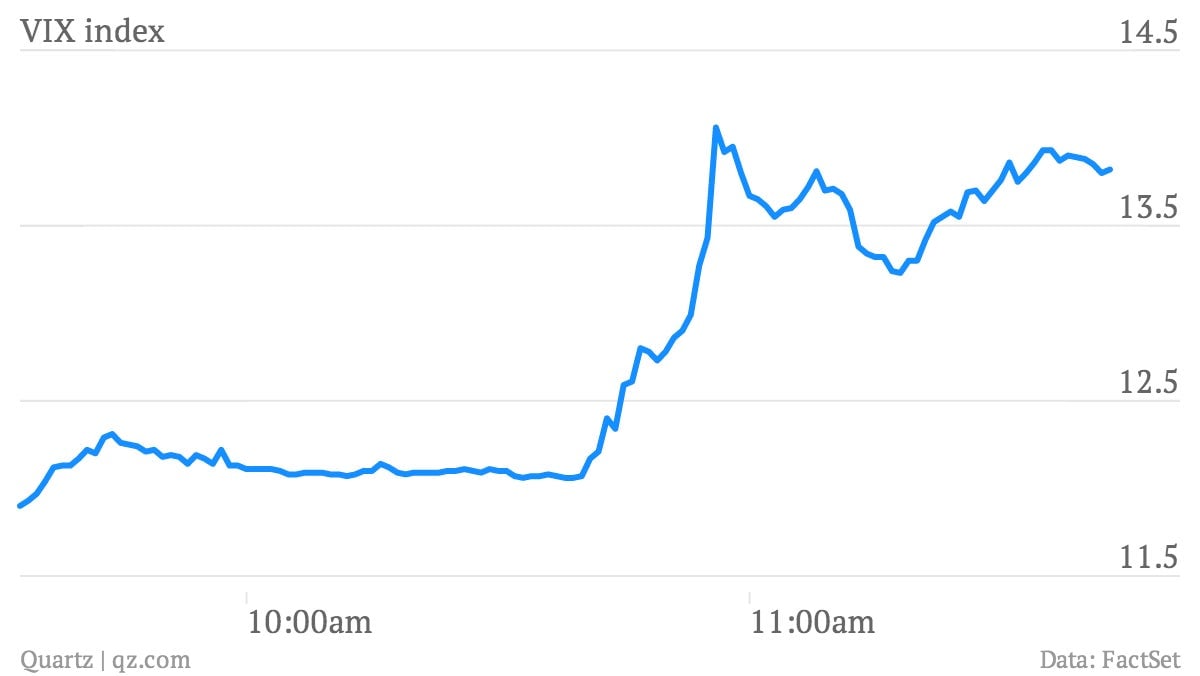

The VIX index of volatility—the so-called “fear gauge”—is also on the rise:

Traders are ditching the Russian ruble, which is now down by more than 8% against the dollar so far this year: