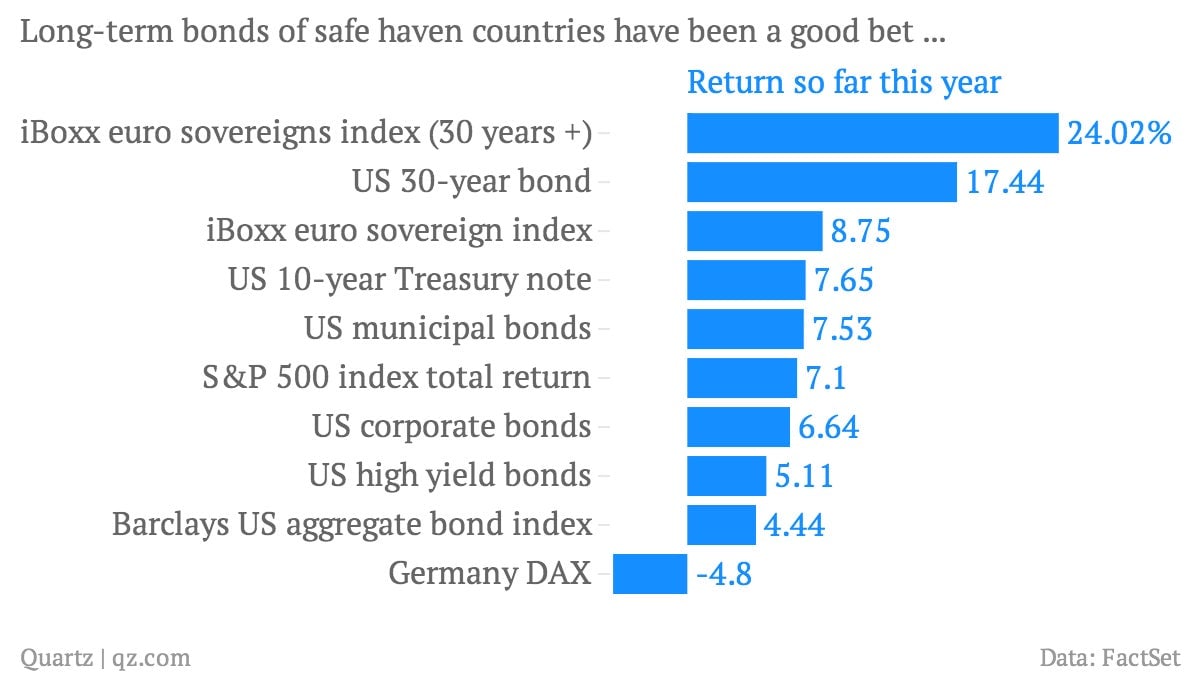

The market’s clear takeaway: Long bonds are beating stocks

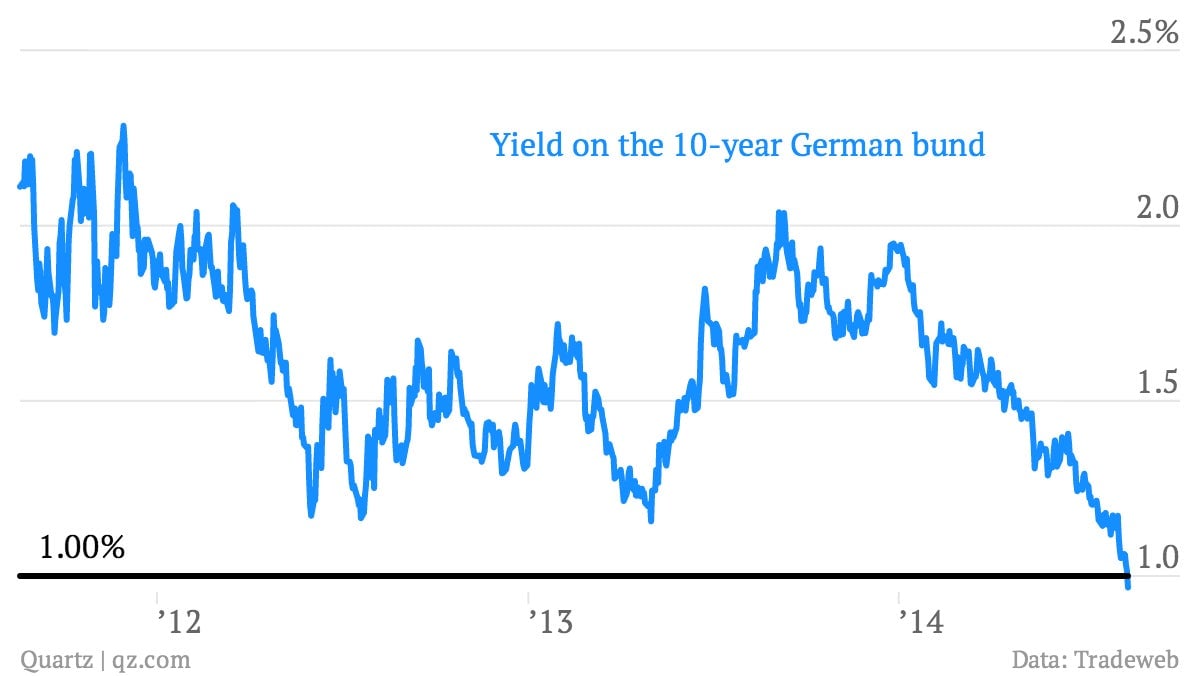

Nobody expected it, (paywall) but the bond markets are having a heck of a year. The unrest in Russia and Ukraine, Iraq and Gaza are helping to drive global bond yields down from already low levels. A fresh scare in Ukraine on Friday sent yields on German bonds to all-time lows, for example, as they fell below 1.00%. (US yields followed suit falling to the lowest level in 14 months.)

Nobody expected it, (paywall) but the bond markets are having a heck of a year. The unrest in Russia and Ukraine, Iraq and Gaza are helping to drive global bond yields down from already low levels. A fresh scare in Ukraine on Friday sent yields on German bonds to all-time lows, for example, as they fell below 1.00%. (US yields followed suit falling to the lowest level in 14 months.)

As interest rates fall, bond prices rise. And because of the special characteristics of bonds, the prices swings for long-maturity bonds—for instance the US 30-year Treasury bond—get larger the lower interest rates go. The upshot? Aggressive positions on long-term government bonds have been some of the best bets in the financial markets this year.