The 800-pound gorilla about to enter India’s mobile market doesn’t need to “disrupt” to succeed

Some 92% of India’s nearly 200 million internet users get online using a mobile device. Yet smartphone penetration in India remains stubbornly low, and only 17% of mobile subscribers have a data plan.

Some 92% of India’s nearly 200 million internet users get online using a mobile device. Yet smartphone penetration in India remains stubbornly low, and only 17% of mobile subscribers have a data plan.

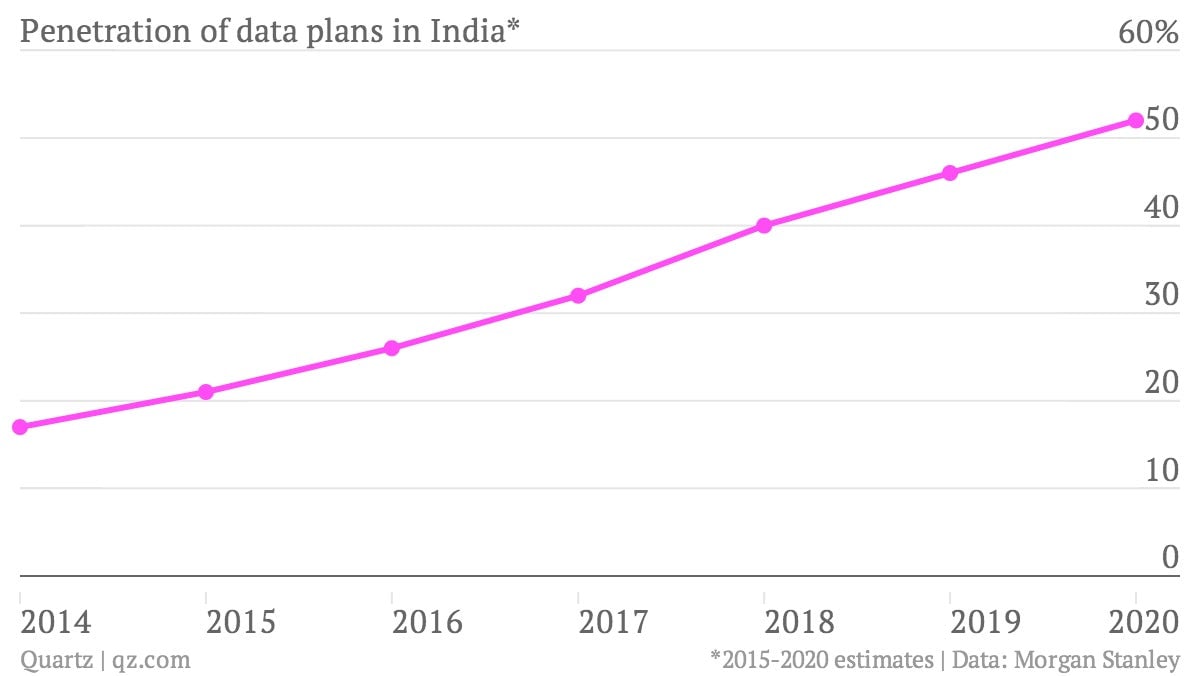

But that is set to shoot up to over 50% by 2020, according to Morgan Stanley:

One of the drivers of this coming growth is a deluge of cheap smartphones flooding the Indian market, which are prompting new customers to sign up for plans that allow them to use those phones’ features. Already smartphone shipments are seeing year-on-year growth of over 80%.

Another will be a yet-to-launch mobile data provider, Reliance Jio. It plans to roll out nationwide 4G technology, which is several times faster than existing 3G mobile broadband. The arrival of Jio (which means “live,” as an imperative, in Hindi) will undoubtedly shake up the market, but it will do so in an unusual way.

Live a little

Reliance Jio comes from India’s biggest corporate house, run by the country’s richest man, Mukesh Ambani. Quartz has been following the ambitious plans for this new venture for some time now: With nearly $9 billion in capital expenditure already—going up to $12 billion by the time the network launches in the second half of 2015—it is an expensive gamble. India already has four strong players in the mobile data market and six or seven who command substantial market share in voice calls. Just how disruptive can Reliance Jio be?

Morgan Stanley struck a cautious note in a recent research note. “There are no examples of a new entrant in a new technology who has ventured out successfully,” analysts warned. New entrants in the US and Canadian markets together boast of combined market share in the single digits. Late arrivals in European countries struggle to attain double-digit market share while many in emerging markets are still suffering losses several years after their launch. Even China Mobile, an incumbent with some 700 million subscribers, has found rolling out new 4G technology to be an expensive proposition.

But Reliance—and India—is different. Analysts at Morgan Stanley see Reliance growing from a standing start to 11% market share by 2018. Even more optimistically, the bank reckons Reliance Jio could break even (before interest, taxes, depreciation, and amortization) by the same time, and become profitable within five years of launch.

But there is one caveat: It won’t do so by disrupting the sector. This growth will only be possible if Reliance manages to increase the overall market size. “We believe RJio will not be disruptive to the Indian telecom space but more a market expander,” the bank explains.

There is good reason to believe that might happen. The last time Reliance entered the mobile sector (albeit under the aegis of the other Ambani brother, Anil), it stormed in with rock-bottom prices—which instead of undermining other carriers, succeeded in growing the market for everyone. From the research note: “We believe we are in a similar phase, but this time it is about data.”